The latest 2023 EMEA hospitality statistics, including exclusive TrustYou and third-party data [updated quarterly].

TrustYou EMEA Hospitality Statistics Q3 2023

#1 Review Volume Registers a Moderate Growth

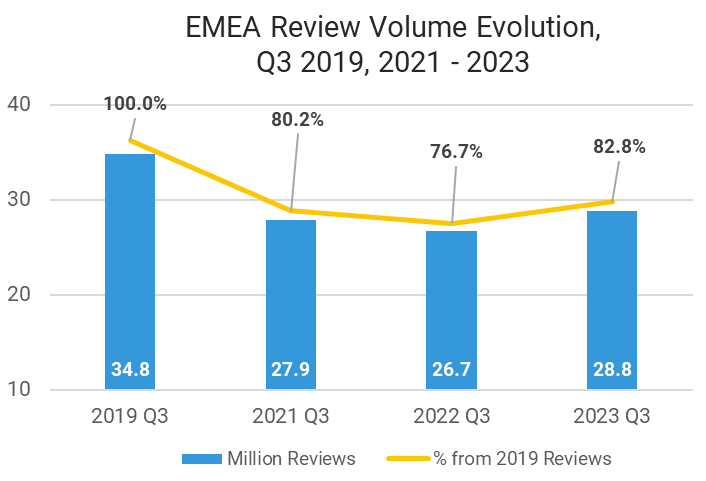

Q3 2023 EMEA review volume reached 82.8% of the pre-pandemic level and recorded a 7.9% increase compared to Q3 2022.

EMEA Review Volume Evolution, Q3 2019, 2021-2023

While the review volume registers moderate growth, other indicators show that the tourism sector is set to outpace the 2019 numbers. In July, the average hotel occupancy rate in Europe was at 96% compared to 2019.

Based on the latest data from Eurostat, the number of tourists visiting the continent is 0.9% higher during the first half of the year than pre-pandemic. Moreover, the number of overnight stays has reached its highest level in the last 10 years. Between January and June 2023, all countries, except Hungary, saw this number increase compared to 2022. Cyprus observed the highest yearly growth in overnight stays in tourist accommodation amongst all EU member countries, with an increase of 39.3%, while Malta saw a rise of 30.5%, and Slovakia saw a growth of 28.7%.

#2 Positive Feedback Remains Steadily High

94% of EMEA’s guest reviews are positive

EMEA maintains an exceptionally high proportion of positive reviews, showing the hoteliers’ dedication and commitment to providing a top-notch guest experience.

#3 Service and Price at the Core of EMEA Guest Satisfaction

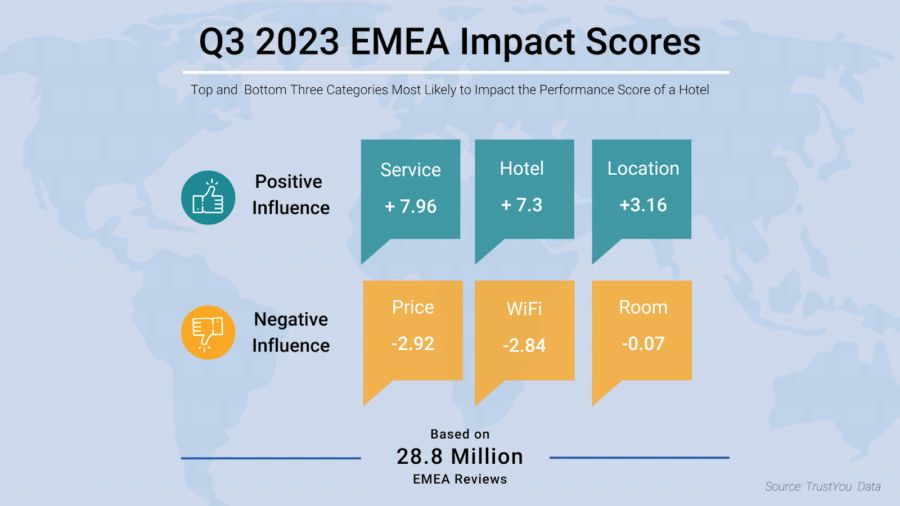

TrustYou’s Q3 2023 EMEA Top and Bottom Impact Scores Influencing the Performance Score of a Hotel

The top and bottom three categories impacting performance remain the same as Q2 2023.

Some new subcategories are becoming more popular among EMEA guests. This quarter, WaterPark Hotels were highly appreciated. For the category Location, proximity to restaurants & bars increased the scores.

