Global Performance

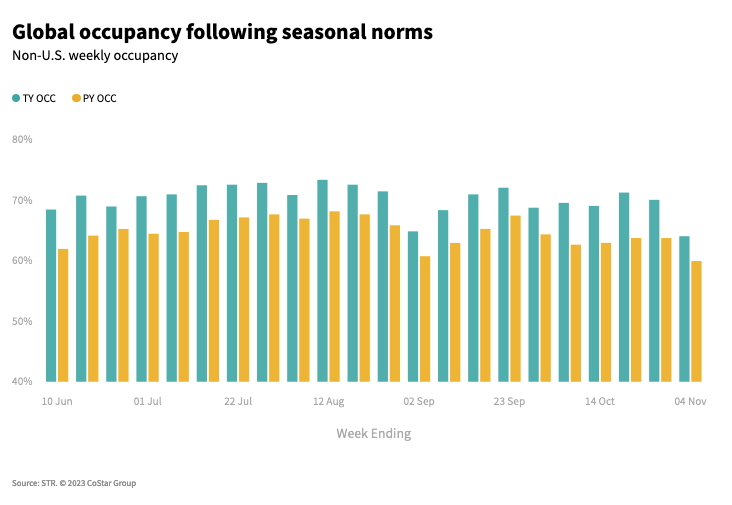

While lower than a week prior, global occupancy, excluding the U.S., was up 4.2ppts year over year to 64.1%. Occupancy fell 6ppts versus the previous week, which is better than the 6.8ppts drop seen the last time Halloween was on a Tuesday (2017). All continents saw a week-on-week decrease with Europe reporting the largest drop (-10.2ppts). Weekly global ADR increased 9.3% YoY, keeping RevPAR growth in double-digits (+16.8%).

Average occupancy among the Top 10 countries by supply grew 5.3ppts YoY. However, six of the 10 countries saw year-over-year declines. While this may seem alarming, based on the 2017 Halloween comparable year, the WoW occupancy fall was less severe, leading us to believe that the decrease is normal. Canada and Germany saw Tuesday occupancy drop by more than 10ppts with the U.K. posting a 5ppt loss year on year.

While the decrease in Top 10 occupancy due to Halloween may be normal, the gain for the group is due to one country, China, which saw occupancy increase 15.5ppts YoY. Excluding China, occupancy for the remaining nine countries was down 0.9ppts YoY with gains in Indonesia and Japan unable to offset decreases elsewhere.

Outside of the top 10, the countries with the highest weekly occupancy were:

- Americas: Uruguay, 74.5% (+6.8ppts YoY)

- Asia Pacific: Fiji, 79.0% (-0.7ppts YoY)

- Europe: Ireland, 80.6% (-0.6ppts YoY)

- Middle East & Africa: United Arab Emirates, 84.9% (+1.7ppts YoY)

The UAE also posted the highest occupancy of any country this week.

Halloween’s Not-So-Scary Results in the U.S.

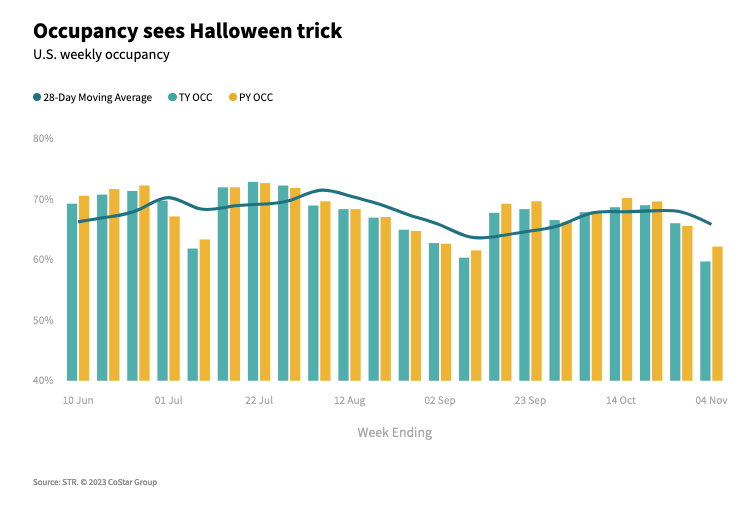

U.S. hotel industry occupancy (59.7%) took an expected step back, decreasing 2.5 percentage points (ppts) from last year. In line with historical trends, that was a predicted outcome due to Halloween falling on Tuesday. The last time Halloween fell on a Tuesday was in 2017, and occupancy decreased 2.6 ppts year over year.

Average daily rate (ADR) increased 1.9%, halting a 6-week streak of growth above 3%. Revenue per available room (RevPAR) declined 2.1%, driven by the Halloween-induced occupancy drop.

The week of Halloween always results in a performance slowdown simply because parents want to be with their children on that day. Hence, meeting planners and businesses avoid scheduling events around the holiday week. Historically, the least impactful Halloween day for the industry is Sunday because there is no regular business to disrupt. The most impactful, based on more than 20 years of results is Thursday, although Tuesdays are nearly as impactful. Therefore, Halloween this year was more significant than last year, which fell on a Monday and provided more opportunity for business and meeting travel afterwards.

While not a trick, there were a few treats in this year’s Halloween results. Overall, the fall in weekly demand was generally in line with the three other times Halloween has been on a Tuesday since STR began daily/weekly reporting. Weekly demand was down 2.5 million room nights week on week versus the average of 2.3 million during previous Tuesday Halloweens.

