Highlights

- U.S. RevPAR moderated after three unsteady weeks.

- Top 25 Markets and upper-tier hotels led U.S. RevPAR gains.

- Weekly group demand reached new heights.

- Global leisure demand beginning to bloom.

U.S. Performance

U.S. hotel performance leveled out following three unstable weeks impacted by the total solar eclipse and Easter calendar shift. Normal patterns returned in the form of solid weekday and Top 25 Market performance, as well as strong group demand. Revenue per available room (RevPAR) rose 1.2% year over year (YoY) driven entirely by average daily rate (ADR), up 1.5%. Occupancy (at 66.8%), the highest level seen in 2024 so far, was essentially flat dropping 0.2 percentage points (ppts) YoY.

Weekdays continue to post the strongest performance while weekends remain soft

Weekdays (Monday through Wednesday) posted the best performance with all three days seeing a roughly 3% RevPAR gain, all from ADR. The shoulder period (Sunday & Thursday) followed with RevPAR increases of nearly 1.5% each day, again driven by ADR. Weekends (Friday/Saturday) have been soft most of the year with Saturday (RevPAR, -2%) down more than Friday (-0.2%). Over the past 15 weeks, (week one was excluded due to the New Year’s Eve impact), average RevPAR change by day followed a steadily decreasing pattern from Monday (+3.4%) to Saturday (-1.2%). Sunday, however, was the outlier (+2.6%). This tidy pattern is possibly a reflection of travel patterns changing as extended leisure weekends decline due to waning pent-up demand while extended business weekdays increase due to growing flexible work schedules.

Top 25 Markets gain RevPAR while the rest of the country posted higher ADR

The Top 25 Markets saw RevPAR increase 1.6% due to a lift in ADR (+1.0%) and occupancy (+0.4ppts). The rest of the country saw a smaller RevPAR increase (+0.9%), lifted by a larger ADR increase (+1.7%), but offset by an occupancy decline of 0.5ppts. The day-of-week shifts described above for the total country generally followed the same pattern when comparing the Top 25 Markets to the rest of the U.S. – with a couple exceptions. Across the Top 25 Markets, the Saturday decline was more pronounced, and the Thursday increase was greater, while Mondays were stronger for the non-Top 25 Markets and Thursdays were weaker.

Room demand bifurcation

For several months, we have been watching the bifurcation of the industry in terms of demand change. Among branded hotels (chain scales), upper-tier hotels (Luxury, Upper Upscale and Upscale) in aggregate have not seen a monthly demand fall over the past fifteen months, whereas Economy hotels have fallen each month. A similar pattern has also been seen in 2024 weekly results. This week, only Economy saw a demand decrease, but the decline (excluding the gains seen from the Easter shift) was the smallest of the year so far and there is some evidence of a moderation in the downward trend.

Market performance

Philadelphia, St. Louis, and Washington, D.C.; posted double-digit, YoY RevPAR gains across all days. New York City and Phoenix also posted double-digit increases this week with most of the growth coming from weekday and shoulder days.

Outside the Top 25 Markets, August, GA; posted a double-digit RevPAR increase, boosted by the closeout of the Masters Golf Tournament on Sunday. Also posting double-digit RevPAR gains were Buffalo, NY, and Gatlinburg, TN, lifted by robust weekend performance, along with Indianapolis and Albany, NY, seeing strong performance all week.

While the crowds were still significant (100K+) over the two weekends of Coachella, hotels in the Palm Springs submarket saw all KPIs decrease. RevPAR over Friday and Sunday of the first weekend fell 15.7% compared to the same weekend one in 2023, due to a decrease in occupancy (-6.6ppts) and ADR (-9%). Weekend one ADR was US$49 with occupancy of 83%. Weekend two, which normally sees lower hotel performance, was more impacted with RevPAR dropping 24% from a year ago, with falling occupancy and ADR (-9.9ppts and -14.2%, respectively). Note, weekend two performance is an estimate as data for Sunday, 21 April is preliminary, however, Friday and Saturday showed similar results to the prelim Sunday figure.

