While other parts of the world began their post-pandemic recovery earlier than Asia Pacific, recent data suggests that the region is accelerating its recovery process and could potentially reach levels seen in Europe and America.

Demand catches up with the rest of the world

Year to date through August 2023, hotel occupancy rates surged past 90 percent of the 2019 comparable levels across most subcontinents worldwide. Notably, the occupancy indices in Asia Pacific subcontinents closely aligned with those in most European subcontinents and North America, ranging from 91 to 100. This indicates that demand in the Asia Pacific region has reached comparable levels to other parts of the world that began their post-pandemic recovery journey much earlier.

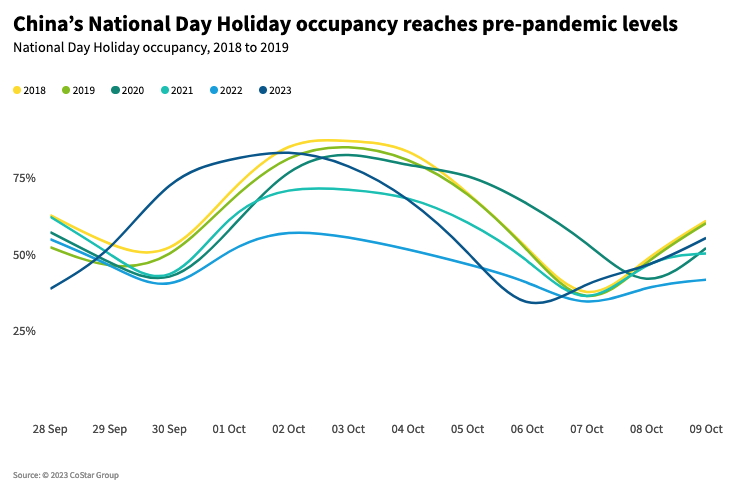

While uncertainty surrounds the possibility of a full return of Chinese outbound demand throughout the region, there is a growing demand in domestic tourism, as past data revealed that leisure markets China, specifically Hainan and Sanya, took the top spots in terms of RevPAR recovery over the summer period across all global markets. Moreover, more recent data for the 2023 National Day Holiday has shown that the region’s occpancy performance has edged close to pre-pandemic performance, showing more evidence of growing domestic demand.

Forecast: APAC recovery matching EMEA's pace

Combining the forecast data for the remaining months of 2023, Asia Pacific markets are poised to recover at a pace similar to that of EMEA markets, with the exception of Melbourne, Beijing, and Guangzhou, which are expected to lag behind 2019 levels.

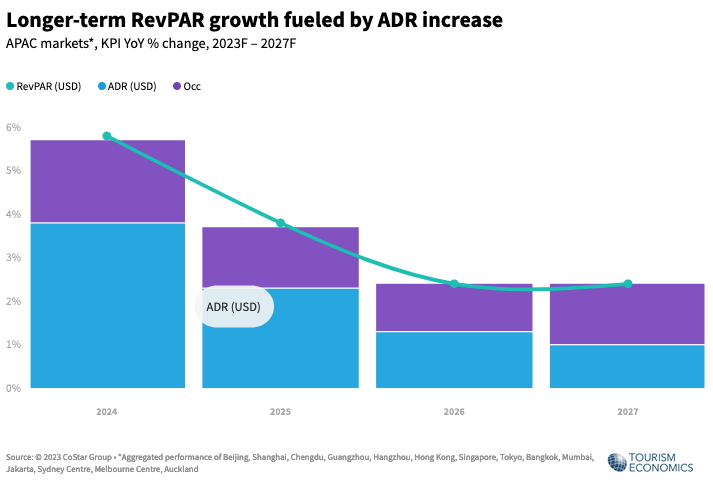

Other than demand-side factors that drive growth in APAC, such as increased demand from Chinese tourists, RevPAR growth in the coming years is more likely to be driven by rate increases. This is due to multiple reasons, such as events, inflation, and cost increases. All things considered, data shows more positive signs compared to the end of 2022.

This article originally appeared on STR.