The Market Snapshot: Asia Pacific 2023 highlights an overview of transaction activity in the region and presents 25 markets current hospitality landscape; each covering demand and supply dynamics, hotel performances, and key transactions.

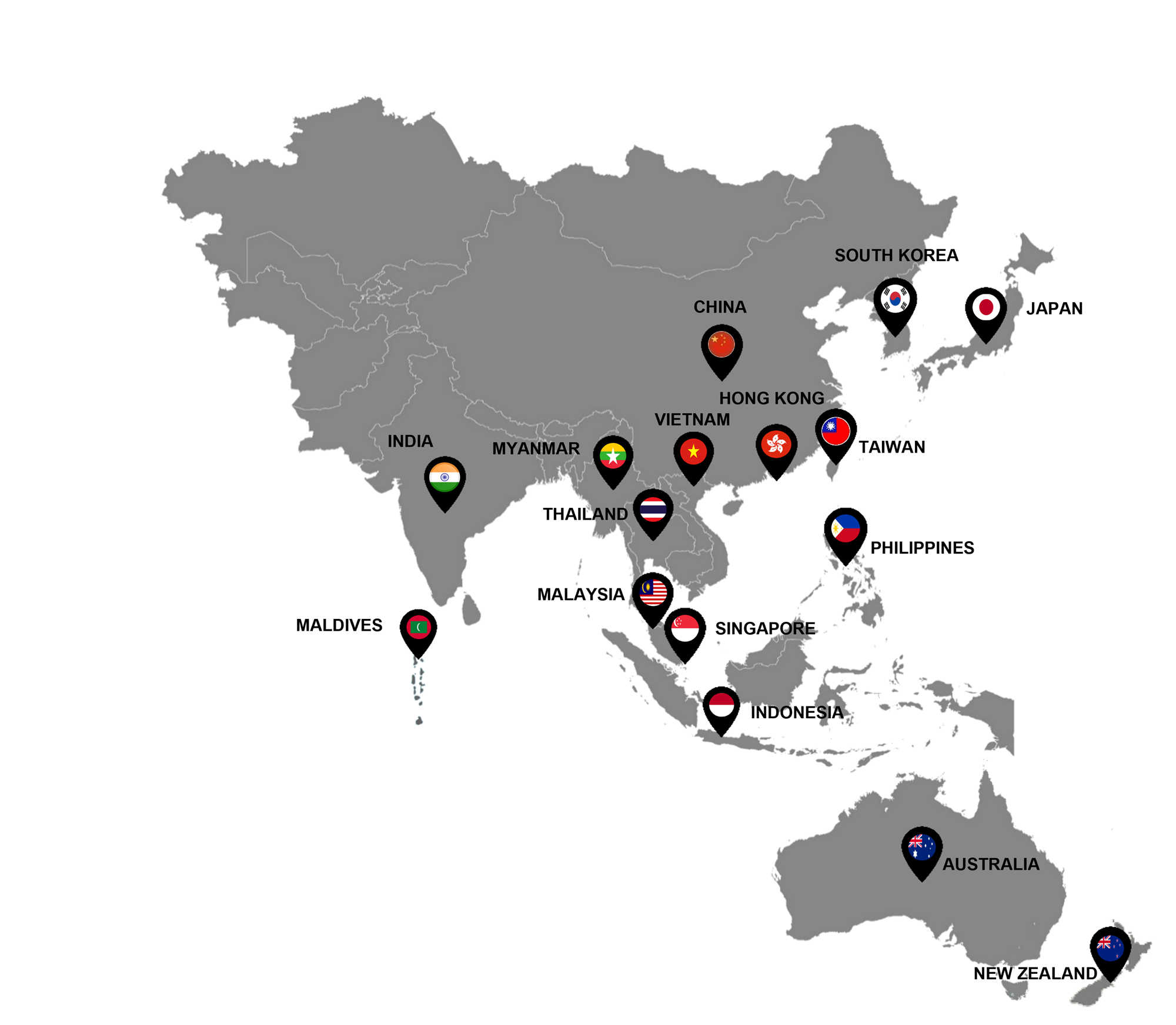

Transactions in the Asia Pacific

In 2022, transaction activity in the Asia Pacific remained steady with a 4% increase in transaction volumes, achieving a transaction volume of approximately USD13.3 billion worth of hospitality assets. While some larger markets may have experienced slowed transaction volumes in the past fiscal year, most notably South Korea and China, other markets are making gains, including both Australia and Japan. Both countries registered increases in the past fiscal year (3Q 2022 to 2Q 2023) in transaction volumes of over a billion USD. Ongoing market conditions including interest rate hikes, slower than anticipated resumption of flight routes and visitors continue to extend an uncertain investment environment in the year ahead.

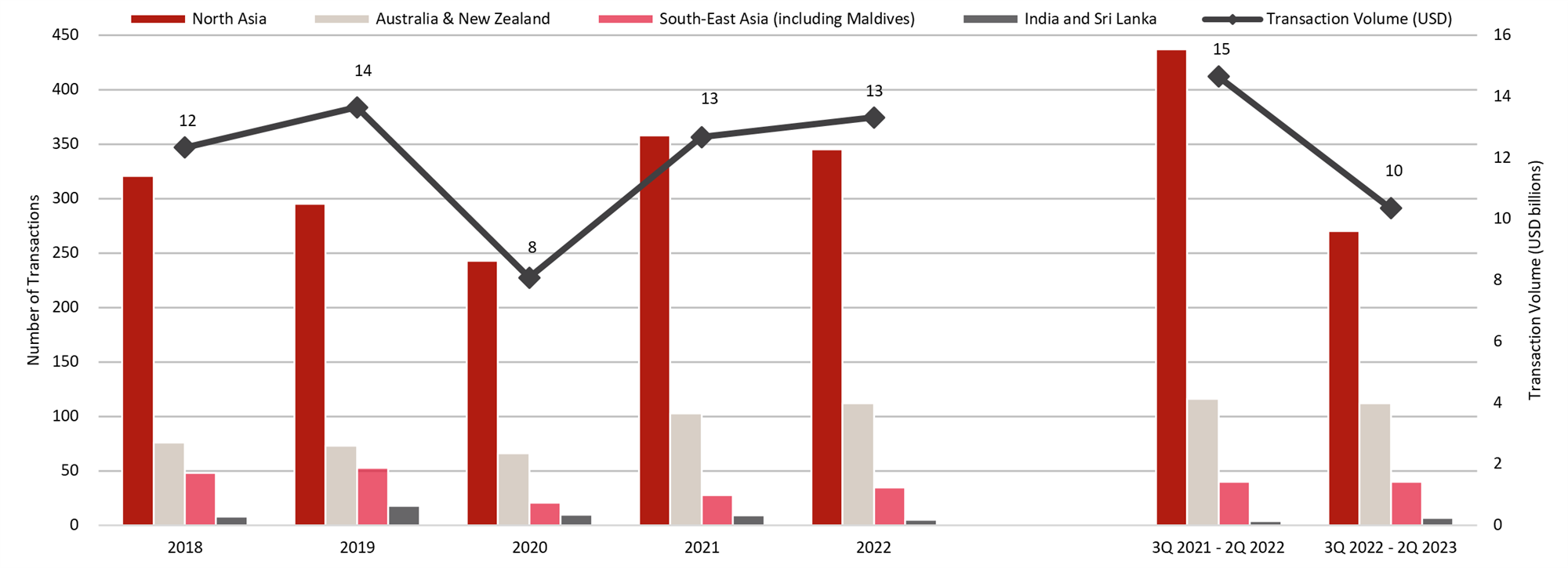

Transaction History in the Asia Pacific (2018 - 2Q 2023)

Source: HVS Research

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

Top Three Most Active Markets (3Q 2021 to 2Q 2023)

Number of transactions have remained the same from 2021 to 2022, with transaction volumes increasing slightly by 4% year over year. It is clear the last four quarters of transactions (3Q 2022 to 2Q 2023 - 427 deals) have slowed compared to the four preceding quarters (3Q 2021 to 2Q 2022 - 593 deals) by 28%. In the last four quarters, the markets of Australia, Japan, and South Korea were leading the transaction volumes for the region. Japan doubled transaction volumes in the last four quarters versus the preceding period, registering an increase of USD909 million.

Transaction Volume in Top Three Most Active Markets (3Q 2021- 2Q 2023)

.png)

Source: HVS Research

*Please note mentions of "transaction values" pertain to the transaction volume based on relevant stake/interest as of the mentioned date

Major Investors in the Asia Pacific

In 2022, transaction activity from the top ten investors in the Asia Pacific accounted for approximately USD4.24 billion or 35% of total transaction volume. In 2022, transaction volumes have steadily increased after a period of slowed activity throughout 2021, impacted by diminished investment sentiment arising from COVID. South Korea showed resilience with over USD4 billion in investments recorded, representing an 18% increase versus the previous year. South Korea ranks first followed by China, Australia, Japan, and Taiwan in volume of transactions for 2022, representing USD10.3 billion. In reviewing activity by number of transactions, Singapore-based GIC recorded 12 transactions in Australia, and four transactions in Japan. Japan-based APA Group recorded 6 transactions, with all properties based locally. Star Lake, a South Korea based company, Japan-based Domus GK each recorded 5 transactions in 2022.

Top Ten Investors

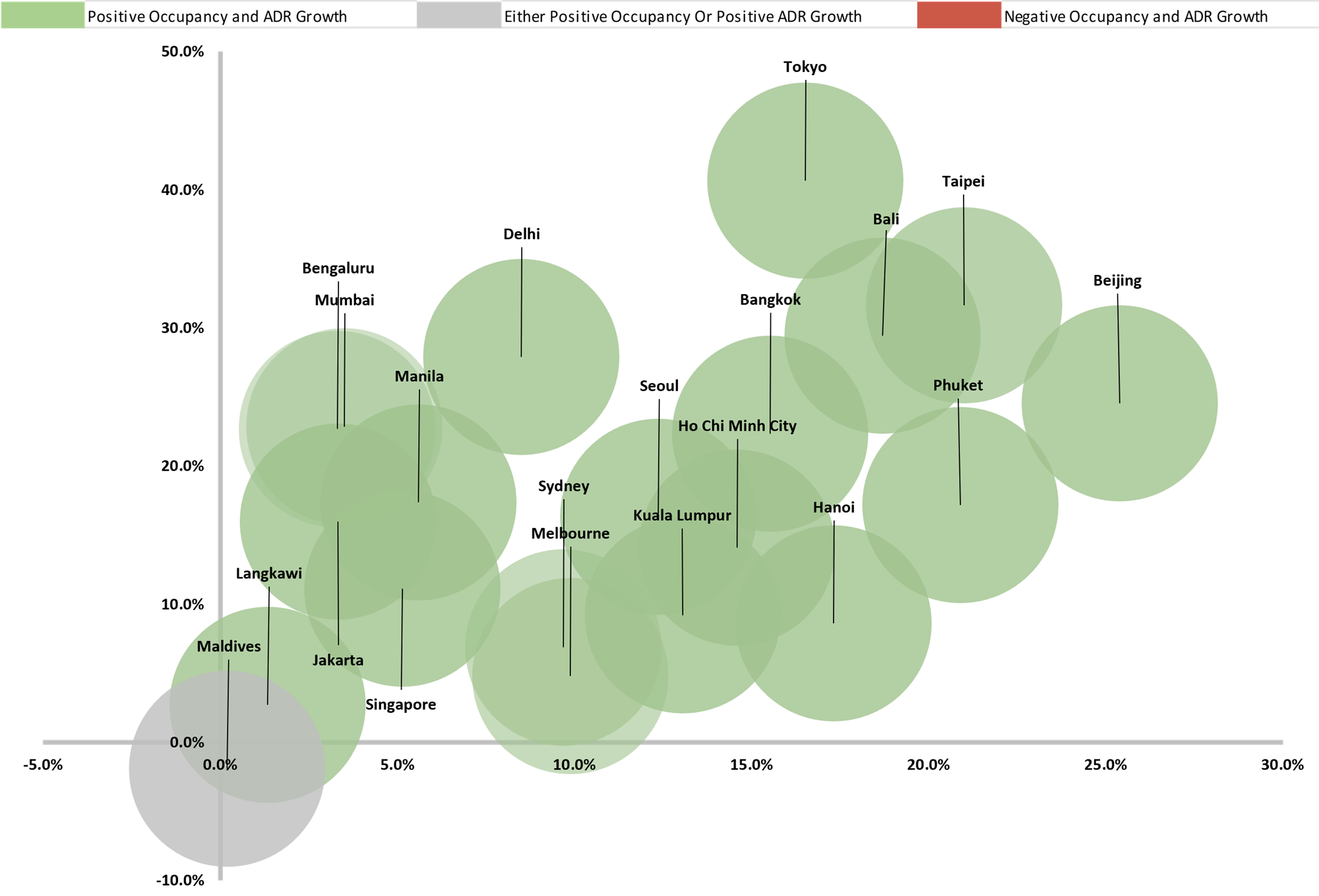

Hotel Performance in the Asia Pacific (2023)

Overall hotel performance across the tracked markets in 2023 is anticipated to continue its recovery, most markets have removed the last of their respective health and travel protocols in the first half of 2023. This includes the much-anticipated release of outbound travel restrictions for Chinese travellers, this includes removal of quarantine requirements, relaxation of outbound group travel to various countries, resumption of foreign tourist visa issuances, and removal of pre-departure COVID-19 Antigen tests requirements. Most markets were expected to recover in domestic travel followed by international, this was clearly reflected by a strong growth in Chinese outbound international flight bookings seen during the National public holidays in Q2.

