While 2023 Lunar New Year produced positive performance, especially as the first since 2019 outside of a COVID lockdown, this year's holiday brought a different level of success to the country.

In Chinese culture, the dragon represents strength and good luck, which is fitting as Lunar New Year brought performance growth to China hotels once more during the important holiday period.

While 2023 Lunar New Year produced positive performance, especially as the first since 2019 outside of a COVID lockdown, this year’s holiday brought a different level of success to the country.

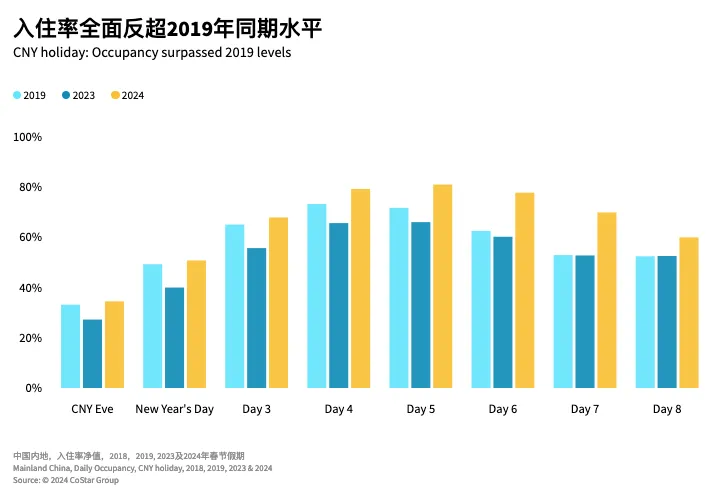

During the traditional holiday period, starting from Lunar New Year’s Eve on 9 February through 17 February, Mainland China saw hotel occupancy surpass 2019 and 2023 comparables all eight days. It is important to note that the official 2024 Lunar New Year period was eight days instead of seven.

While average daily rate (ADR) in the country was lower year over year on Lunar New Year’s Eve and New Year’s Day, the metric surpassed 2023 levels during the final five days of the holiday period. In addition, ADR was higher than 2019 for each of the eight days. When looking at the classes, the most robust ADR growth was in the economy class (+23% over 2019) while upper midscale saw the lowest increase (+7% over 2019).

What destinations were “hot” spots?

A trend this year included increased travel to explore the excitement and fun that some lower-tier cities had to offer, as the urbanizations are more developed than in recent years.

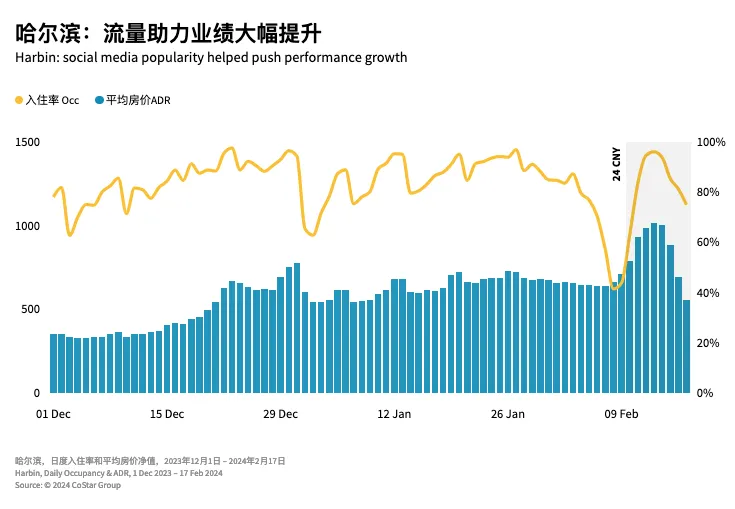

One of the modern success stories is that of Harbin, China’s “ice city,” which showed increased performance thanks to a social media push, as noted by the city’s tourism department. The state media agency, Xinhua, reported that this year’s festival drew 3.05 million visitors during a three-day period, which exceeded the number of pre-COVID visits in 2019, and generated 5.91 billion yuan (US$826 million) in tourism revenue.

When looking at hotel performance, the city’s highest levels of the month were seen on 13 February: occupancy (96.0%), ADR (CNY1,016) and RevPAR (CNY975). The city’s hotels reported three days of occupancy above 90% during the Lunar New Year period, as well as four days of ADR between CNY900-1,000.

Overall, the Northeast region of China outperformed due to the popularity of Harbin, while the neighboring provinces, Jilin and Liaoning, posted both occupancy and ADR increases during this winter/ice season. Shenyang (capital city of Liaoning), Changchun (capital city of Jilin), and Harbin sat among the top 5 market/submarkets for RevPAR growth. Lower-tier cities that typically remain out of the spotlight, such as Quanzhou, Langfang, Xuzhou, and Nanchang, also achieved outstanding performance.

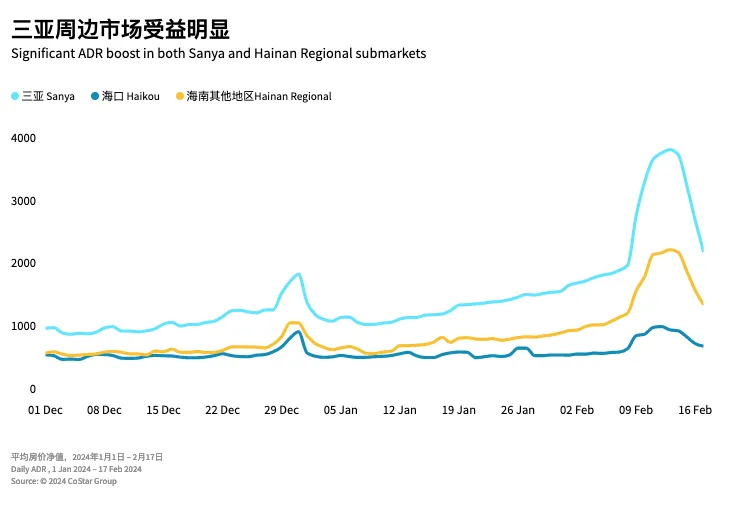

Sanya, a popular destination each year, saw ADR skyrocket, nearly doubling rates during the holiday period. From 10-15 February, rates reached above CNY3,000, with the highest ADR level recorded on 13 February (CNY3,809). For comparison, two days prior to CNYE, ADR was just above CNY1,900, and was roughly CNY1,000 throughout most of December.

The Hainan Regional submarket also showed explosive room rate growth during the holiday period. Due to the higher rate in Sanya, especially in Yalong Bay and Haitang Bay submarkets, tourists flowed heavily to Sanya City, Sanya Bay and Hainan Regional.

Lunar New Year is just one testament to how holidays and events can play in favor towards hotel performance. Growth across many areas in the Asia Pacific region is now more related to individual market drivers (i.e. events) rather than to pandemic recovery, pointing toward a more “normalized” industry.

This article originally appeared on STR.