According to a study by ForwardKeys there is an increase in interest among international travellers in visiting Brazil this December. This is excellent news for Brazil’s travel industry as the country approaches the high season, nearing pre-pandemic levels of demand and international connectivity.

Overall, tickets for international tourist arrivals in December are only 4% behind 2019. However, on a regional level, the recovery is uneven due to different circumstances such as flight connectivity and the dependency on different traveller nationality source markets. The states of Minas Gerais, Rio Grande do Sul, and Santa Catarina stand out as the top regional performers, surpassing pre-pandemic levels of demand for travel in December.

This all shows that there is a strong demand despite the limited international flight connectivity to some states. Indeed, seat capacity for international flights has finally reached pre-pandemic levels in Q4, but the re-establishment of international air connections is uneven across the states. This situation creates a dependency on gateway airports such as Sao Paulo.

Also, it shows the growth potential is higher, provided that the flight connectivity reaches adequate levels. Insufficient connectivity could drive airfares up and put off travellers during the popular high season.

Q1 Outlook for Brazil – Strong long-haul market interest

The travel demand is still strong into the first quarter of 2024, particularly from long-haul markets. Travellers from Germany, Switzerland and Italy will play a crucial role in keeping the tourism sector busy next year. The outlook is also very promising for regional markets like Uruguay, Chile, and Argentina.

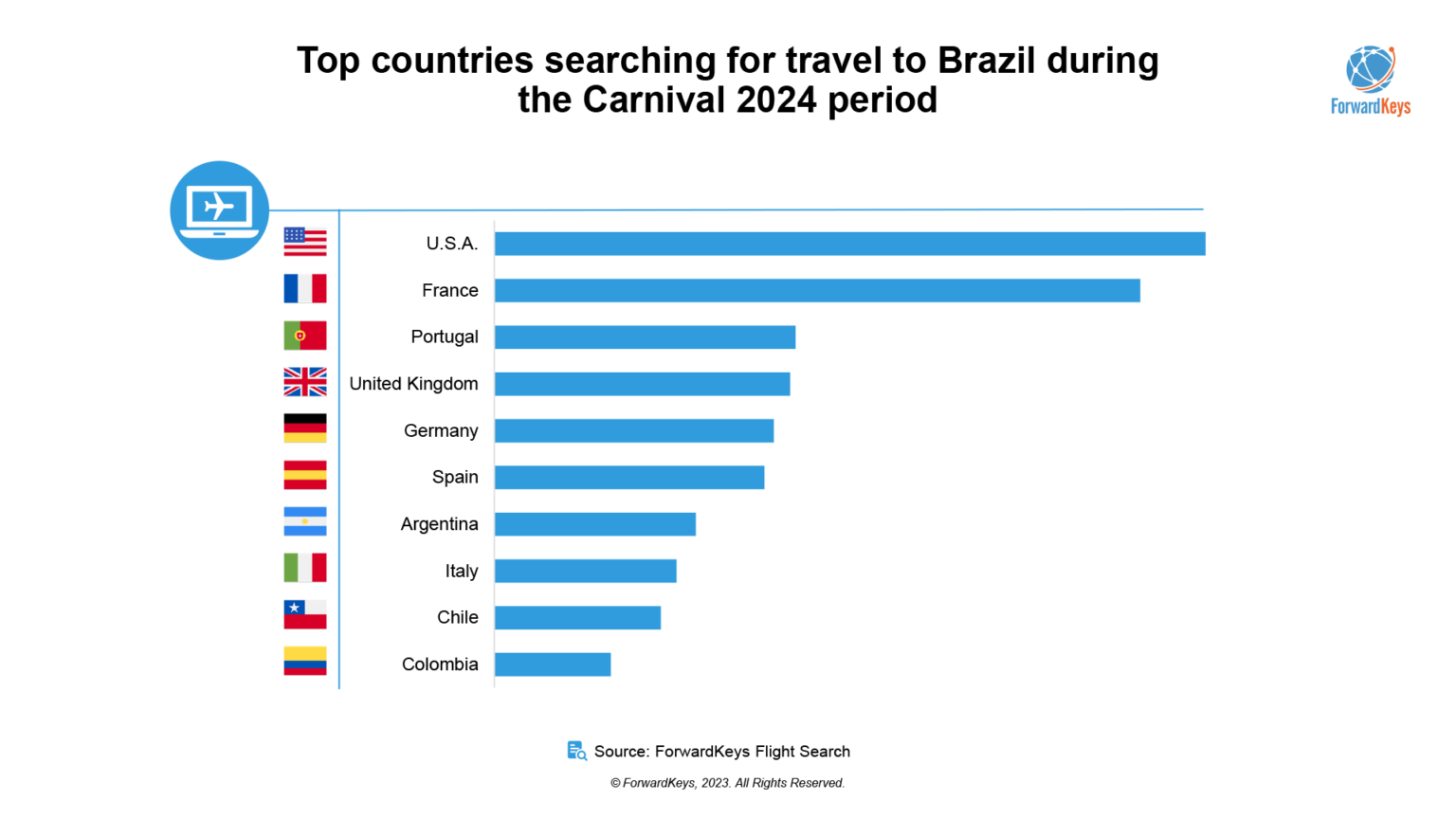

Flight Search data from ForwardKeys reveals strong international appeal for Rio de Janeiro’s February Carnival. The markets that are most interested in visiting this event include the US, France, Portugal, the United Kingdom, Germany, and Spain. This insight is crucial for other destinations that want to promote their “Brazilian carnival experience” to international audiences.

The recovery of Brazil’s inbound tourism has been uneven, which emphasizes the significance of travel intelligence that extends beyond the “big picture”. Detailed data can assist tourism operators and organizations in delving deeper into their local and regional difficulties, as well as in targeting the appropriate traveller demographics at the appropriate times.

With the most comprehensive air travel database in the industry which sets us apart from other data providers — including capacity, bookings, flight searches, ticketing data and Data Smarts — we keep our clients informed about travel patterns, capacity, bookings, flight searches, ticketing demand, travel intent, sustainable travel, the behaviour and preferences of various travel audiences, and much more.

Our air market forecasts offer a comprehensive projection of passenger traffic, spanning from daily predictions over the coming months to annual estimates up to a decade ahead.

You can access this business-critical data via our online applications and Data-as-a-Service platforms — Destination Gateway, Traveller Statistics, Connect and Nexus — as well as benefit from Data Smarts (Licensed Datasets) with a choice of delivery methods.

Stay up to date on the latest travel and tourism trends by subscribing to our monthly newsletter now!