Additionally, this year’s All Hallow’s Eve saw higher occupancy than a year ago (51.5% vs. 50.1%). Both results, however, remain below the 20-year average of 52.8%. Halloween ADR increased 4.5% from 2022. So, while it was down, there was still some evidence of recovery even during an off week.

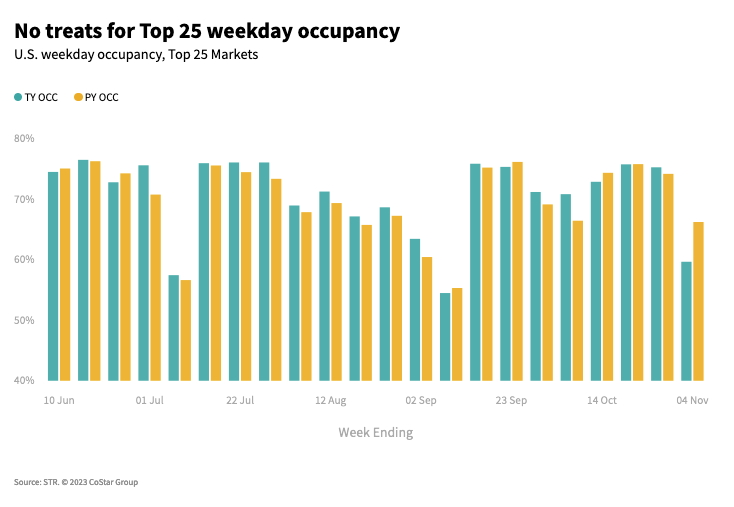

Because of the pause in business and meetings travel, the Top 25 Markets took a slightly bigger hit from Halloween compared to the rest of the country. Occupancy dropped 2.8ppts YoY with ADR increasing less than the national average and resulting in a larger RevPAR decline (-2.8%). Among all other markets, occupancy fell 2.3ppts, while ADR increased 2.6% and netted a smaller RevPAR decrease of 1.4%.

Like the previous week, New York City posted the nation’s highest occupancy (83.1%) followed by Las Vegas (81%). Both markets also saw solid RevPAR growth (~6%+). Like last year, the Big Apple hosted the New York City Marathon on Sunday, which helped Saturday’s results as that night’s RevPAR increased 11.6% on a 9.3% ADR gain.

Other notables among the Top 25 Markets included Boston, St. Louis, and Washington, DC all with weekly occupancy increases of more than two percentage points year over year. These markets also saw solid RevPAR growth in the week: St. Louis (+20%), Washington, DC (+9%), and Boston (+6%). St. Louis was bookended by strong performance on Sunday and Monday as well as the weekend, which featured two sold out Metallica shows. Boston’s results were from robust growth early in the week while DC saw solid growth on all days except Halloween Tuesday.

Notable non-Top 25 Market performance included Indianapolis hosting the Future Farmers of America convention 1-4 November and recording the largest gains of any U.S. market in Halloween occupancy (+12ppts) and RevPAR (+54%) . Twenty-seven markets also posted double-digit RevPAR growth for the week including Austin, Birmingham, Knoxville, Pittsburgh, and Syracuse, with most of their growth coming on the weekend thanks to college and pro football.

With Halloween occurring on a peak convention and conference night, group demand among Luxury and Upper Upscale hotels slowed considerably, dropping 10.4 ppts compared to last year. San Francisco was one market reversing this trend with group occupancy up 3.2ppts compared to the same week last year. Boston, Seattle, St. Louis, and Washington, DC also saw year-over-year increase in weekly group occupancy.

Final thoughts

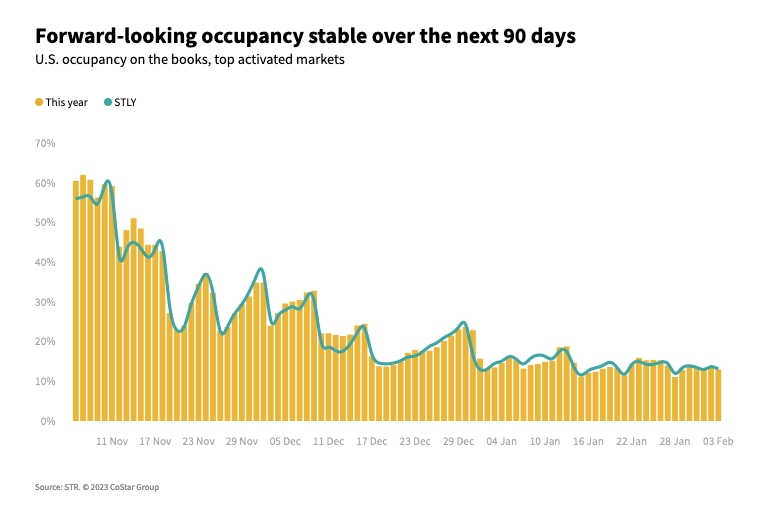

Halloween falling on a weekday caused U.S. performance to soften, but this no cause to be spooked. As we moved through each week this year, the industry has come closer to normal patterns and away from the large swings experienced during pandemic. We expect weekday growth driven by conventions, group meetings, business, and leisure travel to continue reflecting normal seasonal patterns. These normal travel patterns are also taking place in Europe, Asia, South America, and Asia. Full international travel will be the final leg to full global recovery, which is now expected in 2024, according to Tourism Economics.

Looking ahead

In the U.S., expect strong week-on-week gains for the period ending 11 November with the following week (ending 18 November) showing a strong decline ahead of Thanksgiving. Thereafter, performance will continue to follow seasonal patterns as we near the end of the year. Globally, performance will stay strong, but it too will begin to slow as the year closes.

This article originally appeared on STR.