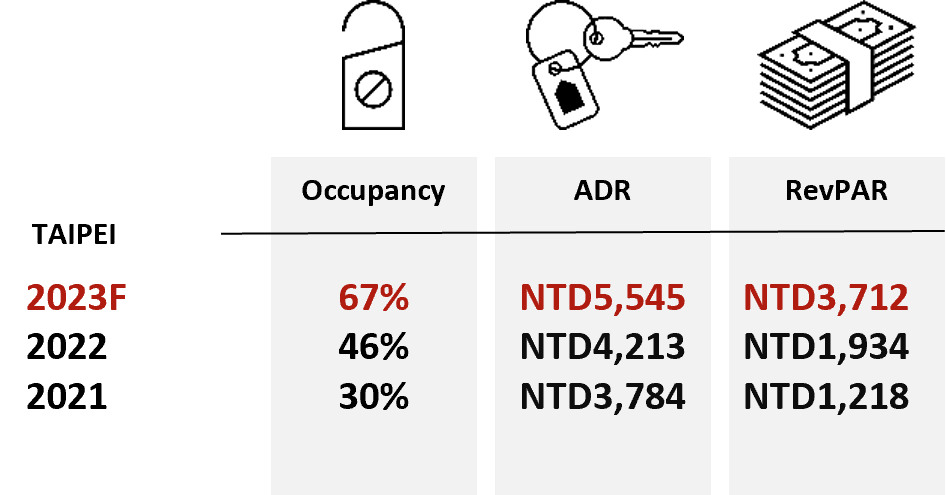

The top five market growth in hotel performances are Beijing, Taipei, Shanghai, Bali, and Tokyo, while static markets are the Maldives and Langkawi. In general, hotel performance in Asia Pacific is forecasted to improve from 2023. The Maldives' performance is expected to be static for 2023 with average rates expected to soften after a strong rate recovery in 2022 while occupancy levels are expected to remain stable.

Hotel Performance in the Asia Pacific (2023)

Source: HVS Research

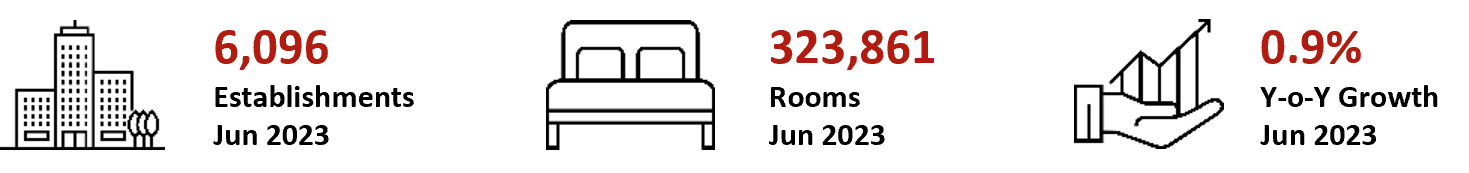

Australia

Key Points

- Tourism contributed 3.1% to GDP in 2022, down from 4.7% in 2021

- 1.5% Real GDP growth is expected in 2023

- 9.6 million international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- From July 6, 2022, the Australian government has lifted all its COVID-19 entry requirements. All international travellers are permitted to enter Australia regardless of their vaccination status.

Infrastructure Projects

- AUD16 billion road infrastructure Project of West and Southwestern Sydney by 2023

- AUD5 billion Melbourne Airport Rail Link to connect to entire Victoria state by 2029

- AUD5.3 billion for new Western Sydney Airport, to be operational by 2026 for international, domestic and freight

Notable Upcoming Hotel Openings in Sydney and Melbourne (2023)

Top 3 Largest Inventory

- W Hotel Sydney, 588 keys

- MOXY Sydney Airport, 301 keys

- Meriton Suites, 298 keys

Notable Transactions

- 296-key Sheraton Grand Mirage Gold Coast transacted at AUD192 million (AUD649K/key) in May ‘23

- 220-key Waldorf Astoria Sydney transacted at AUD520 million (AUD2.4 mil/key) in Feb ’23

- 105-key Sir Stamford at Circular Quay (Sydney) transacted at AUD210.5 million (AUD2mil/key) in Jan ’23

Demand

In 2022, total overseas arrivals rebounded to 9.6 million international arrivals compared to 700 thousand arrivals in 2021. Domestic arrivals in 2022 expanded to 49 million, doubling the domestic traffic in 2021 (23 Million). In reviewing May 2023 YTD Data, the upward trend continues with nearly 7 million overseas arrivals this year compared to 240 thousand in the same period of 2022.

Supply

*Include non-branded hotels

Source: HVS Research

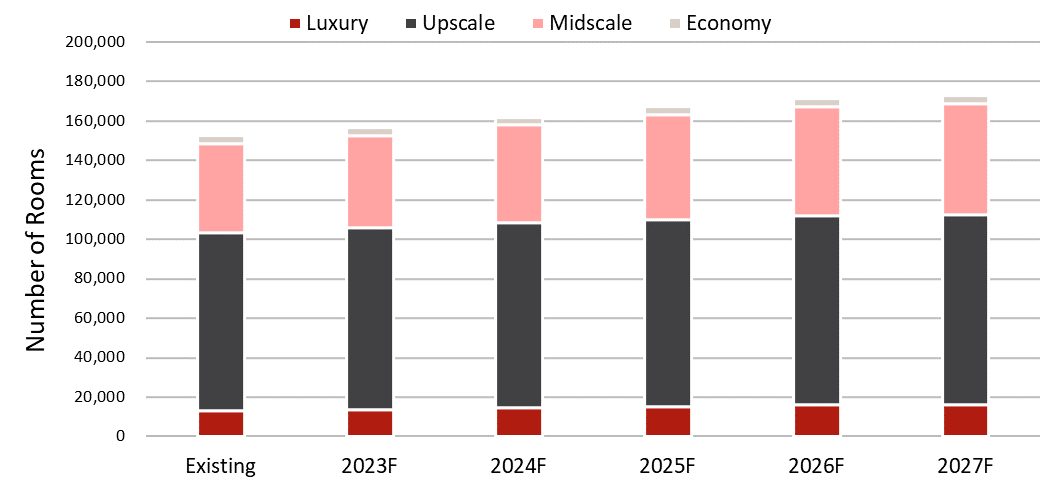

HVS has noted that there will be 122 additional hotels with approximately 20,474 keys by 2027; 21 properties with a total of approximately 4,161 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

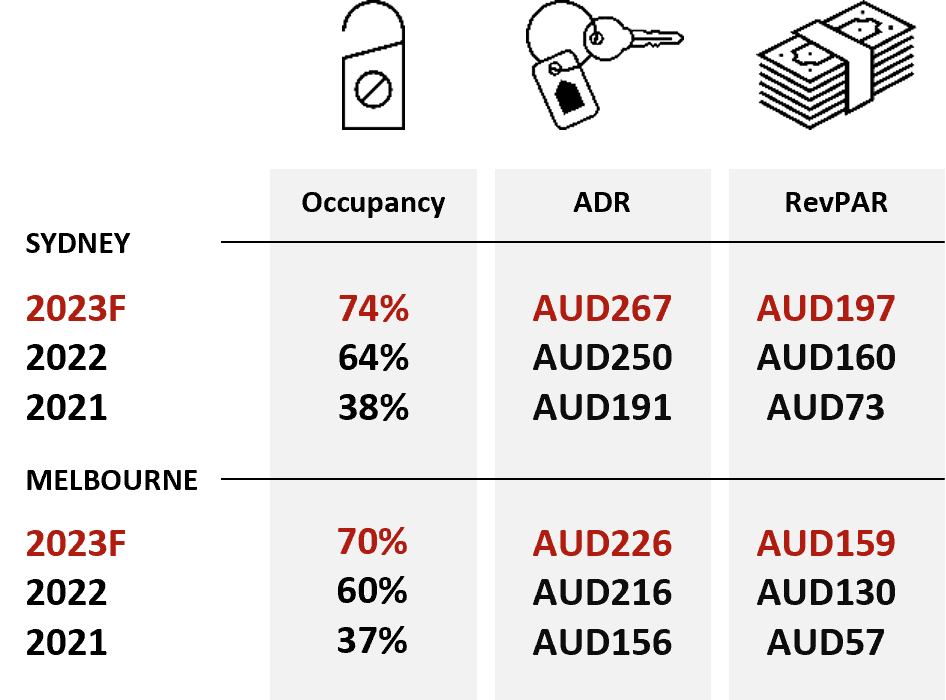

Hotel Performance

Source: HVS Research

As of YTD May 2023, hotel occupancy in Sydney and Melbourne increased by 19.9 percentage points (p.p.) and 15.6 p.p y-o-y, respectively. Sydney’s ADR and RevPAR increased by 16.7% and 59.2% y-o-y. Similarly, Melbourne’s ADR and RevPAR increased by 11.7% and 44.7%. Australia has welcomed international travellers since February 2022 which has improved the occupancy and ADR.

Transactions

From 2018 to YTD June 2023, New South Wales has recorded the highest transaction value, amounting to 50% of the total amount in Australia. This was followed by Victoria with 19% and Queensland with 17%. Transaction levels in 2022 recorded a 61% y-o-y increase. As of YTD June 2023, the total transaction volume has reached AUD1.96 billion.

Transaction Value Recorded By Region (2018 - YTD Jun 2023)

.png)

Source: HVS Research

China

Key Points

- Tourism contributes 3.3% to GDP in 2022, down from 4.6% in 2021

- 5.0% Real GDP growth expected in 2023

- 2.5 billion domestic tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- Since the end of 2022, the Chinese government has gradually lifted its previous quarantine policy and gradually resumed international entry and exit. From March 15, 2023, all types of visas entering China will be fully processed normally, and Singaporeans do not require a visa if travel is within 15 days from June 2023.

Infrastructure Projects

- The 14th Five-Year Plan: Digital China Development

- National 5G Network Coverage

- Big Data Centre

- AI Implication

- RMB141 billion Chongqing-Kunming High-Speed Railway by 2025

- RMB123 billion Shenzhen Bao’an Airport Third Runway Expansion by 2025

Notable Upcoming Hotel Openings in Beijing and Shanghai (2023)

Top 3 Largest Inventory

- Jin Jiang International Hotel Shanghai Lingang, 482 keys

- Somerset Star River Minhang Shanghai, 459 keys

- Golden Bridge Harbour Penguin Resort, 372 keys

Notable Transactions

- 631-key Hyatt on the Bund sold for RMB4.5 billion (RMB7.1m/key) in Feb 2022

Demand

In 2022, international inbound tourist arrivals displayed an 85% decline compared to 2019. Arrivals from Hong Kong, Macau, and Taiwan account for 79.3% of the total inbound arrivals. Domestic visitors continue to play a key role as they account for 95.8% of the total visitor arrivals with 1.1% y-o-y growth in 2019. China’s domestic tourism is expected to dominate the market even with the international border open. In 2022, more than 2.5 billion domestic tourists were recorded, displaying a 58.7% y-o-y reduction in 2019.

