Anticipated Acceleration of China’s Outbound Travel Recovery in Q1 2024

According to flight tickets issued as of 13th February, total international travel from China in Q1 2024 is predicted to experience a 31% decline compared to 2019 levels, although showing a 7-percentage point increase from Q3 2023. The picture varies by region: travel to Africa and the Middle East sees only a 5% decrease compared to 2019, while travel to Europe remains 26% below 2019 levels. The APAC region shows a 31% decline, while recovery in the Americas remains slow, with a 50% decline.

Despite these challenges, the outlook for travel recovery appears optimistic for several reasons. There is an increase in seat capacity from China to outbound destinations, with international connectivity reaching 71% of 2019 levels in Q1 2024, and favourable developments in visa policies contribute to this positive outlook. In addition, Chinese households are allocating a larger share of their budget to cultural and leisure consumption, indicating a growing interest in travel. In the aftermath of the COVID-19 pandemic, the tourism industry in China has assumed a more critical role in the national economy, bolstered by supportive policies aimed at revitalizing the sector.

Visa-Free Travel Surges During Chinese New Year

During the Chinese New Year period, Chinese outbound travel lags behind 2019 levels by 32%. Southeast Asia and Northeast Asia represent the largest shares at 28% and 40% respectively. However, the Middle East emerges as the standout performer, having already recovered to 2019 levels. This recovery is particularly notable in Cairo, which shows a 7% increase, establishing itself as a burgeoning destination for Chinese travellers.

In Europe, significant recovery is evident in the long-haul market, particularly in Central/Eastern Europe (-13%). This resurgence can be attributed to the growing popularity of emerging markets such as Kazakhstan (+61%) and Uzbekistan (+131%), both of which are now visa-free for Chinese tourists. Additionally, Northern Europe (-27%) sees a resurgence due to the unique appeal of in-destination experiences such as Northern Lights expeditions, which are gaining traction among Chinese travellers.

In 2024, trends in Chinese international travel are closely tied to safety concerns and the convenience of visa procedures. Analysis of the most resilient destination cities for Chinese travellers, reveals that Kuala Lumpur, Macau, Singapore, and Ho Chi Minh City have already surpassed 2019 levels, showing growth rates of 24%, 10%, 4%, and 3%, respectively. The surge in popularity of Kuala Lumpur and Singapore can largely be attributed to the recently announced visa-free policy for Chinese travellers. Macau and Dubai have also relaxed entry requirements, which is a key factor in their performance. Ho Chi Minh City’s performance has been boosted by a 15% increase in seat capacity. Furthermore, Seoul and Hong Kong are gradually recovering, experiencing around a 20% decline compared to 2019 levels.

Long-haul destinations like Sydney, London, and Melbourne show significant resilience, with decreases of only 4%, 11%, and 16% respectively compared to 2019 levels, and it is notable that seat capacity to London has already surpassed 2019 levels by 1%.

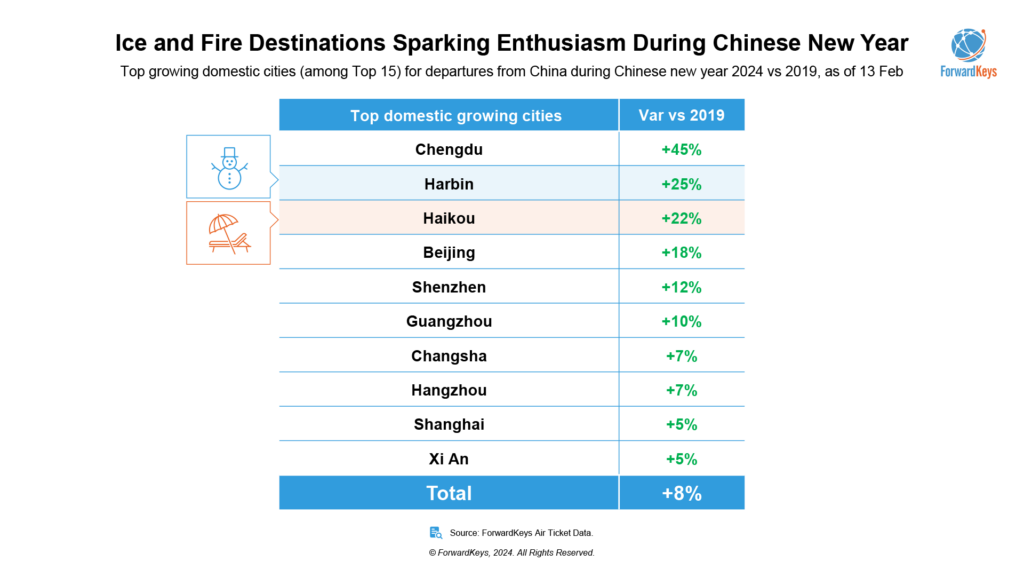

Among domestic destinations in China, Chengdu emerges as the most popular city, surpassing 2019 levels by 45%. Haikou maintains its popularity, with bookings exceeding 2019 levels by 22%, while Sanya experiences a slight decline of 7% due to higher prices during the holiday period. Additionally, there is a notable increase in visitors to destinations in China’s northeastern region, particularly in Harbin, renowned as China’s Ice City, where bookings have surpassed 2019 levels by 25%. The allure of ice and snow sports, along with successful social media marketing efforts, are key contributors to this trend.

Learn more about ForwardKeys here.