The 2023 edition of the Caribbean Hotel Investment Conference & Operations Summit (CHICOS) brought over 300 attendees to the Westin Beach Resort & Spa St. Thomas, USVI, for several days of networking and industry insights from key stakeholders in the region. This article provides key takeaways from this year's conference.

Last year’s CHICOS conference focused on the Caribbean region’s rebound from the closure of the islands due to COVID-19. However, this year’s CHICOS theme, “Shining in Today’s New Normal,” highlighted the exponential growth in arrivals and average rates in the region. A few key takeaways from this year’s conference are presented below.

Record-Breaking Demand

As the Caribbean hotel market has shattered occupancy, ADR, and RevPAR records, with some islands experiencing double-digit growth, there is no question the region is shining bright. During CHICOS 2022 last year, we all met to celebrate the 2022 recovery; however, the underlying sentiment was one of uneasiness due to inflationary trends and the looming recession. The 2023 levels have subsequently proved that the 2022 performance was merely a recovery. Although several islands that are highly focused on European travelers remain slow to rebound, the influx of U.S. consumers continues to assist the Caribbean in revising the record books.

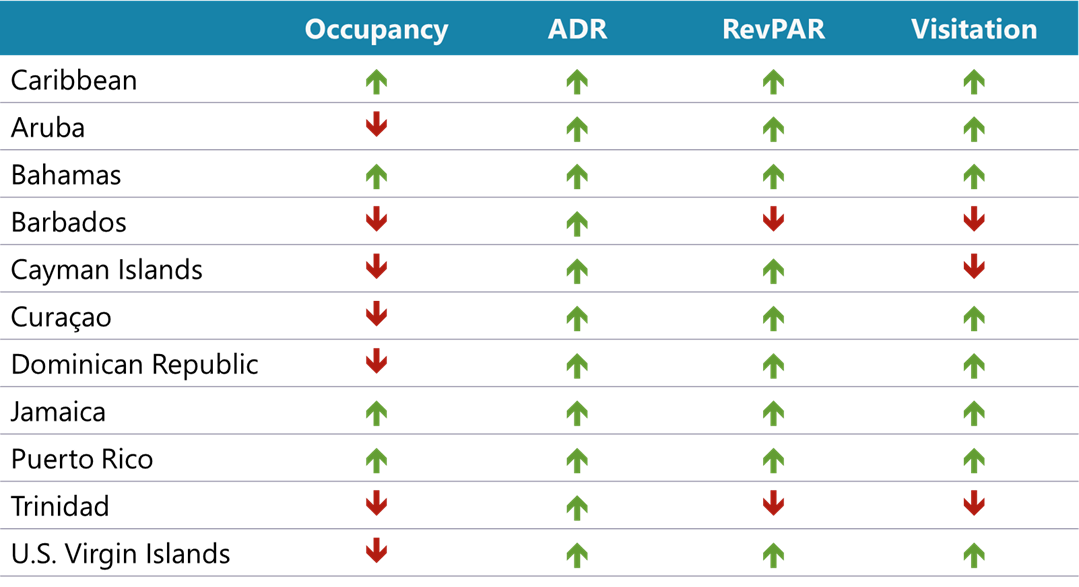

Recent Caribbean Performance and YTD September Comparisons

Source: STR

According to HVS research through various tourism sites, Caribbean demand remains exceptionally strong, with air arrivals for year-to-date 2023 through September already at 88% of calendar 2019 levels. The region is poised for a winter/spring seasonal resurgence in late 2023 and early 2024. The Dominican Republic, Jamaica, Puerto Rico, and the Bahamas outpaced the market and led the occupancy resurgence, with the Dominican Republic attracting almost 40% of all Caribbean travelers. The U.S. Virgin Islands and Curaçao also shined, with more than 20% demand growth in year-to-date 2023 through September. Continental United States residents continue to dominate Caribbean visitation, comprising 50% of travelers to the market. Data suggest that U.S. tourists are trading travel within the continental United States for travel to the Caribbean, further substantiating the need for supply growth in the Caribbean. In addition, recent data indicate less demand seasonality than ever before, as more months record higher-than-typical occupancy levels.