On the negative side, the WiFi, Price, and Room trio have always had a significant negative impact on performance. While almost all factors leading to guest dissatisfaction remain the same as in Q2 2023, Breakfast Prices emerge as a new negative subcategory.

Industry Wrap-Up - EMEA Hospitality Statistics Q3 2023

#1 Tourism Continues to Boom Despite Inflation

Prices continue to be a major concern for European travelers. The latest report from the European Travel Commission shows that 68% of those surveyed plan to travel between October 2023 - March 2024, 2% less than the previous year. Spain and Italy have the most avid travelers - 75% of respondents will likely take a trip in that timeframe.

Despite inflation, resulting in higher room prices, the travel demand remains strong across almost all European markets. Flight bookings to northern Europe experienced a significant increase of 25% between June and August, while bookings to the south rose by 13%. Hotel occupancy across Europe in July was only 4% lower than pre-pandemic levels. France, the most visited country worldwide, is expected to earn a record profit from tourism this year.

#2 Tourism Taxes Increase as Authorities Try to Cope with Climate Changes, Inflation and Overtourism

Starting in 2024, Greece plans to raise tourist accommodation tax rates, generating an estimated additional revenue of 300 million Euros. The increase comes after a difficult summer for Greece, marked by devastating forest fires and flies, and will contribute to a natural disaster relief fund. While confronted with ongoing climate changes, Greece remains a top tourism performer. Between June and August, it was the only destination with flight bookings surpassing 2019 levels - a 10% increase, based on a ForwardKeys report.

Another destination that decided to modify its taxation policy is Amsterdam, increasing the tourism tax to 12.5 % of the final hotel bill. Even before this change, Amsterdam was known for having the highest tourism taxes in Europe. The measure was adopted to support the city in dealing with inflation and overtourism.

TrustYou EMEA Hospitality Statistics Q2 2023

#1 The Region Closest to 2019 Levels

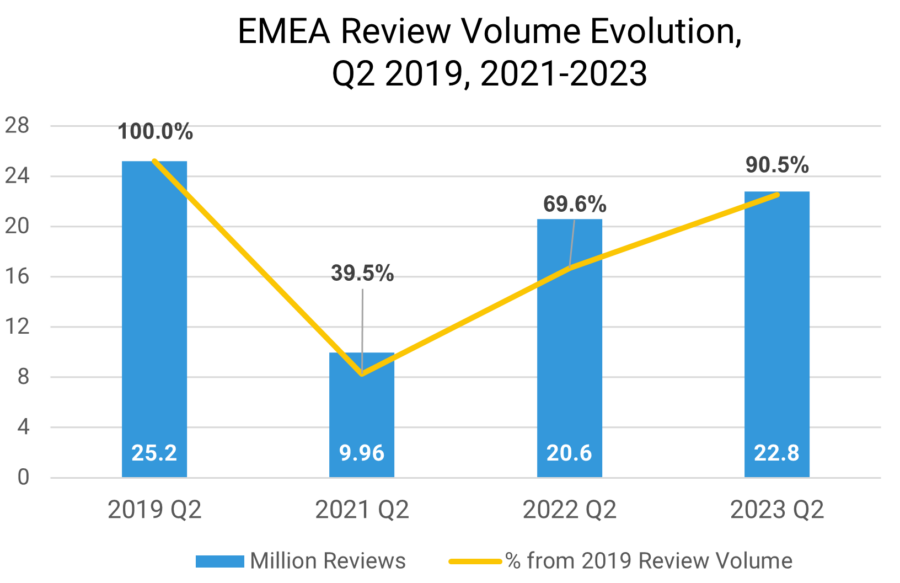

Q2 2023 EMEA review volume reached 90.5% of the pre-pandemic level and recorded a 10.7% increase compared to Q2 2022.

While EMEA is the region getting closest to pre-pandemic numbers, quarter by quarter, we see a slower paced growth. This can be attributed to three main factors: (1) the impressive recovery the region witnessed (2) APAC’s reopening, which made travelers consider other regions for their trips, and (3) Russia not being able to recover fully.

EMEA Review Volume Evolution, Q2 2019, 2021-2023

#2 The Region With the Most Positive Reviews

94% of the EMEA guest reviews are positive.

EMEA maintains its leadership position as the region with the highest proportion of positive reviews.

