This is the 12th edition of Fuel’s COVID-19 Consumer Sentiment Study. As the virus continues to impact the state of travel and the hospitality industry, we want to continue to provide insights on the sentiment of consumers. We’ve asked many questions to find out how a vaccine will impact travel planning for 2021.

We hope that you find the information useful. The survey was sent out on April 8, 2021, and received 2,600 responses. Below is a summary of the findings, along with some observations and opportunities.

Executive Summary

We’ve already seen a giant boom in some markets over the last 6 weeks of people booking hotel rooms. Some properties are seeing more than double the revenue booked online compared to 2019. The data in this survey shows that people are ready NOW to research, book, and travel in the very near future. A few key points are below:

- More than half of the respondents have traveled since the pandemic, and most have traveled more than once.

- Nearly half of survey respondents (see caveat in the question below pertaining to the vaccination) are already fully vaccinated, with another 18% having received their first shot.

- There are some very distinct differences in opinions of what is important to people, based on their vaccination status. Those who are choosing not to get a vaccine are more confident in traveling now than those who are fully vaccinated.

- Nearly 40% of people are planning a trip RIGHT NOW, and 39% will travel during May or June.

- 33% of people will take more vacation days than in 2019, but will also take fewer trips, indicating that people will be making longer stays during their vacation.

- The 1-3 hour drive market continues to be the most popular, but flights have finally picked up in popularity, with more than 20% likely to fly in the next 30 days.

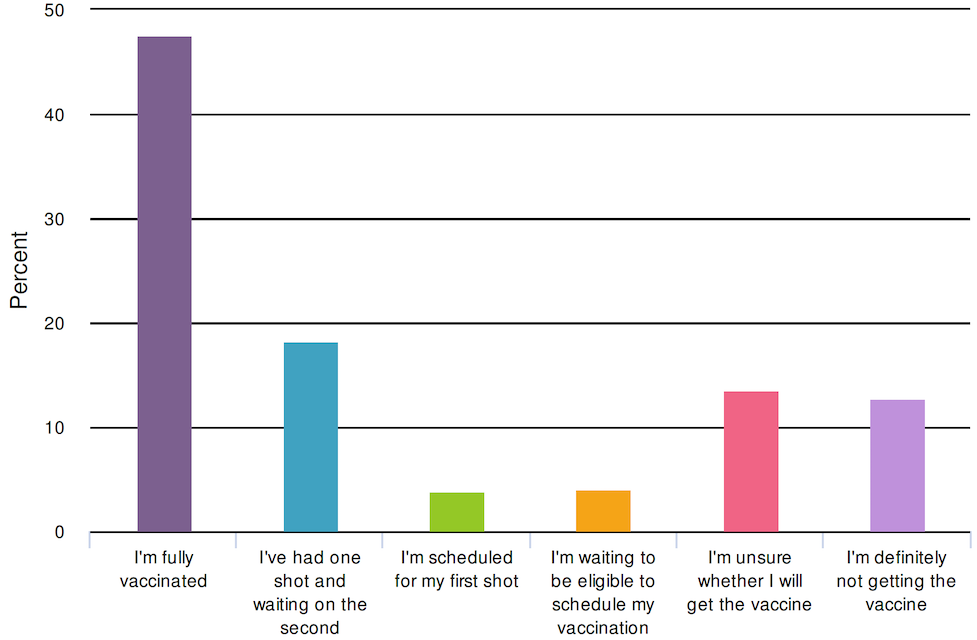

1. Which best describes you regarding COVID vaccination?

- Observation: Nearly 50% of respondents are fully vaccinated, with another 18% who have had their first shot. 14% said they are undecided about getting the vaccine, and 13% responded that they are definitely not getting vaccinated.

- Caveat: The demographic makeup of this survey does skew to an older population and is likely to be skewing the results more towards being fully vaccinated than the leisure travel population as a whole.