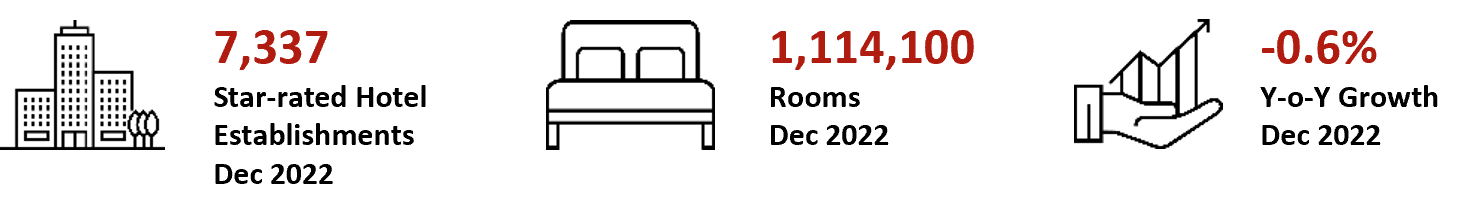

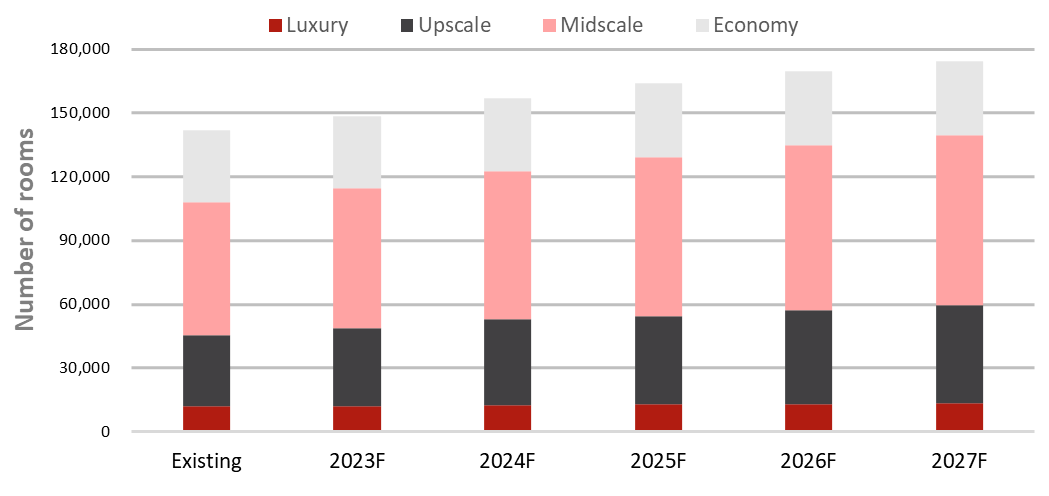

Supply

Source: Ministry of Culture and Tourism of the People’s Republic of China

HVS has noted that going forward, there will be 1,979 additional hotels with approximately 385,277 keys in China by 2027; 387 hotels with approximately 79,890 keys in China will be opened by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

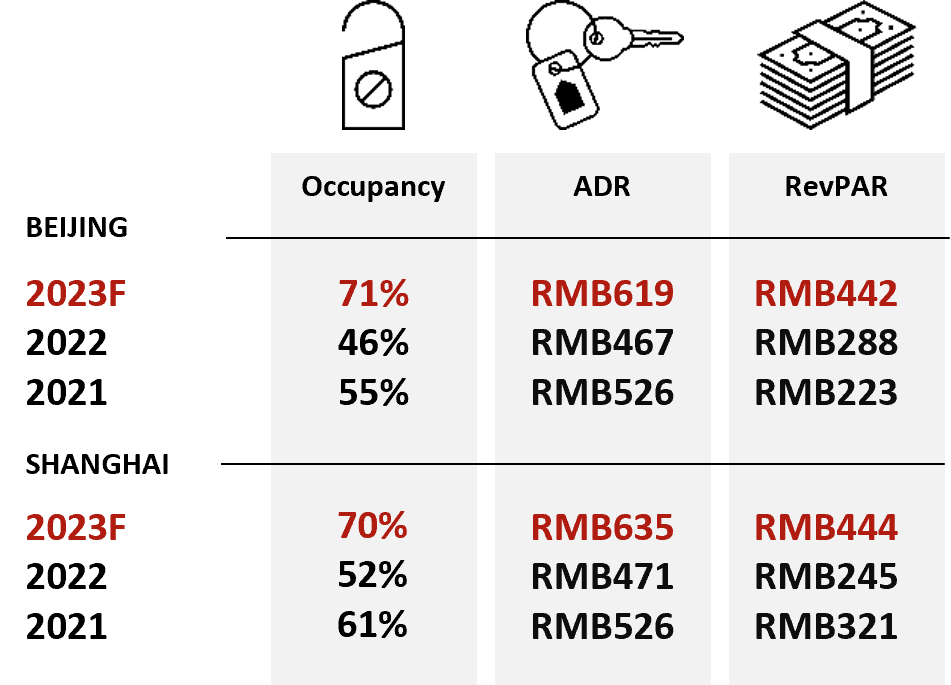

Hotel Performance

Source: HVS Research

The Chinese market is recovering from COVID-19 in 2023. As of YTD May 2023, the occupancy in Beijing and Shanghai has increased by 24.0 p.p. and 12.0 p.p. respectively. ADR has also increased for both cities, resulting in a rise in RevPAR for Beijing and Shanghai by 78.9% and 63.3% respectively.

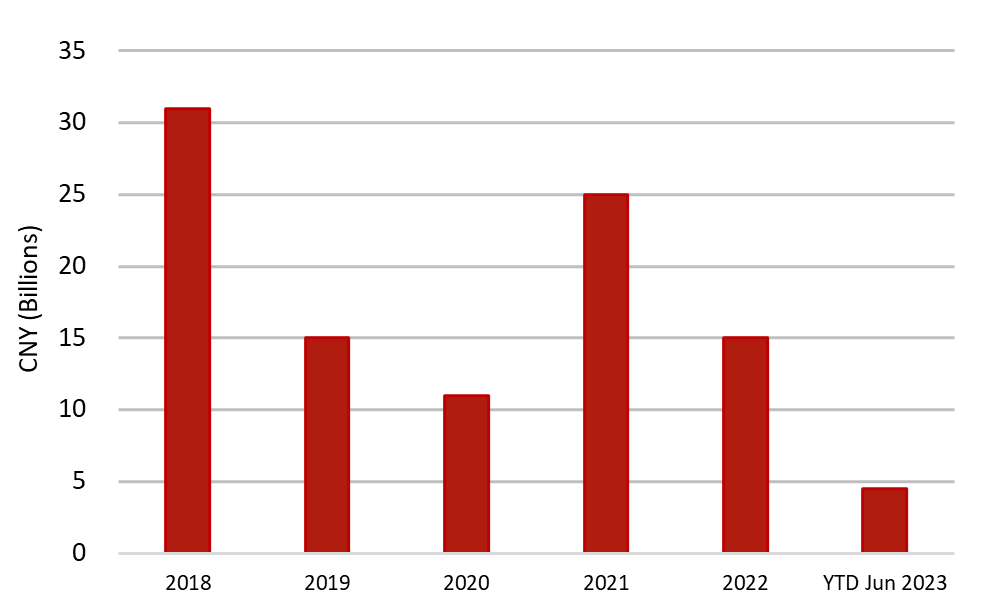

Transactions

Hotel transactions have peaked in 2018, reaching almost RMB32 billion in total. The transaction volume in 2020 halved with the outbreak of the pandemic, but it has risen back to RMB25 billion in 2021. As of YTD June 2023, 38 transactions were recorded with a total volume of RMB7.7 billion. The RMB4.5 billion sale of Hyatt on the Bund in February 2022 marked the highest sale in China in five years.

Transaction Value Recorded By Year (2018 - YTD Jun 2023)

Source: HVS Research

Hong Kong

Key Points

- Tourism contributed 4.5% to GDP in 2022, up from 3.2% in 2021

- 3.5% Real GDP growth is expected in 2023

- 605 thousand international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- From February 6, 2023, travellers can visit Hong Kong with no quarantine, isolation, or vaccination requirements.

Infrastructure Projects

- HKD40 billion upgrade by 2030, for HK International Airport Expansion, up to 2030 with a Three-runway system, further development of Asia World Expo and HK Port Island Development for logistics, transportation and supporting facilities

- Northern Metropolis Development Strategy: to establish the northern economic belt for new town development and to enhance HK-Shenzhen integration

- HKD110 billion investment for railway network expansions for Northern Link, Tung Chung Line Extension, Tuen Mun South Extension by 2030

Notable Upcoming Hotel Openings in Hong Kong (2023)

- Kimpton Hong Kong Mariners Club, 492 keys

- Hmlet Portland, 37 keys

Notable Transactions

- 695-key Pentahotel Hong Kong-Kowloon transacted for HKD2.0 billion (HKD2.9m/key) in Apr 2023

- 546-key The Kimberley Hotel transacted for HKD3.4 billion (HKD6.2m/key) in Mar 2023

- 388-key Hotel Sav transacted for HKD1.6 billion (HKD4.1m/key) in Mar 2022

Demand

In the year 2022, the number of visitors to Hong Kong registered a 561% increase, from 91,400 visitors in 2021 to 604,600 visitors in 2022. The continued growth is evident in the YTD May 2023 data, where HK recorded 10.1 million visitors compared to the same period in 2022 with only 35,000 visitors. This is attributed to the loosening of restrictions, in December 2022, removing PCR Test requirements for all international arrivals and further removal of quarantine or vaccination requirements from Feb 2023. It is no surprise Mainland visitors significantly contributed to the return of visitors, registering 7.9 million visitors as of YTD May 2023 compared to 26,000 in the same period last year. All other markets are registering similar levels of growth, with Short Haul markets taking precedence, including source markets from the Philippines, Taiwan, Thailand, and Singapore.

Supply

*Include non-branded hotels and guesthouse

Source: Hong Kong Tourism Board

HVS has noted that there will be eleven additional hotels with approximately 2,559 keys in Hong Kong by 2027; seven properties with a total of approximately 1,319 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: Hong Kong Tourism Board and HVS Research

As of YTD May 2023, hotel occupancy in Hong Kong increased by 16.0 p.p. Room rates followed a similar trend with an increase of 30.5%. Resulting in RevPAR increase of 66.7%.

Transactions

The transaction activity in Hong Kong has been strong between 2018 and 2019, with the highest transaction volume in 2019, contributed by the Kimberly Hotel and Inn Hotel Deals. The observed decline in 2020 and 2021 was largely attributed to the Hong Kong protests and the COVID-19 pandemic. However, YTD June 2023 transaction volume was approximately at 75% of 2022’s full year of transactions.

Transaction Value Recorded By Year (2018 - YTD Jun 2023)

Source: HVS Research

India

Key Points

- Tourism contributed 5.9% to GDP in 2022, up from 5.8% in 2021

- 6.5% GDP growth is expected in 2023/24

- 6.2 million international tourist arrivals were recorded in 2022 compared to 1.5 million and 10.9 million in 2021 and 2019, respectively

Highlights

COVID-19 Cases

- Total Cases: 44,994,619

- Active Cases: 1,453

Number of COVID-19 Cases (July 2022 - June 2023)

.png)

Source: Our World In Data, Indian Ministry of Health; data as of 12th July 2023

Infrastructure Projects

- National Infrastructure Pipeline for FY2019-25 with investments worth INR111 trillion (~USD1.5 trillion).

- INR980 billion (~USD12 billion) to increase the number of airports from the current 148 to 220.

- Capital investment outlay for infrastructure under Union Budget 2023-24 worth INR 10 trillion (~USD 122 billion) or approx. 3.3% of GDP.

Notable Upcoming Hotel Openings in New Delhi, Mumbai, and Bengaluru (2023)

- Ginger, Mumbai, 371 keys

- Moxy, Mumbai, 106 keys

- Hyatt Centric Hebbal, Bengaluru, 168 keys

Notable Transactions

- MGM Hospital acquired The Palms, Chennai, at USD30 million in Jun 2022

- Vaishnavi Group acquired Hotel Chalukya Bengaluru for an undisclosed sum in Nov 2022

Demand

Travel finally made a comeback in 2022. Domestic travel remained the Indian hospitality industry’s primary growth engine, as leisure destinations continued to thrive and demand for corporate travel and large-ticket conferences and events gradually improved. India also resumed regular international flights in March 2022, which helped kickstart outbound and inbound travel in the country. As a result, tourist arrivals registered a year-on-year (y-o-y) growth of 305% in 2022.

