As sales of luxury goods soften following a pandemic-era surge, with core consumers now cutting back on their spending, luxury brands and retailers will have to work harder for growth and look for new opportunities

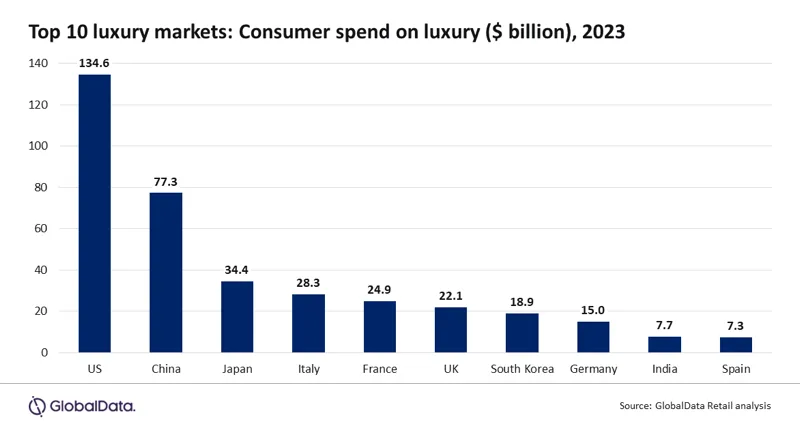

Since the COVID-19 pandemic, the global luxury market has been booming. In 2023 the luxury market in the US alone was valued at $134.6 billion, making it the largest in the world, with China second at $77.3 billion, according to GlobalData.

Harry Butterfield, Consultant and Retail Analyst Consumer Custom Solutions at GlobalData, comments: “Throughout the pandemic years, a large proportion of wealthier consumers were able to save, with limited opportunities to spend. Once restrictions were relaxed, the luxury market in the US surged, with consumers rushing to splurge their accumulated earnings on the finer things in life. At the same time, luxury retailers looked to shift any inventory built up from the pandemic. It was a match made in retail heaven, with luxury retail sales in the US growing 42.2% and 11.0%, in 2021 and 2022, respectively, according to GlobalData analysis.”

However, in 2023, although the luxury market in the US was still one fifth (22.2%) above pre-pandemic levels (2019), sales began to slow, with a decline of 3.7% year-on-year. British brand Burberry recently lowered its operating profit guidance for the year ending March 2024, with the brand’s CEO Jonathan Akeroyd citing a ‘slowing luxury demand’.

Moreover, market leader Capri’s latest Q3 results, for the period ended 30 December 2023, revealed that its luxury brands are in the doldrums, with year-over-year revenue declines of -5.6% at Michael Kors, -1.2% at Jimmy Choo and -8.8% at Versace, and overall group sales slipping by -5.6%.

However, as the global demand for luxury products slows down, there are still things that luxury brands and retailers can do to boost sales:

Looking to younger generations

Younger generations continue to value luxury products and Gen Z in particular continues to be a growing market for many luxury brands and retailers. With fewer financial commitments, and growing disposable income, Gen Z are also willing to cut-back on other areas of spending, such as more expensive travel options, to afford luxury goods.

Focus on vacation shopping

As global travel is projected to exceed pre-pandemic levels in 2024, the revival of destination-focused shopping will continue. Tourist shopping for luxury goods is a key driver for the sector, often with consumers taking advantage of strong conversion rates and tax-free shopping. Now, more than ever, it is vital for luxury brands to have a presence in critical shopping locations around the globe.

Prioritizing the critical segment

Although new audiences and emerging markets continue to gain traction in the luxury sector, providing opportunities for fresh growth streams, it is still the ultra-rich, largely insulated from global economic ups and downs by their wealth, who continue to dominate spending power.

Reflecting this, and after a period of lackluster results, Gucci entered a rapid repositioning plan in 2023, shifting from its maximalist style to an ultra-timeless image that is aimed to allure the world’s very richest, who can both afford to spend more, and who are more reliable in their spending.

Butterfield added: “ After the post-pandemic boom the global luxury market has now arrived at a pivotal time. Although growth opportunities seem anaemic in comparison to recent years, they remain respectable compared to pre-pandemic levels. Long-term the global economy will improve, drawing many consumers back to the market. In the meantime, luxury retailers will need to double down on their core audience, whilst not hesitating to invest in new opportunities, like the rising importance of Gen Z and the revival of vacation-focused shopping.”