U.S. Performance

March concluded with an uptick in weekly U.S. hotel occupancy, which reached the second highest level of the year (66.2%), up 2.2 percentage points (ppts) from a year ago, but 1.3 percentage points below the year-to-date (YTD) high achieved two weeks ago. Average daily rate (ADR) of US$158 matched last week’s level and like occupancy, it was the second highest of the year so far. More importantly, ADR increased 7.3% year over year (YoY), ahead of inflation (+6%). Revenue per available room (RevPAR) came in at US$105, up 10.9% YoY and 14% higher than 2019. Real (inflation-adjusted) ADR was essentially matched the 2019 level whereas real RevPAR was down 4%.

Top 25 Market occupancy and ADR generally followed the same pattern as the U.S. overall, with occupancy increasing to 72.8% from 72.3% a week ago. Compared to last year, occupancy was up 4ppts YoY – its largest gain of the past three weeks. It should be noted that the occupancy level for the Top 25 Markets has been above 72% for the past four weeks – its longest streak at that level since October.

Weekly ADR in these key markets grew 9.0% YoY, its second week below double-digit growth as easy Omicron comparisons fade away, but the growth rate was still higher than the rate of inflation. With strong increases in both occupancy and ADR, RevPAR jumped 15.4%, a pace that was nearly double the growth seen a week ago.

While each day of the week saw occupancy and demand growth week over week, weekdays (Monday-Wednesday) drove Top 25 Market growth as business and group travel continued its recovery. Those three days accounted for 60% of the year-over-year gain in weekly room demand. Weekday occupancy increased 5.9ppts YoY to 71.5% and has been above 71% for the past four weeks, although this week’s result was the lowest of the four. A year ago, and during this same time period, weekday occupancy failed to break 70%.

All of the Top 25 Markets, minus Atlanta and Miami, saw year-over-year growth in weekday room demand. The largest contributors were Las Vegas and Washington, D.C., which saw its highest weekday occupancy (83%) since the start of the pandemic. The market also had its highest weekly occupancy (78.8%) courtesy of the annual National Cherry Blossom Festival. This year’s weekly occupancy was the 10th highest since 2000. In comparison, the 2019 level for the same week ranked 9th (79.9%).

Outside of the Top 25 Markets, weekly occupancy (62.5%, +1.1 ppts) and ADR (US$138, +5.1%) are improving at a slower pace, which is expected given their substantial recovery in the prior two years. Weekly RevPAR was up 7.0% YoY to US$86.

After falling for five consecutive weeks, U.S. weekend occupancy increased 1ppt YoY to 75.6%, its highest level of the year so far. The gain was driven by the Top 25 Markets, where occupancy grew 2.4ppts to 81.1% – its highest level since the fall. Outside the Top 25, occupancy was relatively flat (72.6%, +0.2ppts YoY).

Six of 167 STR-defined U.S. markets reported occupancy above 80%, with the top three spots occurring in Top 25 Markets. Another 37 markets overall saw occupancy between 70% and 80%. In total, two-thirds (110 markets) reported occupancy at or above 60% for the week, increasing from 99 markets last week. A year ago, 98 markets reached 60% occupancy for the matched week, while 121 markets had hit (or beat) that weekly benchmark in 2019. Some top occupancy callouts which reflect the impact of conventions, robust spring travel and sports tournaments include:

- Highest in Top 25: Las Vegas (86.1%), Tampa (82.1%), and Nashville (82%)

- Highest in Non-Top 25: Florida Keys (82.8%), Sarasota (81.2%), and Ft. Lauderdale (80.8%)

- Top YoY gainers: Louisville (+20ppts), Indianapolis (+13ppts), and Washington, D.C. (+12ppts),

In terms of weekly RevPAR gains, five of the Top 25 markets had double-digit WoW RevPAR percentage increases above the prior week: Houston (+23%), Saint Louis (+19%), Washington, D.C. (+18%), Las Vegas (+13%), and Nashville (+11%). Thirty-seven markets saw WoW RevPAR increases of 10% or higher compared to a total of 19 markets with a double-digit lift in the prior week. RevPAR callouts include:

- Highest Top 25 RevPAR: Oahu (US$222), Miami (US$218), NYC (US$195), and Orlando (US$191).