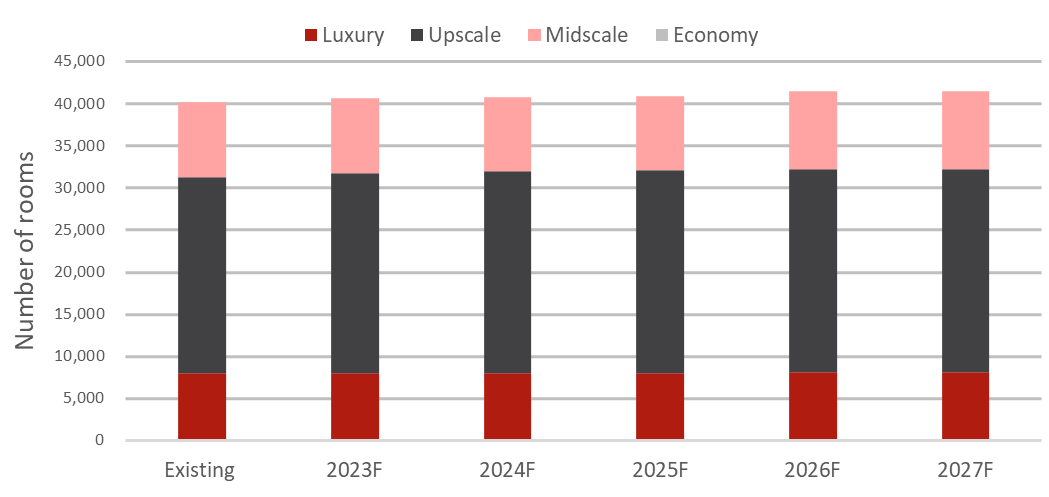

Supply

*Include only branded supply

Source: HVS Research

As per HVS estimates, nearly 42,800 additional keys will be added to the supply in India by 2027, of which over 14,000 branded keys are expected to enter the market in 2023. Hoteliers are increasing their focus on leisure destinations, and Tier 3 & 4 cities, due to the significant potential of domestic tourism.

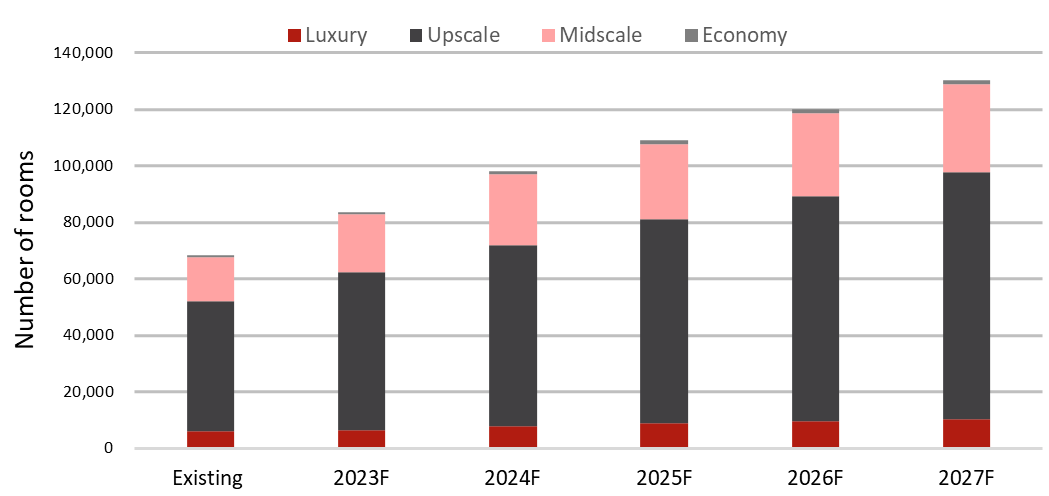

Hotel Pipeline (2022 - 2027)

.png)

*Include only branded supply

Source: HVS Research

Hotel Performance

Source: HVS Research

The resurgence of corporate travel, large-ticket conferences, events, and weddings has fuelled the recovery in commercial markets. New Delhi’s hotel occupancy rate increased by 10 percentage points (pp) in YTD June 2023, while occupancy in Mumbai and Bengaluru increased by 8 pp. New Delhi’s room rates during the period increased by 40%, while room rates in Mumbai and Bengaluru increased by 34% and 33%, respectively.

Transactions

Deal activity remains lacklustre despite several hotel assets for sale in the market. Buyers are back on the table due to improving industry performance, strong hotel demand, and stabilizing cash flows, but owners are torn between selling now and holding on to their assets for future appreciation. A few assets are likely to trade under the National Company Law Tribunal (NCLT), but the process has been slow and prone to litigation.

Transaction Value Recorded by Year (2016 - 2022)

.png)

Source: HVS Research

Indonesia

Key Points

- Tourism contributed 3.9% to GDP in 2022, up from 2.4% in 2021

- 4.9% Real GDP growth is expected in 2023

- 5.5 million international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- As of 9 June 2023, all COVID-19 health protocols for both domestic and international travellers were removed

Infrastructure Projects

- IDR14.3 trillion, a 75.8-kilometre, Bawen – Yogyakarta Toll Road expected to be completed by 2024

- IDR10.2 trillion, five-year, Indonesia Infrastructure and Finance Compact between the U.S’s Millennium Challenge Corporate and the Government of Indonesia

- Advancing transport and logistics accessibility

- Access to finance for women-owned/micro-, small, and medium enterprises

- Financial markets development

Notable Upcoming Hotel Openings in Bali and Jakarta (2023)

Top 3 Largest Inventory

- 25hours Hotel The Oddbird Jakarta (345-key)

- Swiss-belhotel Kelapa Gading (316-key)

- Parkroyal Serviced Suites Jakarta (180-key)

Notable Transactions

- 96.9% interest in 272-key Mandarin Oriental Jakarta acquired for IDR1.27 trillion, reflecting hotel value at IDR1.3 trillion (IDR4.8b/key) in June 2023

- 178-key Hotel in South Bekasi acquired for IDR119.9 billion (IDR673.5m/key) in September 2022.

Demand

In 2022, international arrivals had a y-o-y increase of 251.3%. Malaysia remains as the top source market in 2022, contributing 21% to international arrivals. Other top source markets include Singapore, Timor Leste, Australia, and India, contributing 13%, 12%, 11%, and 5% to international arrivals, respectively. In YTD May 2023, there were 4.1 million international arrivals; a 34% decrease compared to the same period in 2019.

Supply

*Include non-branded hotels

Source: Statistics Indonesia

HVS has noted that there will be 184 additional hotels with approximately 32,415 keys in Indonesia by 2027; 38 hotels with approximately 6,731 keys will be opened by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

YTD May 2023’s occupancy recorded an increase of 2.8 p.p. and 32.9 p.p., compared to YTD May 2022, for Jakarta and Bali, respectively. Similarly, ADR increased by 26.5%, and 65.6%, and RevPAR increased by 33% and 247.4% for Jakarta and Bali, respectively. This can be attributed to the launch of new direct flight routes and the opening of source market destinations. Moving forward, the hosting of key events such as the FIBA Basketball World Cup, will further increase occupancy.

Transactions

2021 recorded the highest transaction value of IDR2.31 trillion, despite having only one hotel transaction – Hotel Sofitel Bali Nusa Dua Beach Resort. In 2022, there were a total of three transactions amounting to IDR216 billion. In YTD June 2023, there were two transactions, Mandarin Oriental Jakarta (IDR1.27 trillion) and Pullman Jakarta Central Park for an undisclosed amount.

Transaction Value Recorded by Year (2018 - YTD Jun 2023)

Source: HVS Research

Japan

Key Points

- Tourism contributes 2.0% to GDP in 2022, down from 4.2% in 2021.

- 1.3% Real GDP growth expected in 2023

- 3.8 million international tourist arrivals recorded in 2022

Highlights

Latest COVID-19 Updates

- As of May 8, 2023, international travellers who are entering Japan, are not required to show proof of their vaccination status or COVID-19 results

Infrastructure Projects

- JPY100 billion expansion of Kansai International Airport in Osaka by 2025

- First phase of the Maglev line by 2027 (Tokyo Shinagawa - Nagoya), 2037 (Nagoya - Shin Osaka)

- JPY276 billion 19.2-Megawatt data centre in Osaka, estimated completion July 2024

Notable Upcoming Hotel Openings in Tokyo & Osaka (2023)

Top 3 Largest Inventory

- Mercure Tokyo Haneda Airport, 363 keys

- Hotel Indigo Tokyo Shibuya, 272 keys

- Hotel Metropolitan Tokyo Haneda, 237 Keys

Notable Transactions

- 746-key Hyatt Regency Tokyo at Odakyu Century Building acquired at JPY57.1 billion (JPY77m/key) in June 2023

- 1039-key Rihga Royal Hotel in Osaka acquired at JPY55billion (JPY53m/key) in March 2023

- Sotetsu Fresa Inn, Shinbashi-Karasumoriguchi acquired at JPY8.4 billion (JPY38m/key) in March 2023

Demand

In 2022, tourist arrivals increased significantly to 3.8 million arrivals reflecting a gradual recovery to 12% of 2019 level of arrivals. Data available as of YTD 2023 March indicates arrivals have surpassed full year 2022 arrivals with 4.8 million arrivals. Travel restrictions and country lockdown caused by the pandemic have significantly reduced tourist arrivals. South Korea has proven to be the top demographic of visitors, representing 26% in 2022, and 33% in YTD 2023. Taiwan was the runner-up at 9.0% in 2022, and 16% in YTD 2023. All vaccination and testing requirements have been removed as of May 2023, thus allowing for a rebound of visitors.

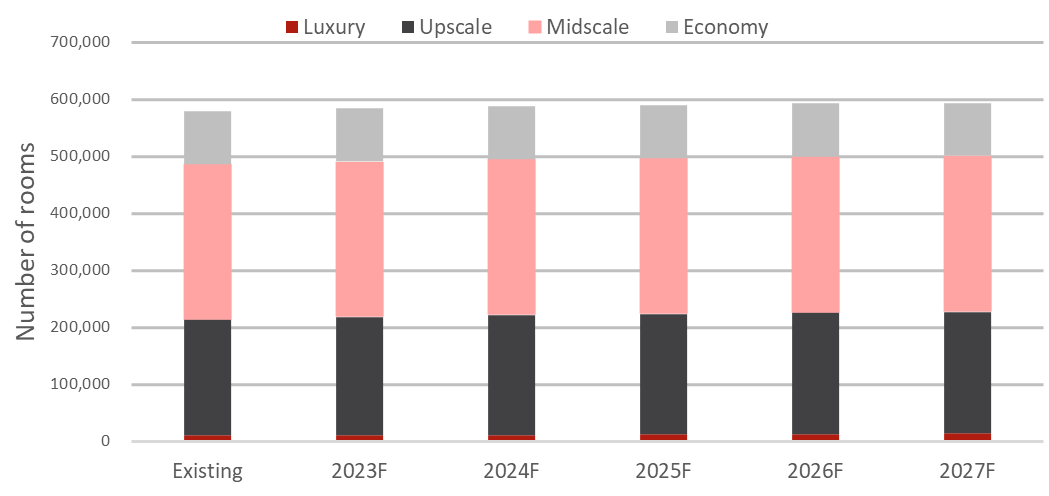

Supply

*Include non-branded hotels

Source: HVS Research

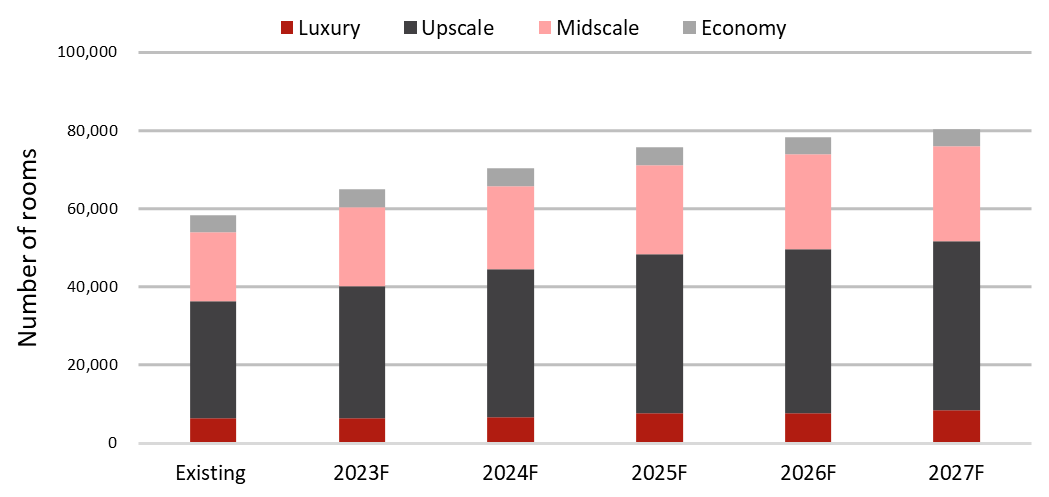

HVS has noted that going forward, there will be 80 additional hotels with approximately 16,499 keys in Japan by 2027; 17 hotels with a total of approximately 4,660 keys will be opened by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