Group demand reached the highest level since October 2023

Conventions and conferences are driving hotels with group demand at Luxury and Upper Upscale hotels reaching the highest level since the fall group season and just 3.8% below the post-pandemic all-time high. Compared to 2019, group demand was 7.5% below the highest week recorded in that year. Group ADR was also strong, up 4.3% YoY. Over the past 16 weeks of 2024, weekly group ADR increased 12 times, with 11 weeks increasing above the rate of inflation.

The strong RevPAR gains seen this week in St. Louis and Philadelphia were driven in part by group demand, as these markets saw the largest group occupancy gains of the Top 25 Markets (along with Dallas). St. Louis also posted double-digit ADR increases. Additional markets posting double-digit group ADR gains were Los Angeles, Detroit, and Washington, D.C.

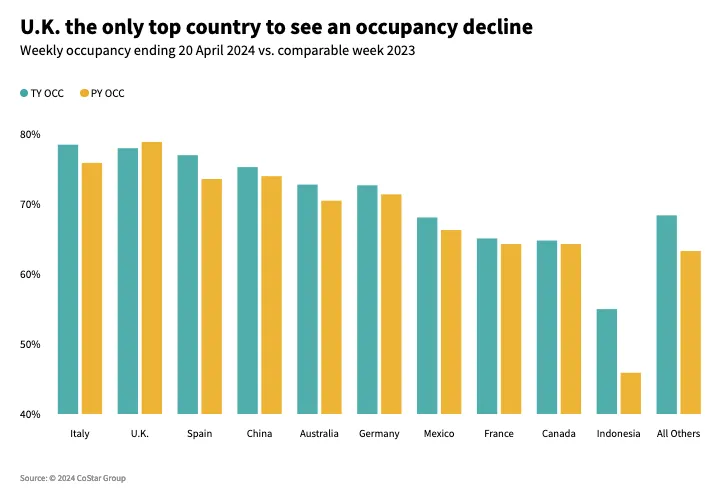

Global performance strong and strengthening

Global occupancies outside of the U.S. continued to grow. The largest gain last week was Indonesia, up +9.1ppts to 55.0%. ADR for the country fell slightly (-2.3%) as all markets across the country showed a decline. This is attributable to the shifting nature of Ramadan, which was two weeks earlier this year.

Among the largest countries, Italy had the highest occupancy (up 3.4ppts to 78.5%), which can be attributed to the beginning of the international art event, La Biennale. ADR in Italy rose 22.4%, resulting in a 26.4% RevPAR gain. In Venice, where the event takes place, ADR soared (+126%) with occupancy growing 10.2ppts to 82.1%. The Italian Northeast market located nearby equally benefited from the event, with occupancy up 5.6ppts and ADR increasing 11%.

Leisure travel also showed signs of blooming as Sardinia, Italy, saw occupancy grow 17.5ppts, while ADR jumped 31.1%. However, market occupancy was still low (at 44.2%) given it is early in the season. Another key leisure country, Spain, grew occupancy (+3.4ppts to 77.0%) with its largest increases coming from the Mediterranean Coast and Canary Islands, up 9.8ppts and 9.0ppts, respectively.

The U.K. was the only key country with a slight occupancy decline (-0.9ppts) this week, attributable to the shifting school holidays around Easter. As a result, RevPAR was flat (-0.2%). The UK still had the second highest occupancy of any key country this week (78%).

Looking ahead

Normalization remains the main theme of the industry as its moves through Q2. The first 16 weeks of the year show RevPAR gains at a similar level seen in the last half of 2023. Looking ahead, gains in group, weekday, and international inbound demand will offset some of the softness seen on the weekends as they slow. Additionally, various indicators (rising debt, delinquencies, inflation, etc.) continue to point to slower leisure travel this year, especially in middle-to-lower income households. One theory is that we are seeing a shift from “revenge” to “selective” travel, with guests becoming more discriminating given the higher living costs. One-time events such as graduations, weddings, and concerts may carry more weight than the annual summer vacation.

Outside of the U.S., the industry will see further strengthening, with the 2024 Paris Olympics set for July, rising international travel, and Taylor Swift’s Eras tour driving the gains. Outbound U.S. travelers, however, are expected to slow, but that isn’t evident just yet.

This article originally appeared on STR.