- Highest non-Top 25 RevPAR: Maui (US$491), Florida Keys (US$407), and Hawaii/Kauai Islands (US$354).

- Top WoW gainers: Indianapolis (+31%), Augusta (+31%), and Tulsa (+29%).

- Top YoY gainers: Louisville (+92%), Indianapolis (+53%), Washington, D.C. (+44%), and Houston (+42%), which hosted the NCAA Final Four tournament.

Global Performance

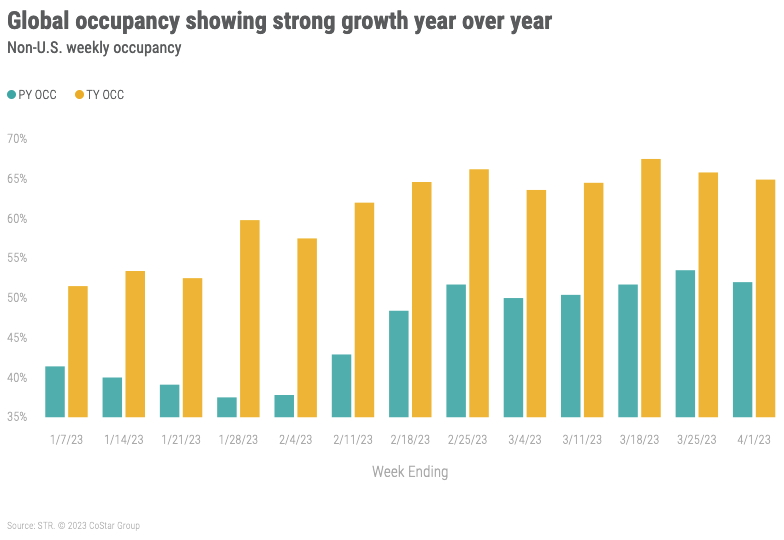

Global occupancy outside the U.S. declined slightly this week to 64.9%, down 0.9ppts from last week but 13ppts ahead of last year. This week’s occupancy was the 14th highest since the start of the pandemic. Weekly ADR rose 20.5% YoY to US$134. With strong results in both occupancy and ADR, RevPAR increased by 50.8% YoY to US$87. RevPAR has grown by 50% or more every week this year, except one (the week ending 25 March). In addition, both ADR and RevPAR attained their highest levels of the past 12 weeks.

Among the top 10 countries based on supply, occupancy was up sharply (+17.4ppts YoY) led by China (+31.5ppts YoY) and followed by Italy, Germany, and Japan where occupancy gains were in the mid-teens year over year. Indonesia saw a noticeable decrease (-8.4ppts YoY) due to the second week of Ramadan. All 10 countries saw YoY ADR growth led by Japan, where ADR jumped more than 106% YoY, which led to a 158% YoY gain in RevPAR. China also saw very strong RevPAR growth, up 151% YoY. Collectively, weekly RevPAR in the top countries was up 62.7% YoY.

Globally, weekly occupancy was the highest in the Bahamas (80.5%) followed by Ireland (79.6%), and Jamaica (79.5%). Fifteen of the 103 countries tracked weekly reported occupancy above 70% this week, which was less than the 27 that did so a week ago.

Final thoughts

This was another solid week with demand slightly outpacing our expectations. Weekday travel continued to recover, driving growth in the Top 25 U.S. markets. We are also encouraged by the strong year-over-year growth in the top 10 countries excluding the U.S. In the U.S., the industry is entering a period of weekly volatility, that in-between period as spring break travel wraps up and summer travel nears. However, these next few weeks will continue to see recovery in weekday demand from business and group segments.

Looking ahead

Our prediction for next week is for slower demand with less positive performance in the Top 25 Markets and generally flat performance coming from markets outside the Top 25. A similar prediction is held globally where the large markets will show muted performance while more leisure destinations will remain steady.

This article originally appeared on STR.