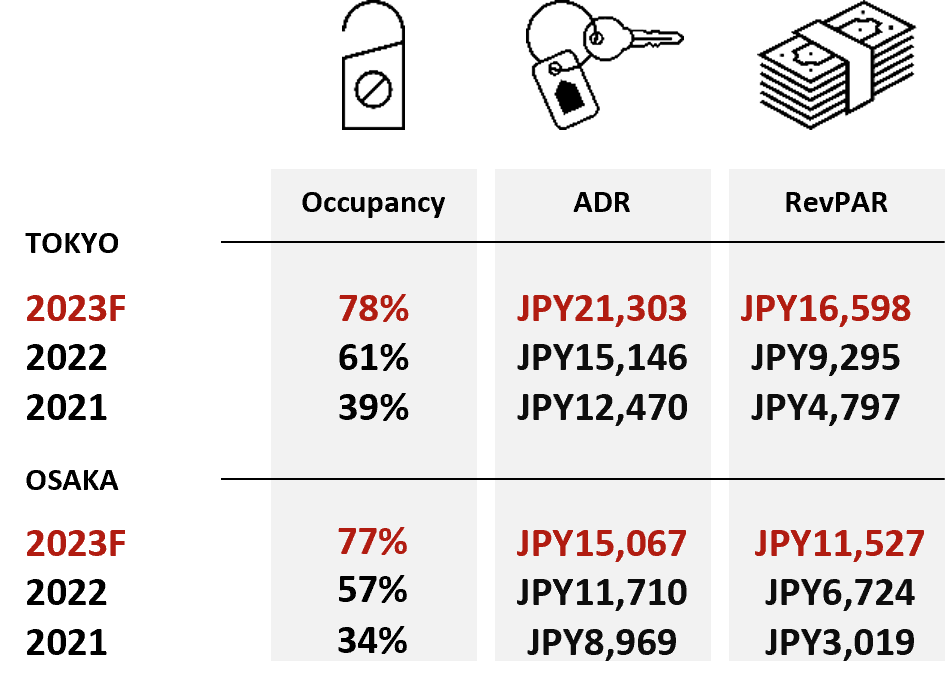

Hotel Performance

Source: HVS Research

As of YTD May 2023, Tokyo and Osaka recorded a y-o-y increase in occupancy by 24.2 p.p. and 29.6 p.p. respectively; ADR has also increased significantly by 90.8% and 59.2% for Tokyo and Osaka, respectively. Therefore, the RevPAR has subsequently increased by 179.4% and 162.3% for both cities.

Transactions

Transaction values peaked in 2019 at JPY299 billion, in contrast to significant declines to JPY96 billion in 2020 due to the pandemic. Transactions in Tokyo continue to dominate, which accounted for 53% of the recorded transactions in YTD June 2023. Two transactions this year accounted for 77% of the YTD volume, these being the Rihga Royal Hotel (Osaka) sold at JPY55 billion in March and the Hyatt Regency Tokyo, Odakyu Century Building (Tokyo) which sold at JPY57.1 billion.

Transaction Value Recorded by Year (2018 - YTD Jun 2023)

Source: HVS Research

Malaysia

Key Points

- Tourism contributes 4.6% to GDP in 2022, an increase from 4.1% in 2021

- 3.9% Real GDP growth expected in 2023

- 10 million international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- As of August 2022, visitors to Malaysia are not required to show proof of their vaccination status, nor are they required to undergo a pre-departure COVID-19 test

Infrastructure Projects

- MYR10 billion four-kilometre Singapore – Johor Bahru Rapid Transit System Link project expected to complete by end-2026

- MYR50 million construction of pedestrian skybridge, connecting Coronation Square to JB Sentral Station, expected to commence by 2024

- MYR75 billion 665 kilometres East Coast Rail Link expected completion by 2026

Notable Upcoming Hotel Openings in Kuala Lumpur and Langkawi (2023)

- Four Points by Sheraton Kuala Lumpur City Centre, 513 keys

- Wanda Realm Resort Langkawi, 350 keys

- Crowne Plaza Kuala Lumpur City Centre, 318 keys

Notable Transactions

- 299-key Four Points by Sheraton Sandakan transacted for MYR42 million (MYR141k/key) in June 2023

- 238-key Holiday Villa Langkawi transacted for MYR145 million (MYR609k/key) in June 2023

- 398-key Sheraton Imperial transacted for MYR135.9 million (MYR341k/key) in May 2022

Demand

In 2022, Malaysia’s international arrivals had a 7375% increase from 134,728 international arrivals recorded in 2021. The sharp increase can be attributed to the lifting of Malaysia’s COVID-19 entry requirements in 2022. The top three source markets of 2022 are Singapore (51.9%), Indonesia (14.7%), and Thailand (7.1%). Compared to 2021, while the top three source markets remained the same, Thailand is no longer the top contributor to Malaysia’s international arrivals.

Supply

*Include non-branded hotels

Source: HVS Research

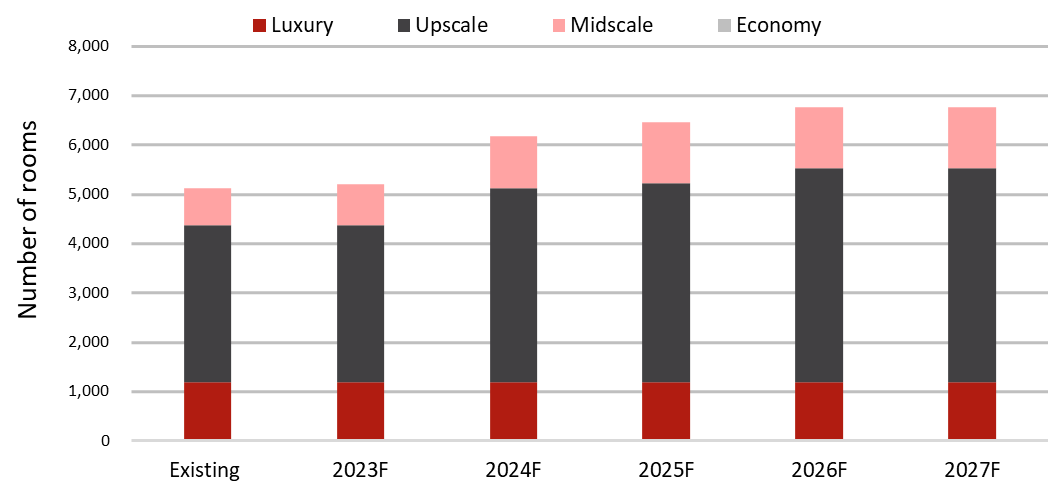

HVS has noted that going forward, there will be 78 additional hotels with approximately 22,091 keys in Malaysia by 2027; 23 properties with a total of approximately 6,516 rooms are expected to open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

For Kuala Lumpur, compared to YTD May 2022, YTD May 2023 recorded increases of 22.9 p.p. for occupancy, 25.7% for ADR, and 106.2% for RevPAR. Compared to Kuala Lumpur, the limited flight availability in Langkawi, along with the opening of alternative resort destinations, would restrict Langkawi’s occupancy growth in 2023.

Transactions

In the past five years, both transaction value and number of transactions have been on a decline. In 2022, there was only one hotel transaction, which amounted to MYR135 million. In YTD June 2023, transactions included Century One Helang Hotel Langkawi (MYR22.5m), Holiday Villa Langkawi (MYR145m), and Four Points by Sheraton Sandakan (MYR42.3m).

Transaction Value Recorded by Year (2018 - YTD Jun 2023)

Source: HVS Research

Maldives

Key Points

- Tourism contributed 58.3% to GDP in 2022, up from 44.6% in 2021

- 12.8% Real GDP growth is expected in 2023

- 1.7 million international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- As of 13 March 2022, the Maldives removed all COVID-19 travel restrictions

Infrastructure Projects

- USD500 million Greater Male Connectivity Project

- December 2023: Male – Villimale bridge

- 2024: Gulhifalhu – Thilafushi link

- USD136 million expansion of Hanimaadhoo International Airport expected to be completed by 2024

- USD29 million expansion of Gan International Airport expected to be completed by 2025

- Development of four airports; Makunudhoo in Haa Dhaalu Atoll, Bilehfahi in Shaviyani Atoll, Thulhaadhoo in Baa Atoll, and Vilufushi in Thaa Atoll, to commence in 2023

Notable Upcoming Resort Openings in the Maldives (2023)

- Amari Raaya Maldives, 200 keys

- Avani+ Fares Maldives Resort, 176 keys (Opened in April 2023)

- SO Maldives, 80 keys

Notable Transactions

- 120-key Amari Havodda Maldives acquired for USD60 million (USD500k/key) in July 2023

- 77-key W Maldives acquired for USD80 million (USD1m/key) in June 2022

- 176-key Sheraton Maldives Full Moon Resort and Spa acquired for USD75 million (USD426k/key) in June 2022

Demand

In 2022, international arrivals recorded a 26.7% y-o-y growth compared to 1.3 million international arrivals in 2021. In YTD May 2023, there were 809,244 international arrivals; a 15.2% increase compared to the same period in 2022. In 2022, the top three source markets of the Maldives were India (14.4%), Russia (12.1%), and Germany (10.7%).

Supply

*Include non-branded hotels

Source: The Maldives Ministry of Tourism

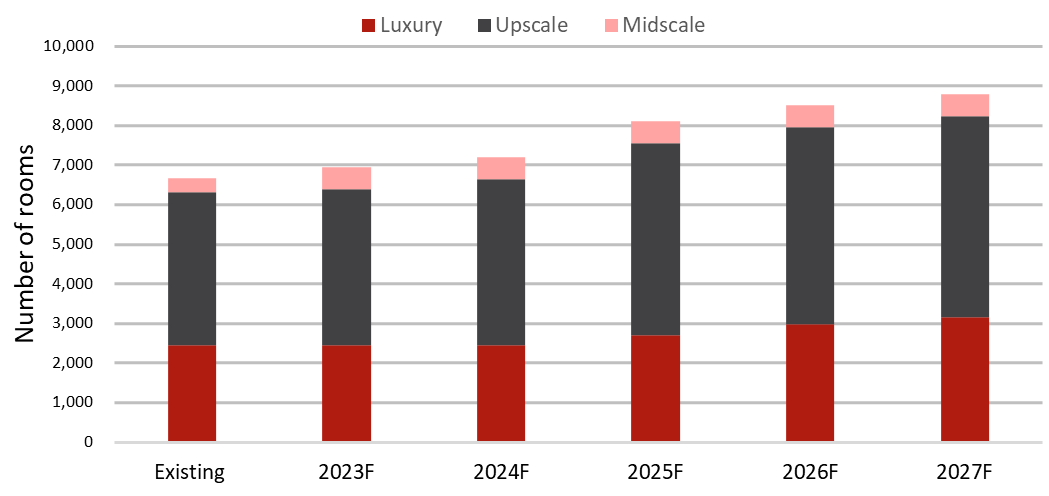

HVS has noted that there will be 18 additional hotels with approximately 2,127 keys in the Maldives by 2027; two properties with a total of approximately 280 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Resort Performance

Source: HVS Research

As of YTD May 2023, the Maldives saw a 1.6 p.p. decrease in occupancy while ADR and RevPAR decreased by 2.2% and 4.4%, when compared to the same period in 2022. This can be attributed to the introduction of new supply, along with the opening of other resort destinations.

Transactions

From 2018 to YTD July 2023, the Maldives had recorded a total transaction value of approximately USD963 million. 2019 recorded the highest transaction value and number of transactions, amounting to USD437.5 million from five transactions. In YTD July 2023, only Amari Havodda Maldives was transacted for USD60 million.

Transaction Value Recorded by Year (2018 - YTD Jun 2023)

Source: HVS Research

Myanmar

Key Points

- Tourism contributed 2.1% to GDP in 2022, up from 1.2% in 2021

- 2.5% Real GDP growth is expected in 2023

- 230 thousand international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- Due to the effective control of the epidemic, Myanmar resumed entry of international commercial flights from 17 April 2022, and immediately announced the shortening of the quarantine time for inbound personnel

Infrastructure Projects

- Opening of the Hanthawaddy International Airport in Bago Region; 77 kilometres north of Yangon. The new airport will have the capacity to handle 12 million visitors, scheduled to open in 2027.

