The collective hotel industry is facing a cold, hard truth: attaining the same level of pre-pandemic operational performance will not be measured in days, but months, even years. That's what August data from HotStats portends and at a crossroads, as summer gives way to fall and a host of new variables come into play that could derail the modest success the past several months have demonstrated.

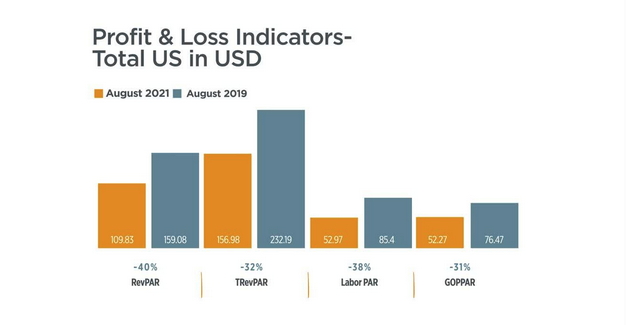

In the U.S., profit continues to lag its 2019 form, with GOPPAR recorded at $52.27 in August, 31% lower than it was in August 2019. However, in a business that changes block to block, there is some good news, with some pockets surpassing expectations. Up to now, profit has been a mix of cost containment with support from leisure business and some destinations in the U.S. are pushing out revenue and profit that is higher now than it was in 2019. Consider Key West, Fla., where in August 2021, total hotel revenue exceeded the same period in 2019 by 28%, while GOPPAR was up 65%.

Non-resort destinations and locations better suited to accommodate corporate and convention travel haven't been as lucky. In Washington, D.C., which relies heavily on government and corporate travel, total revenue is down more than 50% as of August 2021 versus the same month in 2019. Profit per available room was under $10 in August.

Looking ahead, September data from HotStats, which will be available toward the end of October, will have the first payroll data available after three key Covid-era unemployment programs established by the CARES Act expire. Assumptions were that many hotel employees had not reentered the workforce due to the generous benefits. After they sunset, will those reluctant to return rejoin?

Around 7.5 million people are poised to lose *all federal unemployment benefits* in a week. They’re going to $0 in jobless aid as delta cases + hospitalizations surge.

— Joseph Zeballos-Roig (@josephzeballos) August 30, 2021

The looming UI cliff is 3x larger than previous biggest one in 2013, so it’s not really close

Via @pelhamprog pic.twitter.com/jqDsCDwXKg

In Europe, data suggests similar trends of late to the U.S., with most key performance indicators down in August 2021 versus the same month in 2019 at a clip of around 30%. As expected, many of the gateway markets are down more. London GOPPAR in August 2021 was only 30% of what it was in August 2019, while, in Paris, GOPPAR was a bit better off at 61% of the August 2019 level. In fact, Paris has seen rate growth but against still deflated occupancy rates.

A recent Tranio/IHIF survey found that 52% of respondents believe the European hotel market will recover to pre-pandemic levels by 2024, while while another 32% are optimistic that things will revert back to pre-pandemic levels by 2023.

Both the Middle East and Asia-Pacific saw significant year-over-year decreases in profit, the latter suffering from reimposed lockdowns in China due to the Delta variant.

GOPPAR in Asia-Pacific was recorded at just $8.77 in August 2021, an 84% negative difference. Asia-Pacific, especially China, had been the lodestar of hotel operational performance in the weeks and months post COVID-19, and a regression is discouraging. China recorded GOPPAR below $1 in August compared to $40 just a month prior.

HotStats provides a unique profit - and - loss benchmarking service to hoteliers from across the globe that enables monthly comparison of hotels’ performance against competitors. It is distinguished by the fact that it maintains in excess of 500 key performance metrics covering 70 areas of hotel revenue, cost, profit and statistics, providing far deeper insight into the hotel operation than any other tool. The HotStats database totals millions of hotel rooms worldwide. For more information, visit www.hotstats.com.