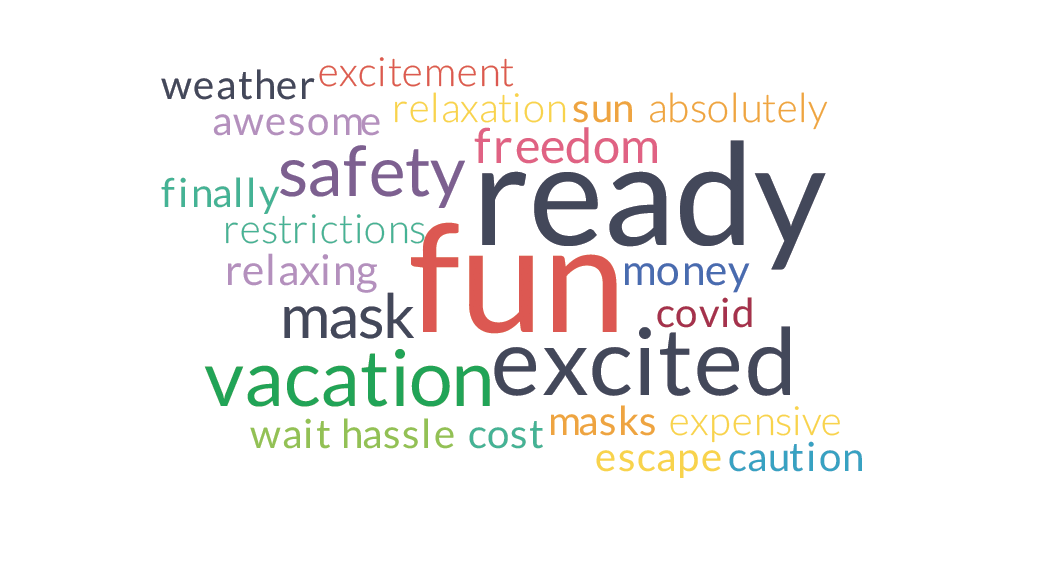

2. What is the first word that you think of when considering travel right now? All Respondents  Not Getting Vaccine

Not Getting Vaccine

- Observation: “Safety” remains the most popular word.

- Data Comparison: Many new positive words have appeared, including, “excited,” “vacation,” “relaxing,” “freedom,” and “fun.”

- Vaccine Status Comparison: Every group, aside from those not getting the vaccine, showed “safety” as the most popular word. Those not getting the vaccine had a very different word cloud, with “fun” as the most popular word. We also see “ready,” “awesome,” “finally,” “absolutely,” and “excitement.”

- Opportunity: While safety remains a top concern, words like, “freedom, “needed,” and “finally” show the consumers are feeling the effects of the last year, and are very ready to travel again.

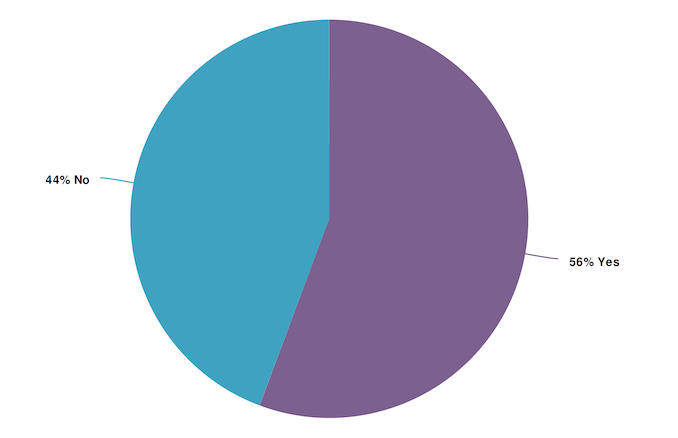

3. Have you traveled since March 15th, 2020?

- Observation: 56% of respondents have traveled since COVID-19 was declared a pandemic.

- Data Comparison: This data is, surprisingly, not drastically changed since we first asked the question before Thanksgiving. Our last survey showed 53% had traveled.

- Vaccine Status Comparison: 71% of those who are not getting vaccinated have traveled, vs. 66% who are unsure of getting vaccinated, 53% who are fully vaccinated, 50% of those who are waiting on a second shot, and 43% who are waiting to be eligible/scheduled.

