Excerpt from STR

The U.S. hotel industry posted its highest weekly occupancy since the end of summer 2021 with a level of 66.9% during the week of 13-19 March 2022. Boosted by Spring Break and NCAA March Madness, one-fifth of the 166 STR-defined U.S. markets reported their highest occupancy of the past 32 weeks with 12 markets achieving pandemic-era highs. For a second consecutive week, average daily rate (ADR) increased by more than 4%, pushing the weekly level 14% higher than the 2019 comparable. Revenue per available room (RevPAR) also increased sharply, up 11% week on week and 10% from the corresponding week in 2019.

Of the 12 markets that reached pandemic-era highs in occupancy, four were in Texas (Austin, Dallas, Fort Worth/Arlington, and San Antonio), four were in Florida (Florida Central, Melbourne, Orlando, and Tampa), and two were in Arizona. As a result, Arizona, Florida, and Texas also recorded their highest statewide occupancies since the start of the pandemic: Florida (87.4%), Arizona (82.9%) and Texas (72.7%).

Nine of this week’s 10 highest occupancy markets were in Florida, led again by the Florida Keys. Orlando, the nation’s second largest market based on hotel supply, posted the fourth highest occupancy, which surpassed 90%. The only market in the top 10 not in Florida was San Antonio, which recorded an occupancy of 86.9%.

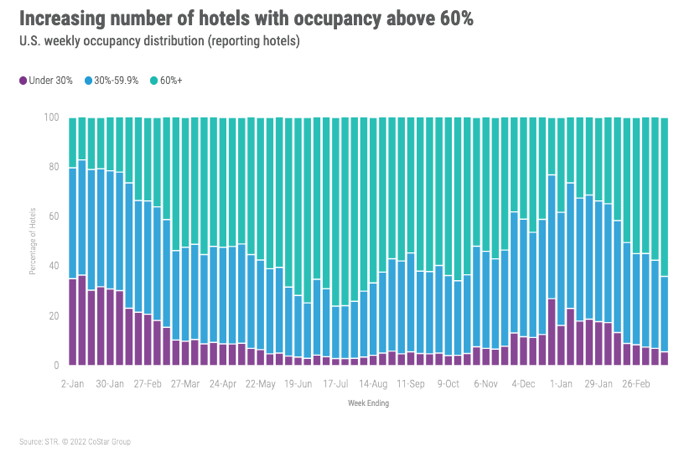

More than 64% of hotels saw occupancy surpass 60% this week, the most since mid-October. In the Top 25 Markets, more than 74% of hotels reported occupancy above 60%, which was the most since July 2021. As a result, occupancy in the Top 25 Markets (71.6%) was at its highest weekly level since early 2020. Weekday (68.9%) and weekend (80.7%) occupancy for the Top 25 also hit pandemic-era records. Shoulder days (Sunday and Thursday) produced their second highest occupancy (66.5%) of the pandemic-era.

After hitting a pandemic-era high the week prior, group demand fell (1.6 million to 1.4 million), which was likely due to Spring Break, as a significant number of schools were on holiday. Despite the decrease in group demand, the upper upscale segment saw its highest occupancy (67.1%) since the start of the pandemic. Luxury chains also set a pandemic-era record (69.3%). For the week, the highest occupancy was in the upscale (71.5%) and upper midscale (70.1%) segments, but neither was a pandemic-era high. The week’s upscale occupancy was the fourth highest since the start of the pandemic, while upper midscale occupancy was ninth best during that time. Weekday (Monday-Wednesday) occupancy in the Top 25 Markets for luxury (67.5%), upper upscale (65.9%), upscale (71.7%), and upper midscale (70.7%) were all pandemic-era highs.

Click here to read complete article at STR.