Customers have started to scratch their travel itch once again, but expectations aren’t being met.

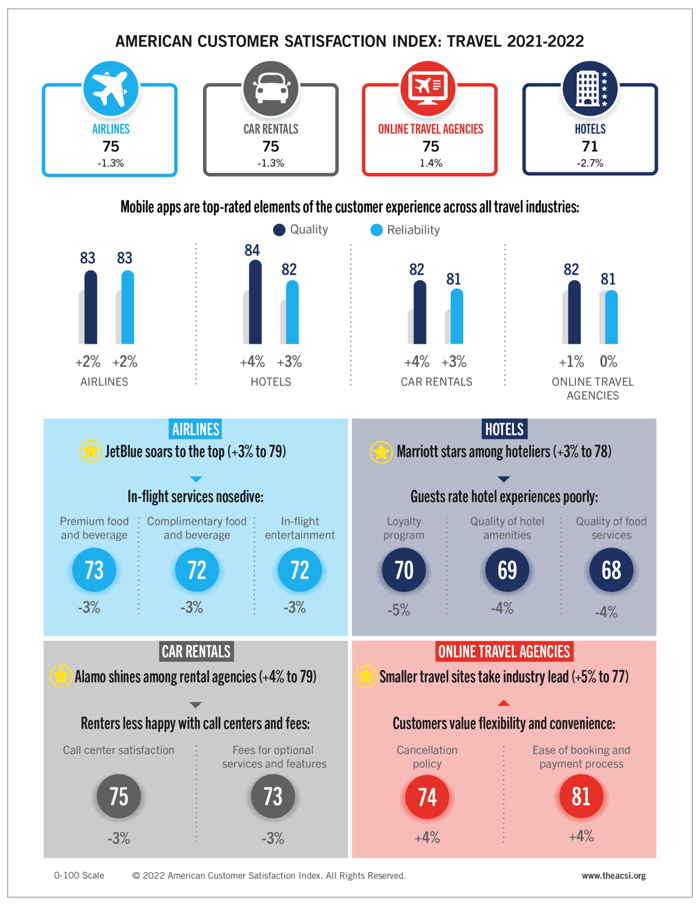

According to the ) Travel Study 2021-2022, satisfaction with airlines is flying in the wrong direction, hotels aren’t hosting happy guests, and car rentals can’t get back on track. Online travel agencies are the only industry to improve customer satisfaction, but not by much.

“Many folks ventured out to travel for the first time since the pandemic hit only to be met with lackluster service and dashed hopes,” says Forrest Morgeson, Assistant Professor of Marketing at Michigan State University and Director of Research Emeritus at the ACSI. “We see this with hotels, where the quality of amenities and food services both dip below customer experience benchmarks of 70. Anyone who anticipated their travel experience would feel like the ‘normal’ pre-pandemic days are likely coming away sorely disappointed. While the desire to travel may be up, it might be time to adjust your expectations.”

This study provides customer satisfaction data across four travel industries – airlines, hotels, car rentals, and online travel agencies – based on surveys conducted from April 2021 to March 2022.

JetBlue soars into first place

After ascending to its best-ever score, the airline industry comes back down to earth, as passenger satisfaction slips 1.3% to an ACSI score of 75 (out of 100).

JetBlue flies into the top spot, up 3% to 79. American and United, both up 3% to 77, climb into a four-way tie for second with Delta and Southwest, which slide 3% apiece.

Alaska decreases 3% to an ACSI score of 75, followed by the smaller carriers (down 4% to 71) and Allegiant (down 3% to 70). The bottom of the industry belongs to ultra-low-cost carriers Frontier, which slumps 3% to 66, and Spirit, which tumbles 5% to 63.

Hotels hurt again by withering satisfaction

The hotel industry faces the ire of unsatisfied customers yet again.

Guest satisfaction overall falls 2.7% to a score of 71, with over half of the major hoteliers posting ACSI declines of 4% or greater.

Marriott becomes the industry satisfaction leader after improving 3% to 78. Last year’s leader, Hilton, finishes second after dropping 4% to an ACSI score of 76. Best Western is steady at 75, just ahead of IHG, which sinks 5% to 74. Choice and Hyatt each score 73, but the former increases 3% while the latter slides 4%.

Wyndham is stable at 69, followed by the large group of smaller hotels, which plummets 7% to 65. The bottom of the industry belongs to G6 Hospitality (Motel 6), plunging 15% to an ACSI score of 56.

Alamo captures top spot among car rentals

Satisfaction with the car rental industry dips 1.3% to an ACSI score of 75.

Alamo drives to the front of the pack, improving 4% to 79. Three brands tie at 76: Enterprise (down 3%), Hertz (up 1%), and National (up 1%).

Dollar drops 3% to 75, ahead of Avis (74) and Budget (72), down 1% each. The group of smaller car rental companies is next with a steady score of 71. Thrifty sits at the bottom of the industry, slumping 3% to 70.

Smaller online travel agencies take industry lead

User satisfaction with online travel agencies overall inches up 1.4% to an ACSI score of 75.

The group of smaller online travel sites takes the top spot after increasing 5% to 77. Orbitz is next, improving 1% to 76, followed by Tripadvisor, down 1% to 75.

Expedia’s namesake site and Travelocity both score 73, decreasing 1% and 4%, respectively. Priceline remains at the bottom of the industry after stumbling 1% to 72.

The ACSI Travel Study 2021-2022 on airlines, hotels, car rentals, and internet travel services is based on interviews with 6,285 customers. Respondents were chosen at random and contacted via email between April 5, 2021, and March 25, 2022. Download the study here.