#3 Service Improves Scores; Price Brings Lower Ratings

EMEA Impact Scores follow similar patterns to the Q1 2023 global categories and subcategories. There are a few differences we see this quarter compared to Q1 2023:

- Price comes first in the bottom categories. Last quarter, WiFi was the first factor to influence the performance score of a hotel negatively. This is also confirmed by the latest findings from the European Travel Commission. Based on their research, travel intent for the months of June to November 2023 sees a 4% decrease among Europeans. Among the reasons for cautious planning are personal budget and inflation. This is in line with the changes in TrustYou’s bottom impact categories for Q2 2023.

- Room registers as a positive impact, even if it made to bottom three impacts, indicating improvements in this category and overall increased guest satisfaction.

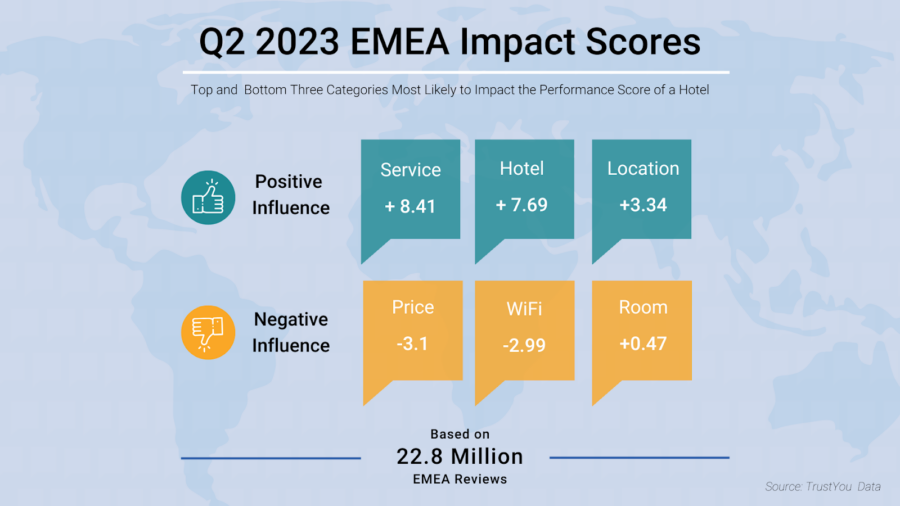

TrustYou’s Q2 2023 EMEA Top and Bottom Impact Scores Influencing the Performance Score of a Hotel

Staff friendliness and helpful management were two key aspects that brought higher scores for EMEA. In the Hotel category, Boutique and Sports Hotels stood out as the most successful categories. In terms of Location, travelers preferred hotels that were situated close to popular attractions or nearby shopping centers.

For the category Price, travelers placed great importance on getting their money's worth. They were more likely to leave lower scores if they considered the food as being too pricey. A poor WiFi connection and costs associated with WiFi were the factors most likely to bring lower scores for a hotel. For the category Room, maintenance, and bathroom were the key things that could lower the ratings.

Industry Wrap-Up - EMEA Hospitality Statistics Q2 2023

#4 The Rise of Affordable Destinations

With inflation still being high on the European travelers' minds, it is expected that the summer and autumn of 2023 will see an increased demand for budget-friendly destinations, such as Serbia, Turkey, and Bulgaria for Eastern Europe and Portugal for Western Europe. Until mid-June 2023, Bulgaria recorded the highest increase in international arrivals, exceeding by 20.7% the pre-pandemic numbers. The country with the best performance in terms of international nights spent in accommodation is Serbia - 61% more nights than in 2019.

#5 US Travelers Leading Long-Haul Summer Demand in Europe

Based on the latest data from the European Tourism Commission, 52% of the analyzed destinations have already registered a higher demand from American travelers than in 2019. When planning their trip to Europe, Americans are particularly looking for affordable deals.

#6 EMEA Countries Snapshot

The French government is looking at ways to introduce more regulations for short rentals as a result of the deepening housing crisis. One of the measures looks at ways to cut the tax reduction currently in place for short-term rentals. Paris is already known for its stricter regulations for those wanting to rent apartments or houses for shorter periods. As a result of continuous demand, the number of properties available on platforms such as Airbnb or Booking.com has increased significantly, pushing the locals out of the city center and fueling high prices in the housing sector. Overtourism impacts France, often posing a threat to preserving the habitat. Some of the nature reserves introduced a scheduling system to control the flow of tourists.

Spain experienced the highest increase in hotel bookings in Europe. For the summer of 2023, bookings were 17% above the pre-pandemic levels.