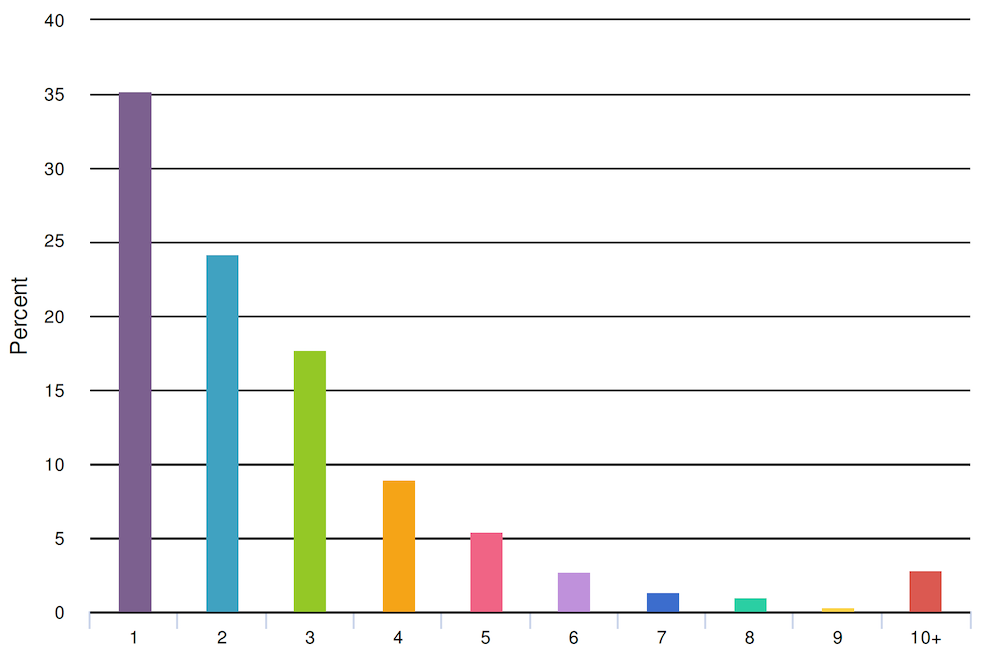

4. How many trips have you taken since March 15th 2020?

- Observation: While traveling once was the most popular response, it only made up 35%, making the majority of respondents traveling at least two times.

- Data Comparison: Compared to the last survey, there is no significant change in this data.

- Vaccine Status Comparison: 80% of those not getting a vaccine have traveled more than once.

- Opportunity: With nearly 70% of people saying that they have traveled at least twice since the pandemic, what can you do to get your guests to come back again?

- Resource: BE the hunter hotelier: The Hunter Hotelier: Driving Their Own Demand & Succeeding In Today’s Market