Notable Upcoming Hotel Openings in Myanmar (2023)

- Centra by Centara Hotel Thiri Hpa-An, 77 keys

- Sheraton Yangon Hotel, 375 keys

- Westin Yangon, 371 keys

Notable Transactions

- 50% interest in 32-key The Strand Yangon acquired at USD358k, reflecting the hotel value at USD717k (USD22k/key) in May 2019

- 50% interest in 211-key Inya Lake Hotel acquired at USD2.4 million, reflecting the hotel value at USD4.8 million (USD22k/key) in May 2019

- 50% interest in 85-key Hotel G Yangon acquired at USD953k, reflecting the hotel value at USD1.9 million (USD22k/key) in May 2019

Demand

In 2022, international arrivals recorded a 75.5% increase, from 131 thousand in 2021 to 230 thousand in 2022. Thailand is the top source market and it accounts for 41% of all international arrivals. This is followed by China and Korea, which contributed 2% and 4% respectively. On April 17, 2022, Myanmar authorities lifted the flight ban and officially opened international commercial passenger flights to stimulate the revival of tourism. On May 20, Myanmar's Ministry of Foreign Affairs reinstated electronic tourist visas, which foreign travellers can apply for online.

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that there will be fifteen additional hotels with approximately 2,882 keys in Myanmar by 2027; three properties with a total of approximately 823 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD May 2023, with the relaxation of entry requirements, hotel occupancy and average rate in Myanmar observed a 4.4 p.p. and 11.4% increase, respectively. Therefore, the RevPAR in Myanmar has increased 29.3%.

Transactions

There is limited information on hotel transactions in Myanmar. In 2019, there were three recorded transactions in Yangon with a total transaction volume of USD3.6 million. In 2020, no hotel transactions were recorded, largely attributed to the coronavirus pandemic. Similarly in 2021, 2022 and 2023, no hotel transactions were recorded and foreign direct investment is expected to continue dwindling due to the military coup in Myanmar. Five hotel development projects that were expected to open between 2022 and 2023 have been deferred.

New Zealand

Key Points

- Tourism contributed 5.9% to GDP in 2022, down from 9.0% in 2021

- 1.0% Real GDP growth is expected in 2023

- 1.4 million international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- Most COVID-19 rules were removed on 13 September 2022, including vaccination and testing requirements.

Infrastructure Projects

- NZD3.4 billion City Link Rail in Auckland by 2024

- NZD1.8 billion Auckland Light Rail to link CBD to Auckland Airport by 2024

- NZD1.85 billion East West Link for improved transport connection by 2025

- NZD3.9 billion Auckland Airport Expansion with new domestic terminal by 2028/29

Notable Upcoming Hotel Openings in Auckland (2023)

- Pullman Auckland Airport (313 keys)

- Hotel Grand Chancellor Auckland (191 keys)

- Intercontinental Auckland (139 keys)

Notable Transactions

- 106-key Econo Lodge City Central in Auckland, sold for NZD21.5 million (NZD203k/key) in Mar 2023

- Mount Cook NZ Hotel Portfolio, a total of 218 units for an undisclosed amount, in Mar 2023

- 286-key Stamford Plaza Auckland, sold for NZD170 million (NZD594k/key) in Dec 2022

Demand

Total tourist arrivals amounted to approximately 1.4 million in 2022, a 593% increase compared to 2021 due to the prolonged closed borders. Given Australia's proximity to New Zealand, tourists from Australia remain the top source market, accounting for 58% of total arrivals in 2022. Conversely, arrivals from China, the second-largest source market in 2019, became the eighth largest source market in 2022. In 2022, New Zealand announced NZD54 million Innovation Program for Tourism recovery. The program’s focus is to drive a regenerative, low-carbon, productive, and innovative tourism sector, improving the sector’s resilience, promoting and protecting social and cultural values of Māori. As of YTD May 2023, there were 1,184,739 total tourist arrivals, a 618% increase compared to the same period last year.

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that there will be 26 additional hotels with approximately 5,428 keys in New Zealand by 2027; Six properties with a total of approximately 865 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD May 2023, Auckland’s occupancy recorded a y-o-y increase of 24.1 p.p. ADR increased by 19.5%, which resulted in an 83.1% increase in RevPAR. The increase in RevPAR may be attributed to the reopening of borders and investments into the country’s Tourism Recovery program.

Transactions

2021 and 2022 transaction values rebounded, after slowed activity in 2020 due to COVID-19. New Zealand registered only two transactions in 2020 but increased to eleven transactions in 2021, similar to 2018. While 2022 had four transactions, volumes were similar to 2021 with the large transaction of Stamford Plaza Auckland for NZD170 million.

Transaction Value Recorded by Year (2018 - YTD Jun 2023)

Source: HVS Research

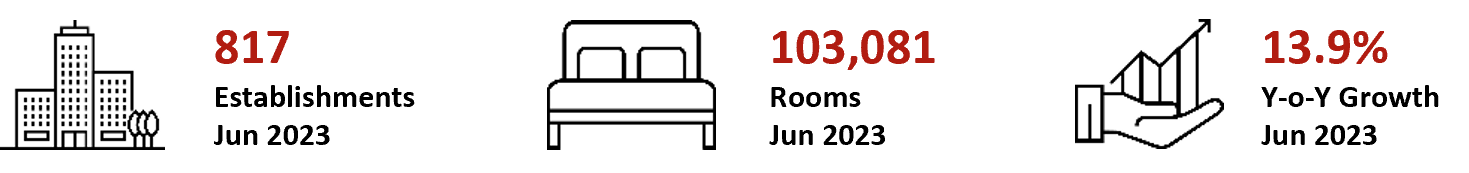

Philippines

Key Points

- Tourism contributes 17.3% to GDP in 2022, up from 10.4% in 2021

- 6.8% Real GDP growth expected in 2023

- 2.7 million international tourist arrivals recorded in 2022

Highlights

Latest COVID-19 Updates

- As of 13 March 2022, the Philippines removed all COVID-19 travel restrictions

Infrastructure Projects

- PHP57 billion Clarin Bridge in Bohol Province by 2022

- PHP740 billion Bulacan Airport by 2025, backed by San Miguel Corporation

- PHP357 billion Metro Manila Subway Project by 2025, backed by Japan

Notable Upcoming Hotel Openings in Manila (2023)

Top 3 Largest Inventory

- Quest Cubao, 240 keys

- Somerset Valero Makati, 184 keys

- Novotel Suites Manila At Acqua, 152 keys

Notable Transactions

- 245-key Red Planet The Fort transacted for PHP469 million (PHP1.9m/key) in August 2022

- 370-key New World Manila Bay Hotel transacted for an undisclosed price in April 2019

Demand

In 2022, 2.65 million international tourist arrivals were recorded in the Philippines, but it has not returned to pre-COVID levels. The United States remained the top source market, representing 19.1% market share. Korea and Australia were the second and third top source markets accounting for 9.17% and 5.9% of the total visitors to the Philippines, respectively. After the Ministry of Tourism issued a recovery plan for 2022, the Philippines' tourism industry received a significant boost in 2023, and the impact of the epidemic on the tourism industry was gradually mitigated.

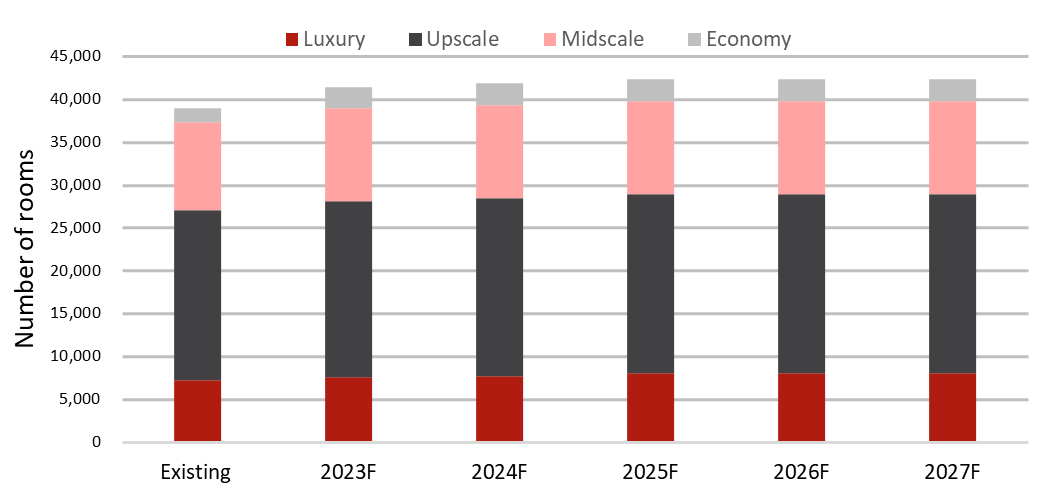

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that going forward, there will be 90 additional hotels of approximately 19,413keys in the Philippines by 2027, with 21 hotels and 5,227 rooms opening in 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

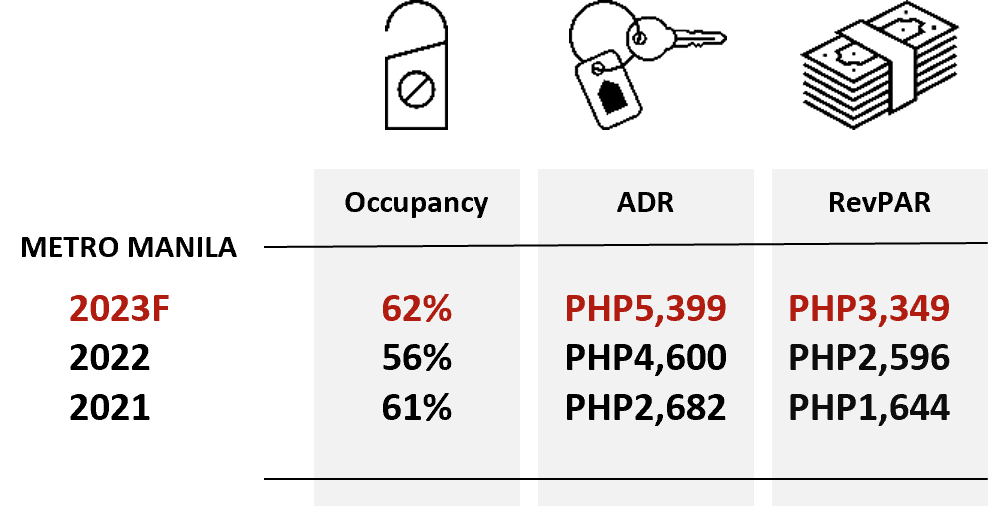

Hotel Performance

Source: HVS Research

As of YTD May 2023, Manila recorded an increase in occupancy of 8.9 p.p, while ADR increased by 42.0% y-o-y. This resulted in an increase in RevPAR of 65.9%. The opening of international borders together with the pent-up demand have helped to improve the overall hotel performance.

Transactions

In 2019, we noted two hotel acquisitions by Hong Kong-based International Entertainment Corporation; the 370-key New World Manila Bay Hotel which was sold for an undisclosed amount, and the 159-key Go Hotels Cubao which was sold for PHP411 million. In 2020, 2021, 2022 and YTD June 2023, no transaction was recorded in the Philippines. This is largely attributed to the coronavirus pandemic and terrorism activities within the country.

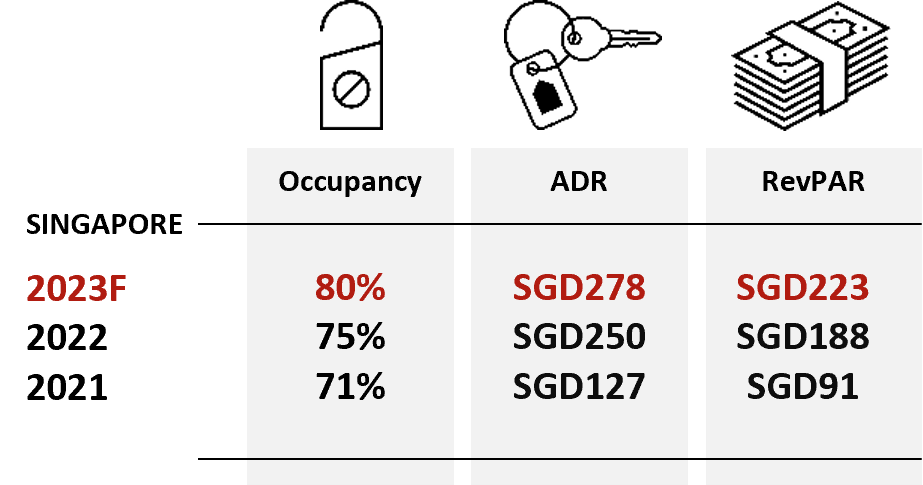

Singapore

Key Points

- Tourism contributed 6.8% to GDP in 2022, up from 3.9% in 2021

- 1.0% Real GDP growth is expected in 2023

- 6.3 million international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- As of 13 February 2023, all COVID-19 border restrictions in Singapore were lifted.

