Highlights

- Super Bowl lifted overall U.S. performance, again.

- Celebrations and weather delays propelled Monday.

- Group demand up six consecutive weeks.

- Taylor Swift, Taylor Swift, Taylor Swift.

- General election slows Indonesia.

U.S. Performance

Super Bowl Sunday, a high-performing Monday, and a soft President’s Day weekend were the most important factors in the latest week of data. U.S. RevPAR increased 1.6% year over year, driven entirely by ADR (+4.2%), while occupancy declined for an eighth consecutive week. Sunday produced the largest RevPAR gain of the week (+19%) followed by Monday (+11.6%). Super Bowl Sunday in Las Vegas drove the overall Sunday increase. Excluding Las Vegas, U.S. Sunday RevPAR decreased 4.8%. However, Monday’s RevPAR increase held at +10.0%. The strong Monday performance was most likely a combination of Mardi Gras, Chinese New Year and other celebrations, major events, and weather issues.

The rest of the week saw steadily declining RevPAR changes. Tuesday showed a positive RevPAR comparison (+1.6%), while the next four days steadily decreased with Wednesday and Thursday down 1.4% and Presidents’ Day weekend (Friday & Saturday) down 3.6%. Occupancy for Presidents’ Day weekend, which typically draws increased leisure travel, was 71.4%, which was the highest weekend occupancy since November although 2.6 ppts lower than last year’s Presidents’ Day weekend. ADR was up on all days except on Saturday, but from Wednesday through Friday, ADR growth was below the rate of inflation. Occupancy decreased for all days except Monday (+1.9ppts). Decreases hovered around -2 percentage points (ppts) Tuesday through Friday. Saturday decreased 3.1ppts.

The Top 25 Markets had a better week than the rest of the country. RevPAR increased 7.3%, led completely by ADR and the Super Bowl boost. Excluding Las Vegas, RevPAR fell 1.1% with both ADR and occupancy down (-0.5% and -0.4ppts, respectively). The Top 25 Markets mirrored the day-of-week performance seen for the country overall with Monday posting the highest RevPAR gain followed by softening RevPAR performance each day with Saturday at -4.7%.

Individual Top 25 Market performance was mixed with an equal number of markets posting positive and negative RevPAR changes. Top performers were Las Vegas (+81.4%), San Francisco (+14.4%) and Oahu (+14.3%).

On Super Bowl Sunday, Las Vegas saw an ADR of US$808 and occupancy of 81%. The market continued to benefit from the Super Bowl in the remainder of the week with the next six days seeing RevPAR up 35.2% compared to the same six days last year.

Oahu’s strong performance was lifted by market events, and San Francisco benefitted from a large medical conference. New Orleans’ Mardi Gras celebrations resulted in RevPAR gains of more than 100% on Sunday through Tuesday due to a calendar shift. A year ago, Mardi Gras occurred two weeks later. Monday was a great day across the Top 25 Markets with all but two markets posting RevPAR growth, and 17 markets seeing double-digit gains. In addition to the markets already mentioned, top Monday performers (+25%) were Boston, Philadelphia, Denver, and Washington D.C. This surprisingly strong Monday performance is most likely due to a combination of events, including celebrations and weather delays.

Across the rest of the country, Monday’s RevPAR was also strong, up 4.1% with the remainder of the week down. Indianapolis was the best performing market outside of the Top 25 Markets due to its hosting of the NBA All-Star game on Sunday, February 18. The market saw steady RevPAR gains all week with Thursday through Saturday growth surpassing 100%.

Group demand continued to strengthen with Luxury and Upper Upscale hotels up for a sixth consecutive week, increasing 3.4% compared to the same week last year and up 7.9% over the past four weeks. Group ADR was up 8.5% with the measure growing 5.8% over the past four weeks. Fifteen of the Top 25 Markets saw year-over-year group occupancy gains. Atlanta, Boston, Denver, Las Vegas, Oahu, and San Francisco posted the largest year over year occupancy increase. These markets, along with Dallas, Minneapolis, Philadelphia, and Tampa also saw 7%+ group ADR increases.

Global hotel performance

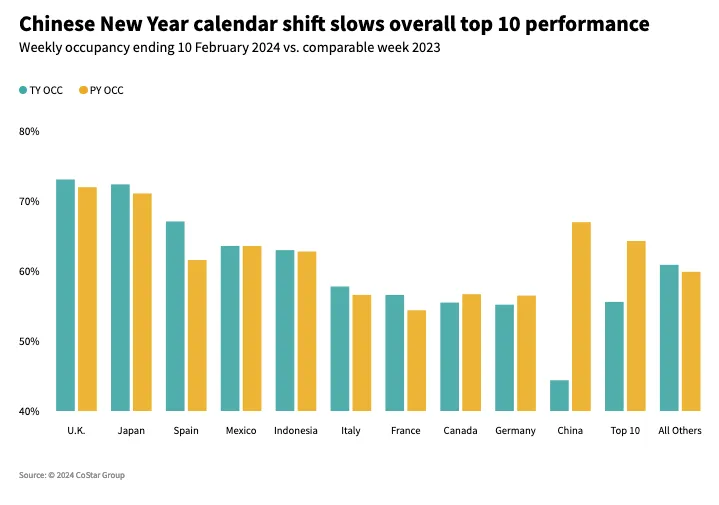

The 10 highest hotel supply countries outside of the U.S. saw occupancy that was largely in line with the comparable week last year. Seven of the 10 countries saw an occupancy change between -2ppts and +2ppts. The positive performance included Spain (+4.7ppts to 71.7%) and Australia (+4.6ppts to 77.1%). ADR for the top 10 in aggregate was up 18.9%, resulting in a RevPAR gain of 20.7%. This year, unlike last year, we have seen a wider variation in weekly RevPAR growth. This was expected as the large recovery-led performance wanes.

The strong occupancy performance in Spain this week continued to be driven by the eastern Mediterranean coast region, up 13.8ppts to 69.5%, and the southern Andalucía region up 9.7ppts to 72.6%. RevPAR was up 36.8% in Mediterranean Coast, driven mostly by occupancy growth. In Andalucía, ADR was largely responsible for RevPAR growth of 31.6%.

In Australia, occupancy was in line with 2018, which matches the days of week this year exactly up until leap day. Occupancy was up 4.6ppts as compared to 4.8ppts in 2018. However, absolute occupancy was about 10ppts lower than in 2018. The country’s ADR, however, was up 11.5%, in no small part due to Taylor Swift’s largest ever performances in Melbourne, boosting ADR for the city 36.8%. For her four upcoming performances in Sydney, occupancy on the books was at 86%, as shown via Forward STAR.

Indonesia saw the largest occupancy decline of the top 10 countries, down 15.3ppts to 48.9%. While some Chinese New Year celebrations took place at the beginning of the week, 14 February was the country’s general election with more than 200 million registered voters spread out over the country’s 6,000 inhabited islands. As a result, 10 of the country’s 12 markets saw occupancy decreases. A similar decline in occupancy was seen during the country’s last election in 2019.

Looking ahead

As Spring blooms, ADR is expected to drive RevPAR with occupancy moderating. Expect next week’s data (week ending February 24) to show softer group demand due to the Presidents’ Day holiday. Group demand is then expected to grow up until the week before Easter (31 March). Global performance will also be impacted by the Easter holiday along with sporting events, concerts (Taylor Swift’s international tour in Australia and Singapore), conferences/conventions, and the change of seasons, just like before the pandemic.

This article originally appeared on STR.