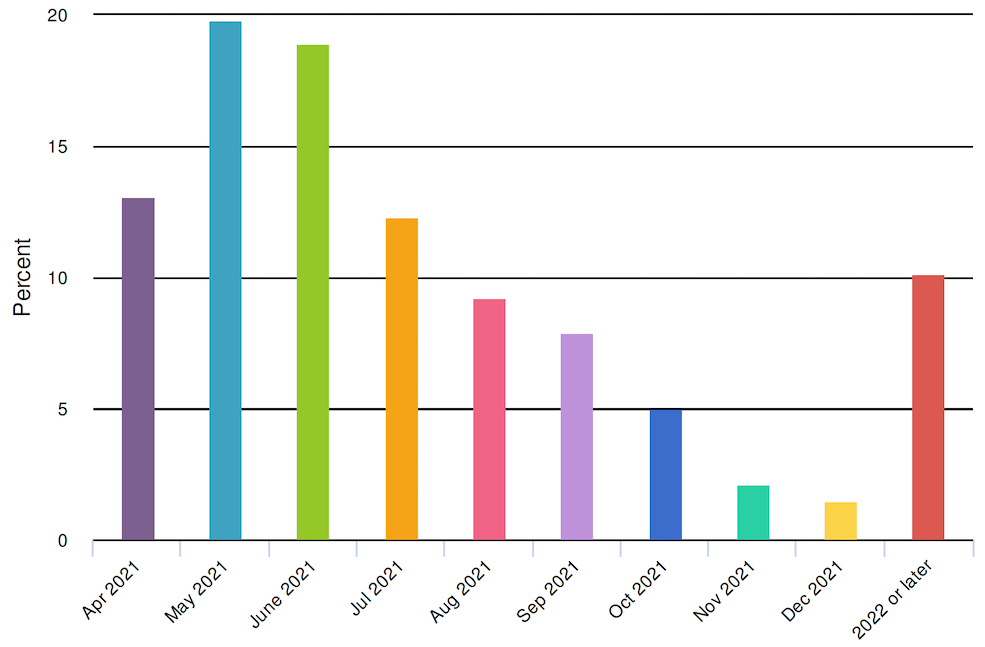

5. When will you likely BEGIN PLANNING your next trip?

- Observation: 40% said they are planning NOW, with another 32% saying they will begin in the next 2 months.

- Opportunity: Now is the time to be getting your brand in front of potential guests.

- Resources: A few articles to get you started on messaging your potential guests:

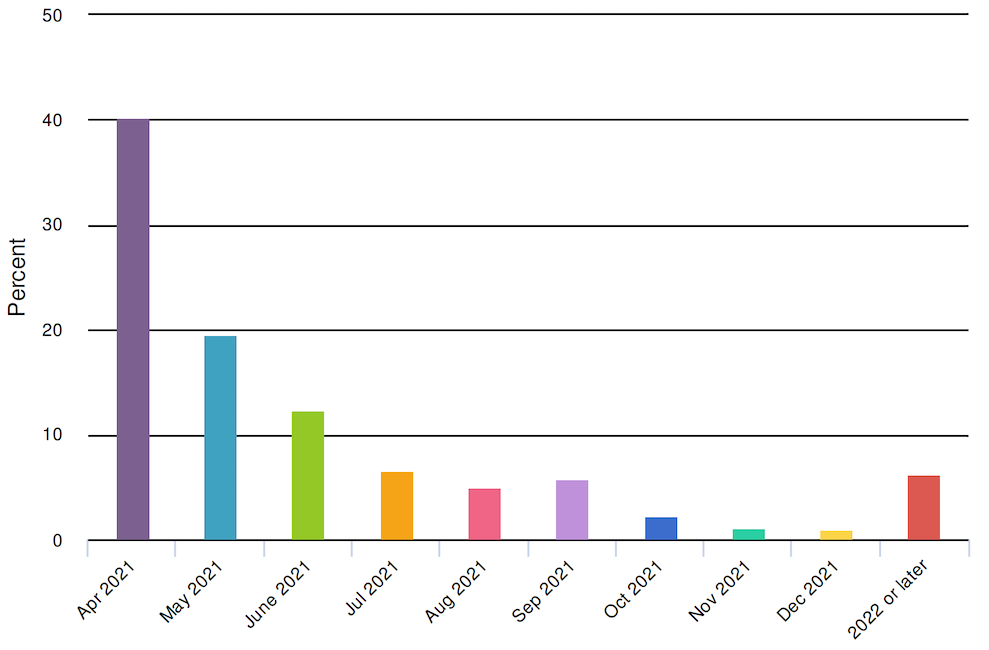

6. When will you likely BOOK your next trip?

- Observation: 39% of respondents said they are in the process of booking their trip now. Very similar to the planning question, 32% said they will book in the next 2 months.

- Opportunity: Consumers are ready to travel NOW. Make sure your website is up to par with current COVID-related information (changes in amenities, cleaning protocols, restaurant limitations, etc.). Make sure your information in your Google My Business listing is up to date.

