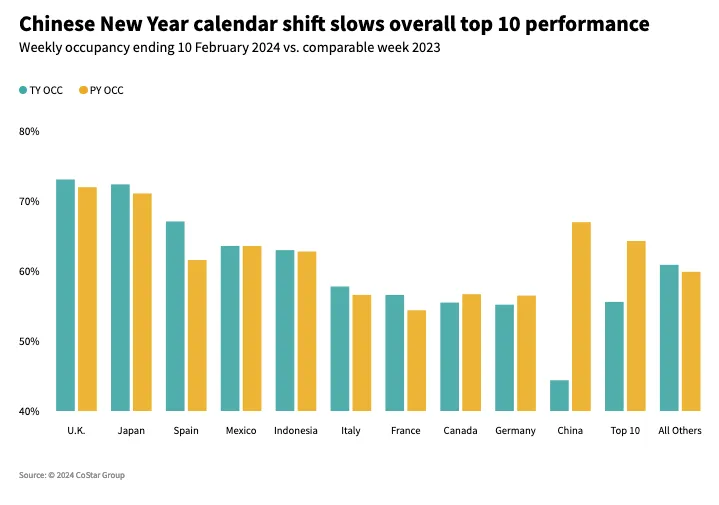

Outside of the U.S., YoY performance for the top 10 countries was largely swayed this week by a Chinese New Year calendar shift. The annual holiday occurred two weeks earlier last year. Only two other countries, Canada and Germany, saw declines - albeit small ones at -1.3ppts and 1.4ppts, respectively.

Highlights

- Super Bowl carried U.S. hotel performance over the goal line.

- U.S. Group demand increased for a fifth consecutive week.

- Las Vegas posted its highest Friday/Saturday ADR on record and the highest for the Super Bowl.

- Chinese New Year calendar shift softened performance in China.

- Strong performance in Japan aided by Taylor Swift.

U.S. Performance

Super Bowl LVIII, hosted in Las Vegas, was responsible for the U.S. hotel industry’s strong year-over-year (YoY) growth in revenue per available room (RevPAR), which was up 3.9% and driven entirely by a 6.8% increase in average daily rate (ADR). U.S. occupancy fell 1.5 ppts as business slowed ahead of the big game. Without Las Vegas’ ADR contribution, U.S. ADR would have been flat compared to last year and RevPAR down 3%. It is important to note that this week’s data only runs through Saturday, and Las Vegas will continue to impact results into the following week given that game day was on Sunday.

Las Vegas also moved performance for the Top 25 Markets in aggregate, with RevPAR increasing 11.1% YoY with ADR up 12.0% and occupancy down 0.5ppts. Excluding Las Vegas, Top 25 Market RevPAR decreased 3.0% YoY as ADR dropped 1.9% and occupancy declined 1.0ppts. Not surprising, weekends showed the greatest RevPAR shift with the Top 25 Markets increasing 20.3%. When removing Las Vegas, RevPAR decreased 9.7%. Las Vegas lifted Top 25 Market weekdays (Monday-Wednesday) and shoulder days (Sunday and Thursday) to a lesser degree with RevPAR up 5.7% on weekdays and 8.9% during the shoulder period. Excluding Las Vegas, RevPAR held at +0.6% on the weekdays, while the shoulder days declined 2.8%.

Las Vegas reset the bar for Friday-Saturday Super Bowl ADR (at $747), which was the highest in history. Until this past weekend, Miami held the record for highest Super Bowl ADR (Friday-Saturday, at $563 in 2020). Las Vegas also set a record for its highest weekend ADR ever as it grew 227.1%, resulting in RevPAR growth of 239.6%. Occupancy reached 83.7% over the weekend. Overall, Las Vegas RevPAR for the entire week was up +139.9% YoY, driven almost entirely by ADR (up 126.1%).

While Las Vegas was the story this week, several other Top 25 Markets also saw solid RevPAR gains including New Orleans (+21.4%), with Mardi Gras lifting weekend RevPAR 60.8%, Boston (+12.5%), helped by strong Sunday and Monday performance, Oahu (+12.4%) and New York City (+11.5%). Oahu and NYC posted strong performance all week.

The rest of the country saw RevPAR decline 2.6% on falling occupancy (-2.1ppts) and modest ADR growth (+1.3%). RevPAR outside of the Top 25 Markets has fallen in every week of the year so far and in 29 of the past 31 weeks.

Outside of the Top 25 Markets, Mobile, AL, and the New Jersey Shore saw RevPAR increase by more than 20% YoY.

Group business gains

Group demand in Luxury and Upper Upscale hotels grew for the fifth consecutive week, increasing 6.5% compared to the same week last year and up 7.8% over the past four weeks. Group ADR has also increased, up 5.9% YoY and 4.7% over the past four weeks.

Sixteen of the Top 25 Markets saw year-over-year group occupancy gains. Las Vegas and Orlando posted the highest group occupancy and greatest year-over-year occupancy increase. St. Louis and San Diego also saw some of the highest group occupancy gains.

Global hotel performance

Outside of the U.S., YoY performance for the top 10 countries was largely swayed this week by a Chinese New Year calendar shift. The annual holiday occurred two weeks earlier last year. Only two other countries, Canada and Germany, saw declines - albeit small ones at -1.3ppts and 1.4ppts, respectively.

Within China, occupancy fell 22.5ppts YoY to 44.4%, however, this comparison does not truly reflect performance due to the holiday starting on a different day each year. Comparing to 2017 (the last year pre-COVID when the beginning of Chinese New Year fell on Saturday), occupancy this year fell less week over week (-16.8ppts compared to -24.0ppts). Based on historical trends, occupancy increases can be expected next week as the national holiday continues until 17 February.

Spain saw the largest YoY occupancy gain out of top 10 at +5.5ppts, up to 61.6%, boosted by Madrid (+12ppts to 72.0%) and the Mediterranean coast market (+9ppts to 60.9%).

Impressive YoY growth was seen in Japan with ADR up 53.4%. This was a result of strong countrywide performance, especially the region of Hokkaido and city of Kyoto, both up 55% YoY and the mega event in Tokyo—four nights of Taylor Swift’s Eras tour performed at the 55,000-seat venue. ADR in the city was up 51.8% to US$245. Japan continues to lead the top 10 in RevPAR growth, this week up 56.3% YoY.

Looking ahead

Another night of Super Bowl data will positively impact the next batch of results in the U.S.. Excluding Las Vegas, we expect hotel performance to increase as we move closer to peak spring conference season in mid-March. The strongest performance continues to be midweek (Monday – Wednesday) travel in the Top 25 Markets, which points to a positive outlook for business travel. Leisure travel, reflected by weekends, appears to have stalled driving the weak overall occupancy performance. The upcoming spring break season should provide some clarity around the direction leisure travel is going. Additionally, demand in lower-tier hotels (Upper Midscale, Midscale and Economy) has fallen in most weeks across all three of those classes with the largest decreases in Economy (-5.6%) and is not expected to show improvement soon.

Over the next two months, global performance will be driven by holidays, in particular Chinese New Year, sporting events, concerts (Taylor Swift’s international tour in Australia and Singapore), conferences/conventions, and the change of seasons.

This article originally appeared on STR.