Qatars travel and tourism industry has been under the scrutiny of the public eye ever since the FIFA World Cup 2022. As the first Arab state to hold the mega event, the country spent around $220 billion on infrastructure during a 12-year preparation and witnessed an impressive and fast-paced transformation, including the development of an ultra-modern new city, spectacular stadiums, a state-of-the-art metro, countless of leisure attractions and world-class hotels dotting the skyline.

The 28-day soccer event was a major success for Qatar. A cumulative of 3.4 million football fans attended the tournament and average occupancy across stadiums was recorded as 96.3%. The country welcomed 1.18 million international visitors, representing 412% and 318% year-on-year increase throughout November and December. Hotels and resorts achieved the highest-ever performance, registering a marketwide ADR of QAR 2,112 and RevPAR of QAR 1,281 in December 2022, a 328% and 286% year-on-year increase, respectively.

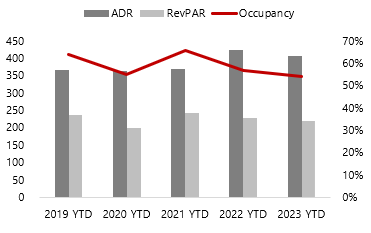

Nonetheless, months after Argentina cheerfully lifted the trophy, for some, the uncertainty remains: what is next for Qatar? Indeed, the country is witnessing the lowest year-to-date occupancy (54%) for the five past years, even lower than during the pandemic given the quarantine bookings that supported the industry back then. However, the number of hotel keys has multiplied throughout the same period, increasing by 45% versus 2019 and 24% when compared to same time last year. Under such a substantial influx of supply, it is expected that the market records a slight decrease in occupancy.

Key Performance Indicators (YTD September 2019-2023)

Source: Qatar Tourism, 2023

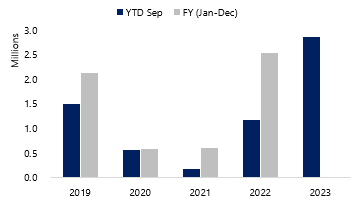

A deeper look into the country’s tourism data presents a more positive perspective. The number of occupied room nights between January and September has grown by 21% and 20% when compared to the same period in 2022 and 2019. Throughout the same period, the average rate has reached QAR 407, the highest since 2018 excluding pre-World Cup performance. In terms of visitor’s arrival, 2023 is already paced ahead. For the first nine months of this year, the country welcomed over 2.8 million international visitors, already exceeding 2019 and 2022 full year visitation. Every month throughout this year has presented an extraordinary two- to three-digit percentage increase in visitation versus same time last year. The market is primarily boosted by the luxury segment, representing 43% of the room nights year-to-date with a RevPAR of almost QAR 300.

While the World Cup 2022 signified a historic moment in Arab history, Qatar, reportedly is focusing on the future to sustain its travel and hospitality sector. By 2030, the gas-rich country aims to welcome over 6 million tourists and raise its tourism contribution to GDP from 7% to 12%, in a push to become the fastest-growing tourism destination in the Middle East. The infrastructure development, the potential growth of the sports sector, and a growing investment in education, culture and entertainment sectors will positively impact Qatar.

The national events calendar is strengthening with Expo Doha 2023, a 6-month event recently opened and anticipated to bring 3 million visitors. The second edition of Formula 1 Qatar Grand Prix was hosted earlier this month and is scheduled to extend further under a 10-year contract. The first Geneva International Motor Show (GIMS) was purposefully organized on the same dates - with an intent to reunite global automotive fans. Additional major international sports events include the MotoGP – Grand Prix of Qatar and the 2023 AFC Asian Cup. Qatar Airways has rebuilt its network from the pandemic-driven slowdown, now flying to over 160 destinations and carrying over 31.7 million passengers on its 22/23 fiscal year. The country’s cruise sector has also recorded accelerated growth, welcoming over 250,000 cruise visitors in the 22/23 season and set to expand further in the years to come, with a major renovation in Doha Port that can accommodate up to 12,000 visitors a day.

Number of International Visitors to Qatar (2019-2023)

Source: Qatar Tourism, 2023

However, a stronger brand name is necessary to establish itself as a tourist destination and business capital. The country finds itself in the midst of a growing GCC competition, with Saudi Arabia leading its own Vision 2030 and UAE pursuing ambitious lifestyle and business goals. With 41% of Doha’s inbound visitors year-to-date from Gulf countries, Qatar’s tourism is GCC-dependent and is in need of diversification. International marketing campaigns need to be impactful and compelling, offering a differentiated product from its neighbors. For instance, it is not widely known that the country is home to one of the largest gatherings of whale sharks and turtle hatching beaches on the planet, or that its family-friendly products and experiences are developing in line to top-notch family destinations.

Establishing further expat-friendly labour, visa, investment and lifestyle regulations will increase the attraction of talent into the country. Additional initiatives to offset seasonality will benefit the industry given Doha still experiences deeper drops in occupancy during the summer season when compared to its UAE counterparts.

Although some World Cup facilities may be dedicated for domestic and international events, for a more supportable industry on the longer term, repurposing some hospitality sites into one-of-a-kind facilities is an advantageous option: expanded wedding and conference halls, high-performance sports clinics, wellness destination resorts, entertainment and adventure parks are some of the opportunities which could be tapped. The sector could also benefit from dedicated packages for soccer fans seeking to trace steps of an extraordinary World Cup.

While the country needs to continue its efforts to sustain its tourism industry, the outlook is bright on account of the growing investment in a number of economic sectors, the strong initiatives of Qatar Tourism, and the extensive line-up of business and leisure events hosted in the country.

About Maria Quintero

María is an Associate at HVS Dubai working in strategic consulting for hospitality assets across the Middle East.

As part of HVS, María has been involved in numerable financial studies including complex feasibility projects, re-development plans, appraisals and strategic advisory for hotels and resorts of all asset types. María has also engaged in operator search and selection assignments and specializes in wellness, luxury and hospitality-driven mixed-use developments throughout the GCC.

Prior to joining HVS, María worked in luxury hotel management in UAE and Qatar. She also has experience in business consulting in Colombia.

María holds a Master’s Degree on International Business in Hotel and Resort Management from Swiss Hotel Management School, and a Bachelor’s Degree in Economics from Universidad de Los Andes, Colombia.

For more information, contact Maria at mquintero@hvs.com.