- Resources: Some great content ideas: https://www.fueltravel.com/blog/create-kickass-website-content/

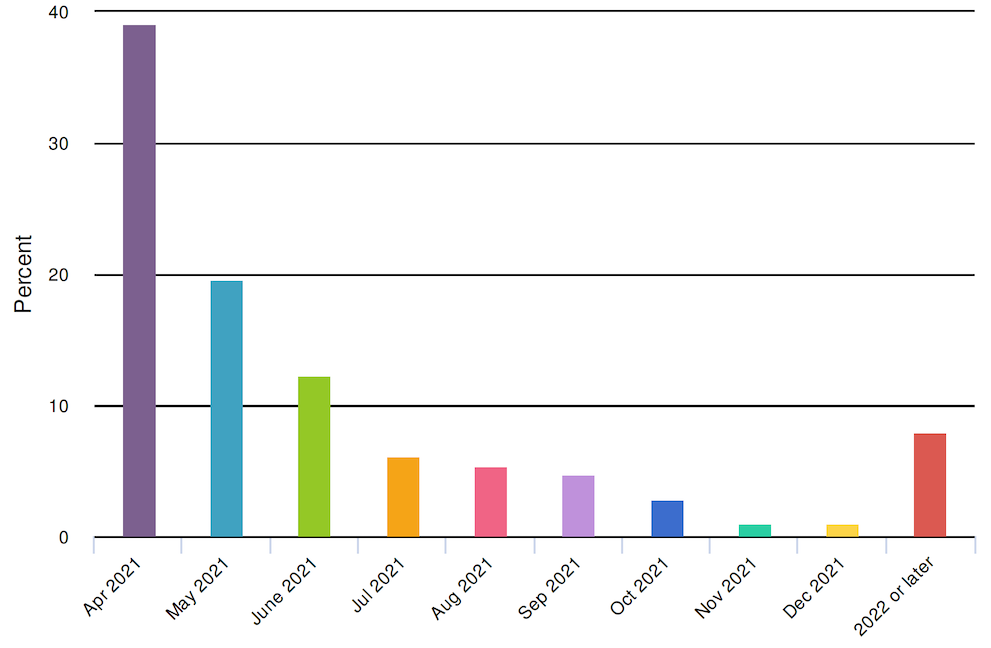

7. When will you likely TRAVEL for your next trip?

- Observation: Answers were quite diverse, with May and June being most popular, and comprising nearly 40% of responses.

- Opportunity: Once you get the booking, don’t forget to keep in communication with your guests to ensure they don’t end up canceling. It is also critical that in the communications leading up to their stay, all pertinent information about the property is conveyed clearly. It is absolutely imperative that expectations are set BEFORE guests arrive, so they are not surprised and disappointed when there is no hot breakfast buffet, or their room isn’t cleaned every day. This will certainly lead to negative reviews that could have been prevented if guests knew what to expect to begin with.

- Resources: What consumers what to hear from hotels right now

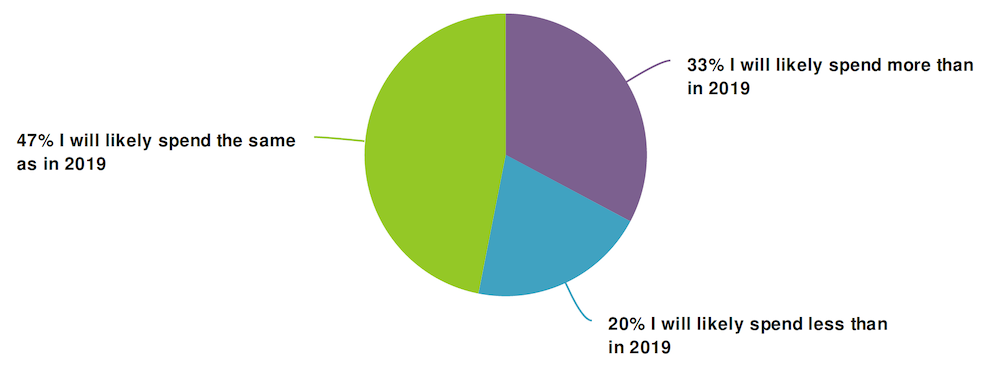

8. In 2021, do you expect your travel budget to increase, decrease, or

remain the same as it was in 2019?

- Observation: Over 1/3 of people plan to spend MORE than they did in 2019. 47% of people said they would have no change in spending vs. 2019. Only 20% said they would spend less.

- Data Comparison: When we first asked this question in November, 50% would have no change, and 22% said they would spend less.