Turkey registered a 23.1% increase in tourism revenue in Q2 2023 compared to Q1 2023. While there is no exact number provided for the number of international arrivals for the first half of 2023, sources from the Tourism Ministry revealed that until April 2023, the number of tourists grew by 27.5%. Turkey is seeing impressive growth this year. The number of US tourism arrivals grew by 78%, among the highest increase in Europe. The country is among the few that still operates flights with Russia, seeing an influx of travelers coming from there. It also registered the highest growth in ADR in Europe (33%), attributed to the booming luxury market.

Saudi Arabia reported a 26% increase in air traffic in the first half of 2023.The growth is partly attributed to a better connectivity, with the number of accessible destinations growing by 15% in the first six months of 2023.

TrustYou EMEA Hospitality Statistics Q1 2023

#1 EMEA Review Volume Growth Continues in Q1 2023

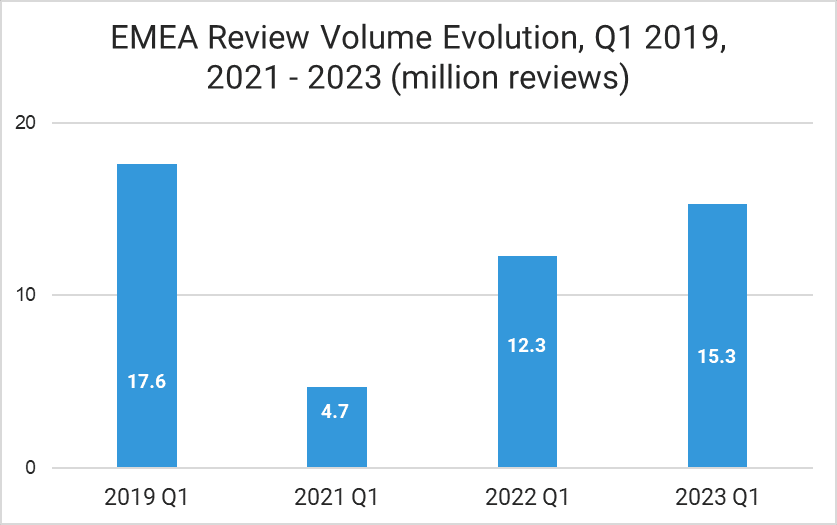

Q1 2023 EMEA review volume reached 86.9% of the pre-pandemic level and recorded a 24.4% increase compared to Q1 2022.

In Q1 2022, the review volume was 69.6% of the total 2019 reviews. At this accelerated pace, the review volume could surpass pre-pandemic numbers starting Q2 2023.

EMEA Review Volume Evolution Q1 2019, 2021-2023

Other indicators show strong growth. Based on STR and CoStar data, the average occupancy rate for Europe for Q1 2023 was just 5% below the pre-pandemic levels. The Middle East & Southern Africa registered the best performance compared to 2019. Arabic countries reached the same occupancy rate as in 2019, and Southern Africa is just 1% behind their 2019 levels. Northern Africa reached 91% of 2019 numbers.

In terms of ADR, the entire EMEA surpassed the pre-pandemic numbers. We see the highest increase in Northern Africa - 81% growth compared to 2019, followed by the Middle East - at 27%, Southern Africa - at 25%, and Europe at 21%.

#2 Positive Feedback is Steadily High

94% of the EMEA guest reviews are positive.

EMEA maintains its leadership position as the region with the highest proportion of positive reviews.

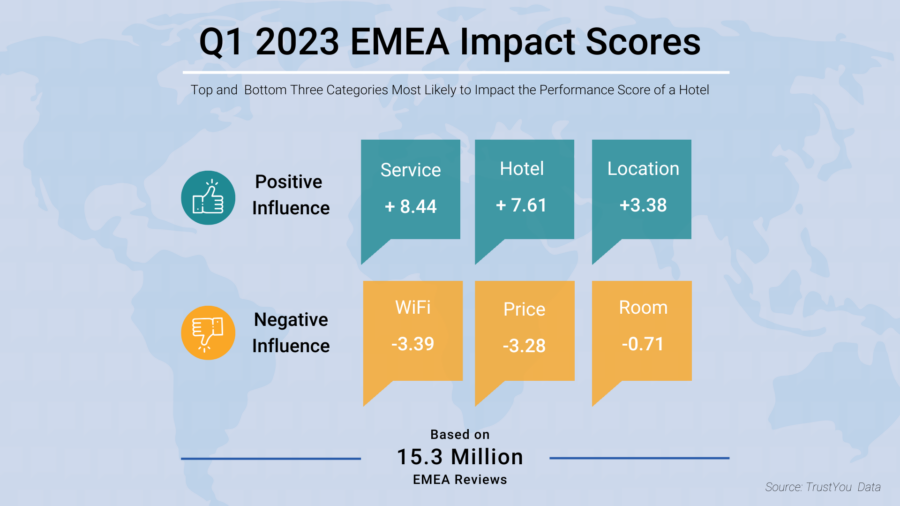

#3 Service Improves Scores; WiFi Brings Lower Ratings

EMEA Impact Scores follow similar patterns to the Q1 2023 global categories and subcategories.