Recovery Summary—YTD September 2019 vs. 2023

Source: STR, HVS Research

The Maturation of the Caribbean

The addition of ultra-luxury properties as well as limited-service and select-service midscale inventory in the Caribbean highlights the maturation of the region. It also emphasizes the overwhelmingly positive outlook for the market, with developers open to building a variety of product types. Despite the complexities within the capital markets, well-established development projects continue to be financed. ADR is expected to continue driving RevPAR growth, and occupancy in the Caribbean has surpassed that of the United States, with 12% occupancy growth in the region year-to-date, compared to a decline in the U.S. occupancy levels. The recent strong performance of luxury developments, including developments that combine luxury hotels with branded residences, is proof of concept for the traditional luxury model and evidence of the continued demand for this product type. The success of the traditional luxury segment also supports the continued development of the luxury all-inclusive resort model.

Potential Disruptions—Don’t Steal Our Sunshine!

While the Caribbean has shown resilience through major cycles of natural disasters and the COVID-19 pandemic, it is important to examine ADR increases and the corresponding impact of airfare increases. The Caribbean has always been a value-added destination for U.S. families, and although the influx of midscale and upscale brands may provide temporary relief for travelers, flight costs remain a challenge. Thus, the increase of available flights and new carriers at major hubs should create incremental demand for the islands, while bolstering competition and making flight costs more competitive.

In addition to airfare costs, the region has other issues to work through. While interest in new hotel and resort developments is prevalent as demand continues to outpace supply, developers are facing a difficult financing environment and must be more creative with their capital stack. Increased insurance costs are also a challenge for new developments, as well as existing assets. Nevertheless, the development pipeline remains robust. Progress is expected to continue on projects that have supporting components such as a feasibility study, quality sponsor, strong brand, great location, and strong equity contribution.

Let It Shine, Let It Shine, Let It Shine

The Caribbean’s future remains bright, with record occupancy, ADR, and RevPAR performance metrics, as well as strong visitation from both air and sea arrivals in 2023. Despite the recessionary soft-landing fears and other challenges in the region, all the components are in place for the glimmering Caribbean to shine on. Thus, barring the effects of any natural disasters, the outlook is favorable for additional ADR and demand growth in 2024.

About CHICOS

The Caribbean Hotel Investment Conference & Operations Summit (CHICOS) is the premier hospitality conference in the region. Having completed its 12th edition in the U.S. Virgin Islands in 2023, CHICOS brings together over 350 regional and international investors and operators, as well as the region’s leading decision makers. Attendees or speakers include government representatives, opinion leaders, developers, developers seeking investors, bankers and other lenders, tourism officials, investment fund representatives, hotel brand executives, franchise and operations company delegates, public and private institution members, consultants, advisors, architects, and designers. Conference attendees network and discuss the region’s markets and possibilities, while analyzing the most important trends that can affect their investment decisions.

About Kristina M. D'Amico

Kristina is a Senior Vice President in the HVS Miami office, as well as the Director of the Caribbean Region. Her expertise encompasses consulting and valuation of existing and proposed hotels and resorts throughout Florida. Furthermore, Kristina’s significant international consulting, advisory, and appraisal experience includes assets in the Caribbean Basin across 22 Caribbean islands, as well as the Riviera Maya region of Mexico and many countries in Latin America. Given her analytical skills, her creative-thinking ability, and her aptitude for solving problems that arise in complex projects, clients particularly value Kristina’s insights and recommendations regarding hotel room counts, product positioning, amenities, and branding for many types of proposed properties, including hotels, all-inclusive resorts, and mixed-use resorts with complementary real estate. Contact Kristina at (305) 338-0354 or kdamico@hvs.com.