Infrastructure Projects

- Expected completion of the Thomson-East Coast MRT Line by 2025

- Construction of Changi Airport Terminal 5 will begin in 2025 and is expected to be operational by the mid-2030s

- New Science Centre Singapore in Jurong Lake District expected to open in 2027

- Minion Land, in Universal Studios Singapore, set to open in 2024

Notable Upcoming Hotel Openings in Singapore (2023)

Top 3 Largest Inventory

- 8 Club Street Hotel, 900 keys

- Short Street Hotel, 500 keys

- Pullman Singapore Hill Street, 350 keys

Notable Transactions

- 542-key PARKROYAL on Kitchener Road for SGD525 million(SGD968,635/key) in July 2023

- 50% interest in 25-key Amber Hotel Katong acquired for SGD23.3 million, reflecting hotel value at SGD46.6 million (SGD1.8 million/key) in January 2023

- 78-key 12 On Shan for SGD86.5 million (SGD1.1 million/key) in July 2022

Demand

In 2022, visitor arrivals recorded a y-o-y increase of 1810.5%. YTD June 2023 observed 6.28 million arrivals, a 317.8% increase compared to the same period in 2022. In 2022, the top five source markets were Indonesia (18%), India (11%), Australia (9%), Malaysia (9%), and the Philippines (6%). Compared to 2021, Indonesia, India, and Malaysia remained part of the top source markets, while China and Bangladesh are no longer top contributors to Singapore’s international arrivals. Instead, the Philippines and Australia have emerged as new top source markets.

Supply

*Include non-branded hotels

Source: Singapore Tourism Board

HVS notes that there will be 14 additional hotels with 3,394 keys in Singapore by 2027, including eight hotels with 2,453 keys opening in 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

Compared to YTD May 2022, in YTD May 2023, there were increases of 10.6 p.p. for occupancy, 61.8% for ADR, and 89% for RevPAR. The increases can be attributed to the launch of new flight routes. Moving forward, with key events in 2H2023, such as the F1 Singapore Grand Prix, it is forecasted for Singapore to achieve higher growth.

Transactions

In the past five years, while 2019 recorded the highest transaction value, 2022 recorded the highest number of hotel transactions.

- In 2019, ten hotels were transacted at SGD1.99 billion.

- In 2022, 15 hotels were transacted for a total of SGD1.27 billion.

In YTD July 2023, there were two hotel transactions – Amber Hotel Katong and Parkroyal on Kitchener Road for a total of SGD548 million.

Transaction Value Recorded by Year (2018 - YTD Jun 2023)

Source: HVS Research

South Korea

Key Points

- Tourism contributed 3.5% to GDP in 2022, up from 2.7% in 2021

- 1.4% Real GDP growth is expected in 2023

- 3.2 million international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- Since May 7, 2023, South Korea has gradually relaxed its travel restrictions, and Visa-free and visa-waiver programs have resumed.

Infrastructure Projects

- KRW1.3 trillion development on South Korea’s largest commercial data centre by 2024 in Incheon Bupyeong-gu

- KRW13.5 trillion construction of major roads and railways including Seoul-Sejong Expressway by 2024

- KRW4.1 trillion expansion of New Jeju International Airport by 2025

Notable Upcoming Hotel Openings in Seoul and Incheon (2023)

- Inspire Entertainment Resort, 1100 keys

Notable Transactions

- 57-key Seoul Hilltop Hotel transacted at KRW106 million (KRW1.8 m/key) in Jun 2022

- 119-key Hotel Prima Seoul, transacted at KRW409 billion (KRW3.4 m/key) in Mar 2022

- 680-key Millennium Seoul Hilton transacted at KRW1.1 trillion (KRW1.6 m/key) in Feb 2022

Demand

In 2022, international arrivals recorded a 231% increase, from 967,000 in 2021 to 3.2 million in 2022. The United States, previously the second top source market, rose to the top source market as China maintained its zero COVID policy. The United States source market accounts for 19.1% of all international arrivals. This is followed by Japan and China, which contributed to 9.7 % and 7.8%, respectively. To further stimulate the recovery of tourism, the South Korean government has released a five-year plan to achieve the goal of 30 million international visitors by 2027.

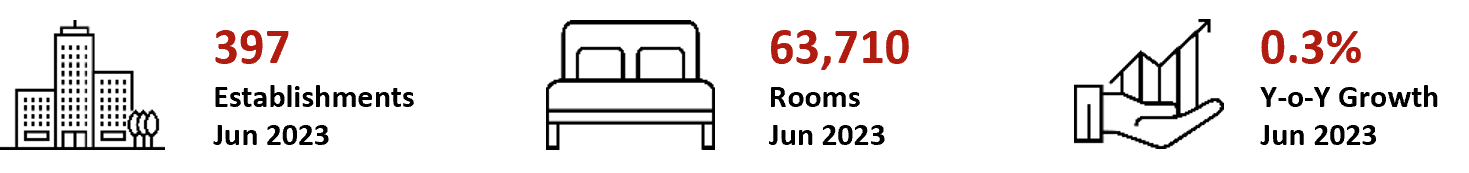

Supply

*Include non-branded hotels

Source: HVS Research

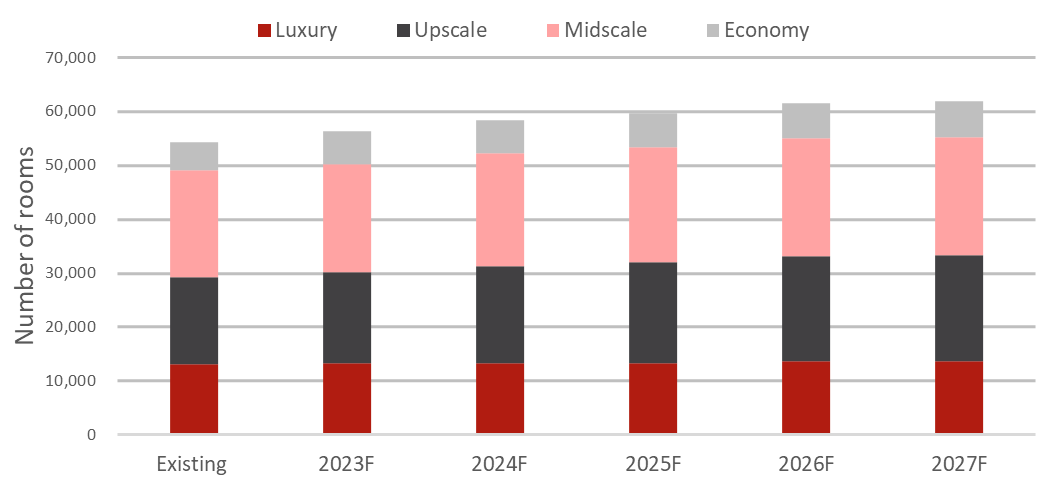

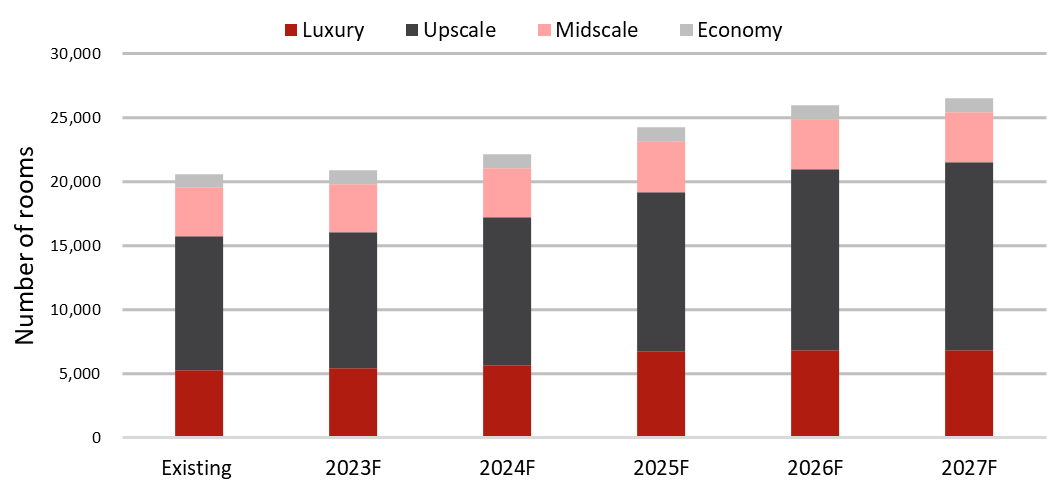

HVS has noted that there will be 40 additional hotels with approximately 11,417 keys in South Korea by 2027; three properties with a total of approximately 1,717 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

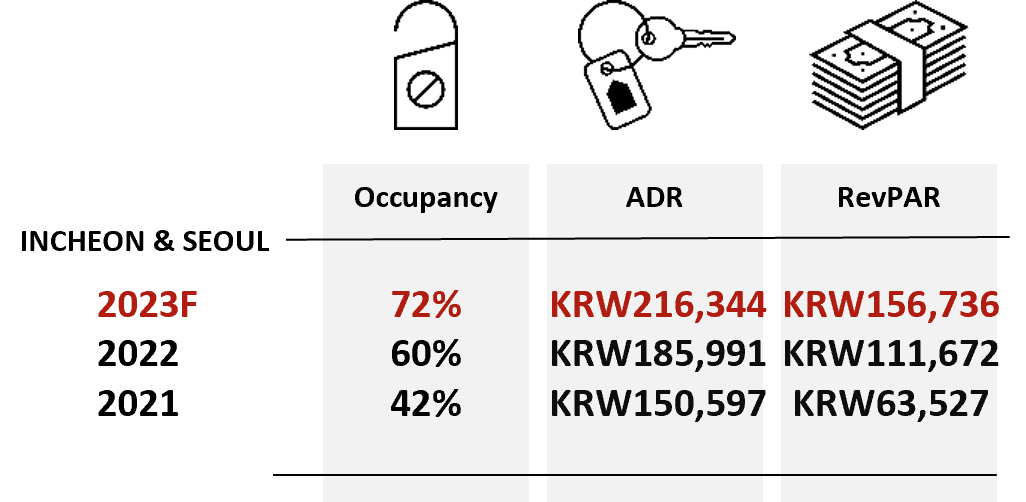

Hotel Performance

Source: HVS Research

As of YTD May 2023, occupancy in Seoul and Incheon experienced an increase of 16.8 p.p, and an increase in room rates of 29.1%; with RevPAR increased by 40.3%. The relaxation of all restrictions by the government and the reopening of its borders to international visitors resulted in the improvement of the hotel's performance.

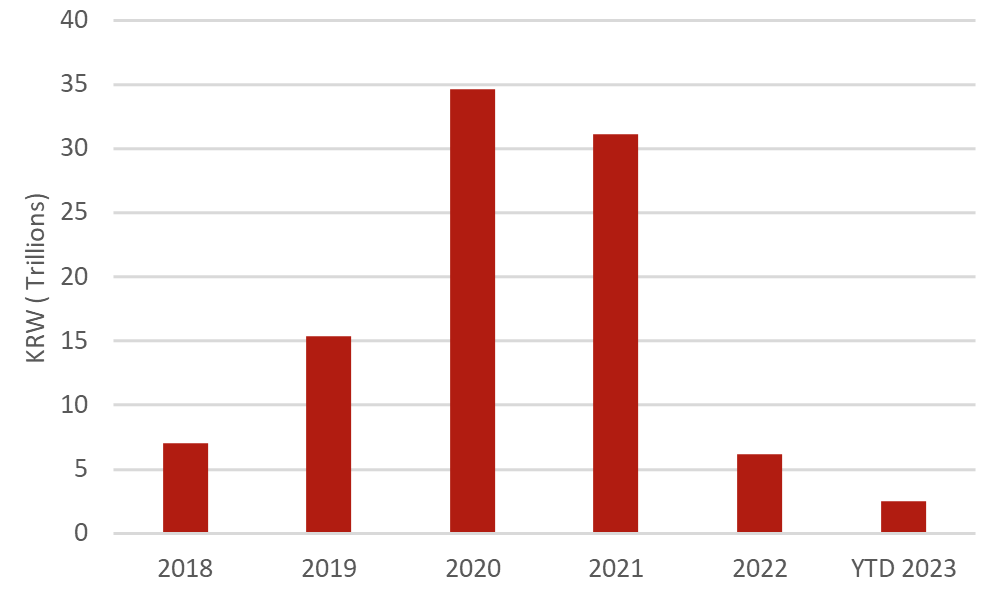

Transactions

South Korea, especially Seoul, registered a high value of investment activity in recent years, reflecting a robust hotel investment market. Transaction value exceeded KRW2 trillion in 2019 and peaked in 2022 at approximately KRW 5 trillion. As of YTD June 2023, 39 transactions were recorded with a total volume KRW1.1 trillion.