TrustYou’s Q1 2023 EMEA Top and Bottom Impact Scores Influencing the Performance Score of a Hotel

EMEA is also where Service & Hotel had the highest positive impact on a hotel’s performance across the regions analyzed.

Guests were more likely to leave higher ratings when staff members were helpful and friendly In the Hotel category, Boutique and Water Park were the categories most likely to improve performance. For Location, closeness to local attractions was a crucial factor for travelers.

A poor WiFi connection and costs associated with WiFi were the factors most likely to bring lower scores for a hotel. For the category Price, travelers placed great importance on getting their money's worth. Lower scores for the category Room were more likely to result from maintenance and cleanliness.

Industry Wrap-Up - EMEA Hospitality Statistics Q1 2023

#4 Domestic Flights Declining

European internal flights are less popular than before the pandemic. Germany, for example, recorded a 38% decrease in domestic flights in 2022 - one of the sharpest declines in the region. Other countries that registered a significant drop are Lithuania (-38%), Finland (-35%), and Austria (-32%).

Three main factors contributed to this massive decline:

- Policies encouraging travel by train - the 9 & 49 Euro ticket in Germany

- National initiatives banning short-haul flights to reduce carbon emissions, with France being one of the countries leading these efforts.

- Travelers are becoming more aware and prepared to choose sustainable options when traveling.

The latest ETC study shows that 30% of Europeans think of traveling between April and May, a 6% increase compared to 2022. 4 out of 10 would make plans for June and July. August and September, the peak months, recorded a 9% decrease in demand.

Europeans are concerned about the rising travel costs (23%) and their available budget (17%) when planning their trip. Extreme weather also became a reason for concern - with 7% of Europeans considering this factor for their trips.

#6 Living the Good Life: The Rise of the Luxury Segment

The luxury class registered the highest ADR in Q1 2023: 143 EUR, followed by upper upscale (121 EUR) and economy (119 EUR).

The high-end consumer sector is also more likely to spend on sustainable travel: 3 out of 4 EU travelers are willing to allocate more for sustainable activities and actions when on a trip.

#7 EMEA Countries Snapshot

?? Greece has it all to record the best year for tourism. The summer season's pre-booking data shows that 2023 will be better than 2022. Arrivals and occupancy are expected to be 20% higher compared to 2022.

?? Spain already exceeded pre-pandemic airport arrivals. 53.6 million airport passengers visited Spain in Q1 2023, 1.6% more than in 2019 and 41.6% higher than in Q1 2022.

?? Turkey recorded a 12.3% year-on-year increase in arrivals in March 2023. Saudi Arabia visitors (+ 1959%), Japan (+259%), and China (+254%) registered the highest growth.

*The requested Q1 2023 top and bottom Impact Scores reflect the main semantic categories.

** Q1 2023 Impact Scores and Review Volume were requested at the beginning of April 2023. Due to the dynamic nature of the database with reviews and hotels being updated, the numbers may vary if data were requested at an earlier or later stage.

***the report includes rounded numbers for a clearer data representation.

Catalina Brinza

Catalina is a social media and data enthusiast. At TrustYou, she's on the mission to bring the most out of travel and hospitality data. One day, she hopes to experience Japan's culture to its fullest.

About TrustYou

TrustYou is on a mission to make guest communication and feedback simpler and more productive. All communication channels, together in one place, is the new way of doing business. Today, customers expect instant responses on their preferred communication channels. As a subset of communication, feedback is the foundation to build better products, services and companies.

TrustYou helps companies win through the power of listening and provides a Guest Experience (GX) Platform that makes listening to customers easy, powerful, and actionable. The platform unlocks the potential of guest feedback and helps to:

- Create unlimited opportunities to listen and respond to guests’ needs.

- Understand all reviews across the web and make better business decisions.

- Publish hotel reviews on the website and on Google and allow positive feedback to influence bookings.

TrustYou empowers companies to earn trust, make better decisions, and ultimately, win.

Find more information on TrustYou and our GX platform on www.trustyou.com.