Highlights

- Strong weekly U.S. performance due to an easy Easter comparison over last year.

- Post-Easter performance identical to last year.

- Group demand still bright along with special event impacts, such as the solar eclipse.

- Worrisome March performance signals caution for rest of the year.

U.S. Performance (31 March – 6 April 2024)

Weekly U.S. results were robust with revenue per available room (RevPAR) rising 6.9% year over year (YoY) via gains in occupancy (+2.9 percentage points [ppts]) and average daily rate (ADR, +2.1%). This week’s strong RevPAR growth came from an easy comparison to last year due to a shift in the Easter observance, which occurred a week later in 2023. As a result, the weekend (Friday & Saturday) drove weekly results with RevPAR growth of 26.1%. Weekday (Monday – Wednesday) and shoulder (Sunday & Thursday) periods were down in aggregate as they began the week with Easter Sunday 2024. Performance improved from Wednesday as the easy Easter 2023 comparisons materialized.

It’s easy to dismiss the week due to the easy Easter comparison, however, offsetting the comparison to the same post-Easter week last year, the industry held up rather well despite ongoing weakness in the lower segments of the industry.

A year ago, RevPAR was up 8.6% versus 6.9% this year. The difference was due to lower ADR gains (2.1% TY vs. 4.7% LY). Occupancy grew faster this week but ended up at nearly the same level as it was a year ago (64% TY vs. 64.1% LY). Demand growth was higher this year, particularly over the weekend, which we attribute to travel for the total solar eclipse. As a result, this year’s weekend RevPAR growth was higher than last year. On the concerning side, weekday and shoulder travel was better in the week after Easter in 2023 due to flat ADR. Last year, ADR growth in those two periods was closer to the rate of inflation.

Group demand a bright spot

Group demand bounced back after the Easter week slump, increasing 22.1% week over week and up 33.3% YoY. When comparing matched post-Easter weeks, group demand was down 6.1% YoY which was one of the first times group demand declined this year. Group ADR increased a healthy 9.6% YoY and +3.8% when compared to the matched week.

Market performance lifted by sporting events and travel for the solar eclipse

The NCAA Men’s Final Four and WrestleMania 40, drove Phoenix and Philadelphia to lead the Top 25 Markets, as RevPAR rose more than 35% YoY in both markets. And with the easy comparisons, weekend RevPAR increased more than 100%. Adjusting to the same post-Easter week last year, Phoenix was the big winner with RevPAR up 77% over the weekend and 35% in the full week, as ADR rose 25%. Outside the Top 25 Markets, the greatest RevPAR gain was seen in Cleveland, OH (+59.2%), which hosted the NCAA Women’s Final Four. Des Moines, IA (+53.1%), which hosted several youth sports events, and Indianapolis, IN (+51.2%), followed. Cleveland and Indianapolis were also in the direct path of the solar eclipse.

U.S. Performance (preliminary March 2024)

The first quarter of the year has seen much lower RevPAR growth than anticipated. We expected the quarter to be slightly weak given the strong performance seen last year, but it was softer than projected . In particular, March was much weaker than we anticipated as illustrated by the preliminary estimates below.

We could point to the fact that this March had five Sundays versus four last year, and the fifth Sunday was Easter Sunday – traditionally a very weak performance day. However, if you just look at the month where both years are matched (Friday, 1 March 2024 to Friday, 29 March 2024; compared to Friday, 3 March 2023 to Friday, 31 March 2023), you will see that the month was soft regardless beyond the fifth Sunday. For those 29 days, RevPAR was down 1.5% due to falling occupancy.

It is likely that lower-to-middle income travelers are being squeezed out of travel due to the continued rise in prices, increased debt, and servicing costs. This has led to the end of pent-up demand, which is not being offset by robust business and international travel. The lower-tier segments are being impacted more than the upper tier, which continues to benefit from increased group travel.

- RevPAR: -2.2%, first decrease since February 2021.

- Demand: -2.7%, has fallen in 12 of the past 13 months.

- ADR: +0.2%, smallest gain since March 2021

- Chain Scale RevPAR: All down, ranges from -0.4% (Upper Upscale) to -7.2% (Economy).

- Chain Scale Demand: Luxury and Upper Upscale, +8.3% and +1.8%, respectively. All others down from -1% (Upscale) to -6.0% (Economy).

Global industry entering next phase of recovery?

Most of the largest global countries saw RevPAR decline as well, which is in line with past years and the Easter holiday. While RevPAR was down in Mexico, it saw the largest occupancy increase, with the largest gains being in the markets in the northern and central parts of the country that were in the path of the solar eclipse. March overall was generally positive, however, the next few months will start to reflect more stable patterns as the pandemic is completely gone from all year-over-year comparisons.

Looking ahead

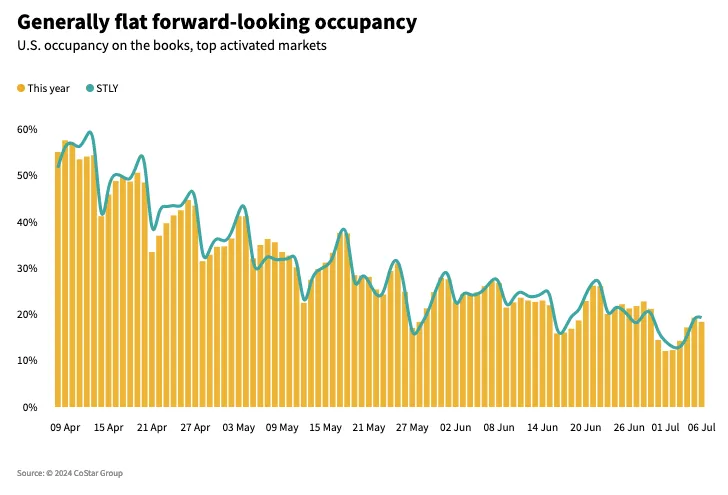

The U.S. hotel industry should see better growth in April with tailwinds from Easter 2023 and the solar eclipse, along with continued strong group demand. Headwinds include the Passover observance in late-April that will slow some group travel along with the lack of an April spring break season due to the early Easter observance. Last year’s Taylor Swift tour from mid-March through August boosted travel along the path of the tour and will be missed this year, resulting in some softness in select markets. However, travel for events, concerts, sports, and festivals remain a strong demand driver but we do expect travelers to be more selective than they were a year ago. As of now, summer is still anticipated to be more robust than last year.

Globally, the industry appears to have reached its normalization period. Double-digit RevPAR gains have faded away and will now only appear among special events. Along with the 2024 Paris Olympics, several markets in Europe will benefit from the “Taylor Swift effect” as her tour starts up next month in France and runs through the summer, ending in London in August.

This article originally appeared on STR.