Transaction Value Recorded By Year (2018 - YTD Jun 2023)

Source: HVS Research

Taiwan

Key Points

- Tourism is estimated to contribute 2.2% to GDP in 2022, up from 2.1% in 2021

- 2.0% Real GDP growth expected in 2023

- 900 thousand international tourist arrivals were recorded in 2022

Highlights

Latest COVID-19 Updates

- As of March 9, 2023, Taiwan will only restrict the entry of patients with serious diseases.

Infrastructure Projects

- NTD45 billion Taiwan Taoyuan International Airport Terminal 3 is expected to complete construction by 2026

- NTD61.8 billion High Speed Railway Extension to Pingtung County by 2029

Notable Upcoming Hotel Openings in Taipei (2023)

Top 3 Largest Inventory

- Hotel Indigo Qingcheng Mountain, 241 keys

- Park Hyatt Taipei, 178 keys

- Ibis Taipei National Taiwan University, 58 keys

Notable Transactions

- 60-key Diary of Ximen Hotel in Taipei was transacted at NTD258 million (NTD4.3m/key) in Jan 2023

- 257-key Ambassador Hotel Hsinchu in Hsinchu City was transacted at NTD5.8 billion

Demand

In 2022, with the gradual end of COVID-19, Taiwan's tourism market gradually recovered. This led to a 542.9% increase in international arrivals. In 2022, Vietnam was the first top source market for Taiwan, representing 22% of the total market share, followed by Indonesia and China, with 10% and 9% of the total market share, respectively. Taiwan reopened its border to international travellers in July 2022, allowing business and leisure travellers to enter Taiwan, but quarantine is still required.

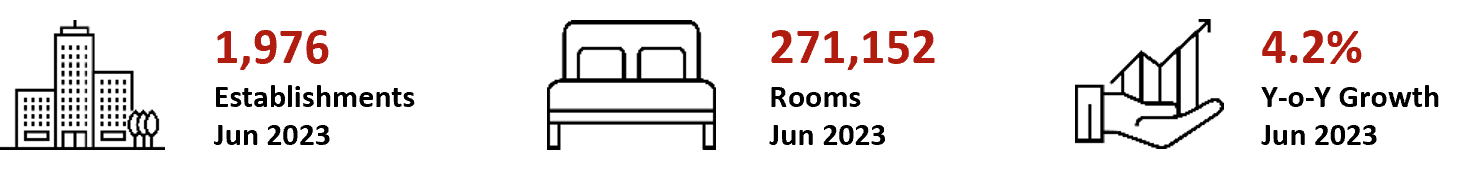

Supply

*Include non-branded hotels

Source: HVS Research

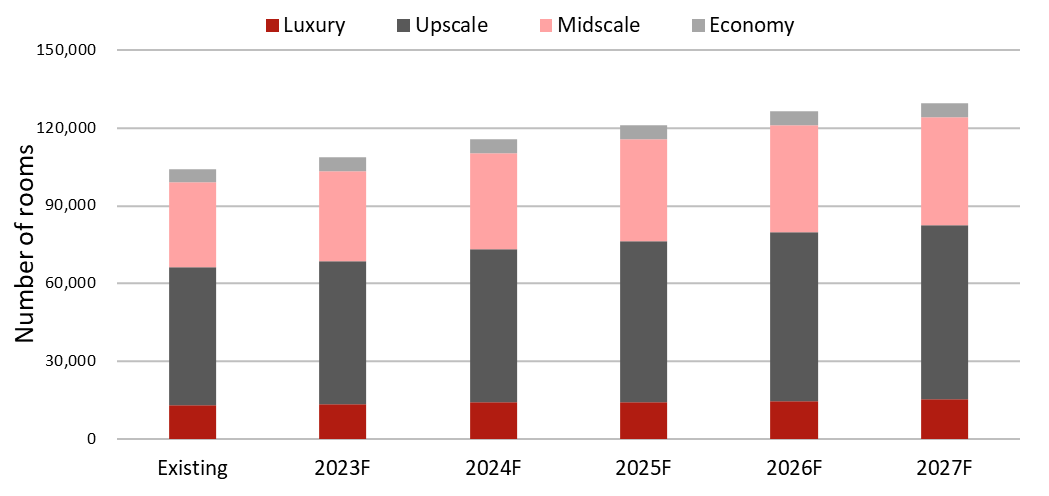

HVS has noted that going forward, there will be 31 additional hotels with approximately 6854 keys in Taiwan by 2027; three properties with a total of approximately 657 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

As of YTD May 2023, hotel occupancy in Taipei has increased 86.1 p.p y-o-y. Similarly, ADR increased by 39.1%, which has resulted in an increase in RevPAR by 146.1%. The performance can be attributed to the increase in global travel demand due to Taiwan’s gradual border reopening policy.

Transactions

Transaction value in Taiwan in YTD June 2023 remains relatively stagnant compared to the highest record of NTD36.8 billion in 2020. Investment activities were mainly transacted outside of Taipei, with only four transactions in Taipei in 2022 and one in YTD in June 2023.

Transaction Value Recorded By Year (2018 - YTD Jun 2023)

Source: HVS Research

Thailand

Key Points

- Tourism contributes 10.1% to GDP in 2022, up from 5.8% in 2021

- 3.8% Real GDP growth expected in 2023

- 11.1 million international tourist arrivals recorded in 2022

Highlights

Latest COVID-19 Updates

- As of 9 January 2023, visitors to Thailand are not required to show proof of their vaccination status or COVID-19 test results

Infrastructure Projects

- USD1 billion Don Mueang Airport expansion expected to be completed by 2029

- THB224.5 billion Don Mueang – Suvarnabhumi – U-Tapao high-speed rail expected to be completed by 2029

- THB290 billion transformation of U-Tapao Airport construction expected to begin in 2023

Notable Upcoming Hotel Openings in Bangkok and Phuket (2023)

Top 3 Largest Inventory

- Moxy Bangkok Ratchaprasong, 504 keys

- Courtyard by Marriott Bangkok Suvarnabhumi Airport, 450 keys

- Ramada Phuket, 426 keys

Notable Transactions

- 257-key Westin Siray Bay Resort & Spa Phuket acquired at THB 2.4 billion (THB9.5m/key) in November 2022

- 456-key Grand Mercure Windsor Bangkok was acquired at THB3.1 billion (THB6.9m/key) in November 2022

- 123-key Dhara Dhevi acquired at THB2 billion (THB16.3m/key) in April 2022

Demand

In 2022, international arrivals had a y-o-y increase of 2507%. In YTD May 2023, international arrivals increased by 714% y-o-y with 10.6 million visitors compared to 1.3 million visitors YTD May 2022. The top three source markets in Thailand are Malaysia (17.5%), India (8.9%), and Singapore (5.5%). Compared to 2021, Malaysia has overtaken India to be Thailand’s top source market.

Supply

*Include non-branded hotels

Source: HVS Research

HVS has noted that going forward, there will be 110 additional hotels with approximately 25,521 keys in Thailand by 2027; 21 properties with a total of approximately 4,627 rooms will open by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

Compared to YTD May 2022, YTD May 2023 recorded increases of 27.8 p.p. and 32.3 p.p. for occupancy, in Bangkok and Phuket, respectively. Similarly, ADR increased by 56.9% and 38.7%, while RevPAR increased by 161.9% and 150.6%, in Bangkok and Phuket, respectively.

Transactions

There was a total of 32 transactions recorded from 2018 to YTD June 2023. 2022 recorded a transaction value of THB13.53 billion from eleven transactions, the highest number of transactions in the past five years. In YTD June 2023, there were three transactions at undisclosed amounts – Ibis Hua Hin, Ibis Phuket Kata, and Ibis Styles Krabi Ao Nang.

Transaction Value Recorded By Year (2018 - YTD Jun 2023)

Source: HVS Research

Vietnam

Key Points

- Tourism contributes 4.3% to GDP in 2022, up from 2.6% in 2021

- 4.8% Real GDP growth expected in 2023

- 3.4 million international tourist arrivals recorded in 2022

Highlights

Latest COVID-19 Updates

- As of 15 May 2023, Vietnam lifted all its COVID-19 entry requirements

Infrastructure Projects

- VND420 trillion airport agenda whereby 2030, Vietnam will have a total of 30 airports (14 international and 16 domestic airports) with priority given to Noi Bai International Airport in Hanoi and Long Thanh International Airport (LTIA) in HCMC

- Construction of roads at VND2.63 trillion by 2025, connecting National Highway 51 – LTIA and HCMC – Long Thanh-Dau Giay Expressway – Road No. 1 (National Highway 51 – LTIA)

- Construction of a 31.85km road (USD34.5 million) by November 2025 to enhance connectivity between the Central and Central Highlands regions

Notable Upcoming Hotel Openings in Hanoi and HCMC (2023)

Top 3 Largest Inventory

- L7 West Lake Hanoi by Lotte, 264 keys

- The Okura Prestige Saigon, 250 keys

- Hilton Saigon, 236 keys

Notable Transactions

- 364-key Somerset Metropolitan West Hanoi acquired at VND2.1 trillion (VND5.8b/key) in August 2021

- 70% interest in 90-key Somerset West Lake (Hanoi) acquired at VND0.23 trillion, reflecting hotel value at VND0.33 trillion (VND3.6b/key) in October 2019

- 75% interest in 318-key Intercontinental Hanoi West Lake Hotel acquired at VND2.91 trillion, reflecting hotel value at VND3.89 trillion (VND12.2b/key) in May 2019

Demand

In 2022, there were 3.4 million international arrivals, an 81% decrease when compared to 2019. In YTD June 2023, there were 5.57 million international arrivals, a 1249% increase from YTD June 2022. Moreover, YTD June 2023’s international arrivals were 64% higher than the recorded international arrivals in 2022. According to the National Assembly of Vietnam, as of 15 August 2023, a visitor’s e-visa will be valid for 90 days, instead of 30 days, with multiple entries permitted. Moreover, visitors from visa-exempted countries will be permitted to stay in Vietnam for 45 days, an increase from 15 days. This will encourage international tourists to visit Vietnam.

Supply

*Include non-branded hotel

Source: HVS Research

HVS has noted that moving forward, there will be 182 additional hotels with approximately 61,912 keys in Vietnam by 2027; 29 hotels with approximately 15,112 keys will be opened by the end of 2023.

Hotel Pipeline (2023 - 2027)

*Exclude non-branded hotels

Source: HVS Research

Hotel Performance

Source: HVS Research

YTD May 2023’s occupancy recorded increases of 25.6 p.p and 29 p.p, in Hanoi and HCMC respectively, compared to YTD May 2022. Similarly, ADR increased by 19.7% and 34.8%, while RevPAR increased by 105.8% and 151.2%, for Hanoi and HCMC respectively. This can be attributed to the launch of new direct flight routes.

Transactions

In 2018, there was one recorded transaction at an undisclosed amount. 2019 recorded the highest number of transactions at four, for VND3.5 trillion. 2020 and 2022 had no transactions. 2021 had two transactions, Somerset West Metropolitan West Hanoi (VND2.1 trillion), and V Tower (Serviced Apartment) at an undisclosed amount. In YTD June 2023, Capri by Fraser Ho Chi Minh and Ibis Saigon South were transacted at undisclosed amounts.

Transaction Value Recorded by Year (2018 - YTD Jun 2023)

Source: HVS Research

Notable contributions were made by:

For Asia Pacific: Ho Mei Leng, Adrian Lee, Jackson Wang, and Michelle Soputan.

For India: Mandeep S. Lamba, Akash Datta, and Dipti Mohan

About Hok Yean CHEE

Hok Yean CHEE is the Regional President of HVS Asia Pacific. She has 30 years of experience in more than 30 markets across 19 countries in Asia Pacific, providing real estate investment advisory services for a wide spectrum of property assets. Her forte lies in providing investment advisory on hotels and serviced apartments including brokerage, strategic analyses, operator search, market feasibility studies, valuations and litigation support. For further information, please contact: hychee@hvs.com

This article originally appeared on HVS.