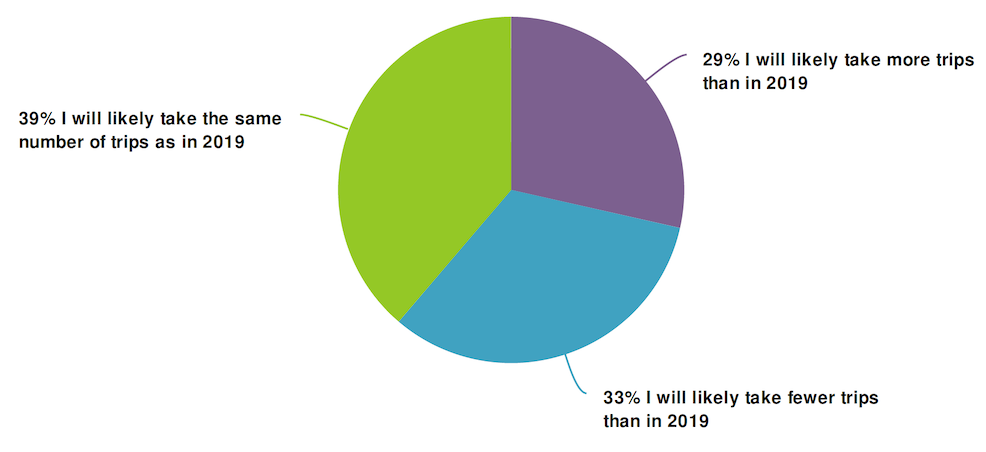

9. In 2021, do you expect to take more, fewer, or the same number of

trips than you took in 2019?

- Observation: 39% of respondents said their travel frequency would be unchanged. There were slightly more people who said they would take fewer trips than who said they would take more.

- Data Comparison: In our last survey, there were 44% saying their travel frequency would be unchanged, and equal percentages saying either more or less. Those saying they would take fewer trips increased on this round, while the percentage of people taking more trips remained the same.

- Vaccine Status Comparison: Those waiting to be eligible/scheduled for first shot had a big discrepancy in responses, compared to the group as a whole. 46% said they would take fewer trips, 20% will take more trips, and 34% will remain the same.

Those not getting the vaccine also showed a large variance: Only 13% will take fewer trips, 38% will take more, and 48% remain unchanged.

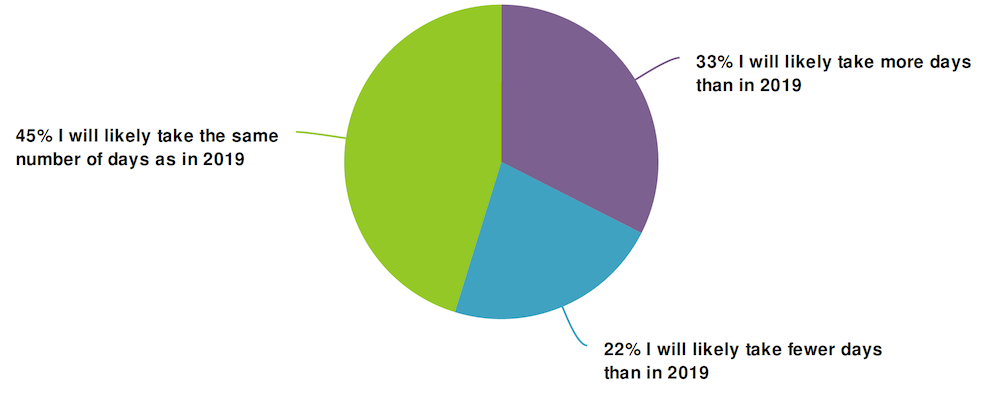

10. In 2021, do you expect to take more, fewer, or the same number of

total vacation days than you took in 2019?

- Observation: 45% responded that their vacation days will be unchanged.

- Opportunity: The percentages for those taking more or less time off are reversed from the answers given to the previous question on frequency of travel, with a higher percentage of people saying they will take more time. This could indicate that the trips people are taking will be for longer lengths of stay. Can you build packages around longer lengths of stay to make the most of this intent?

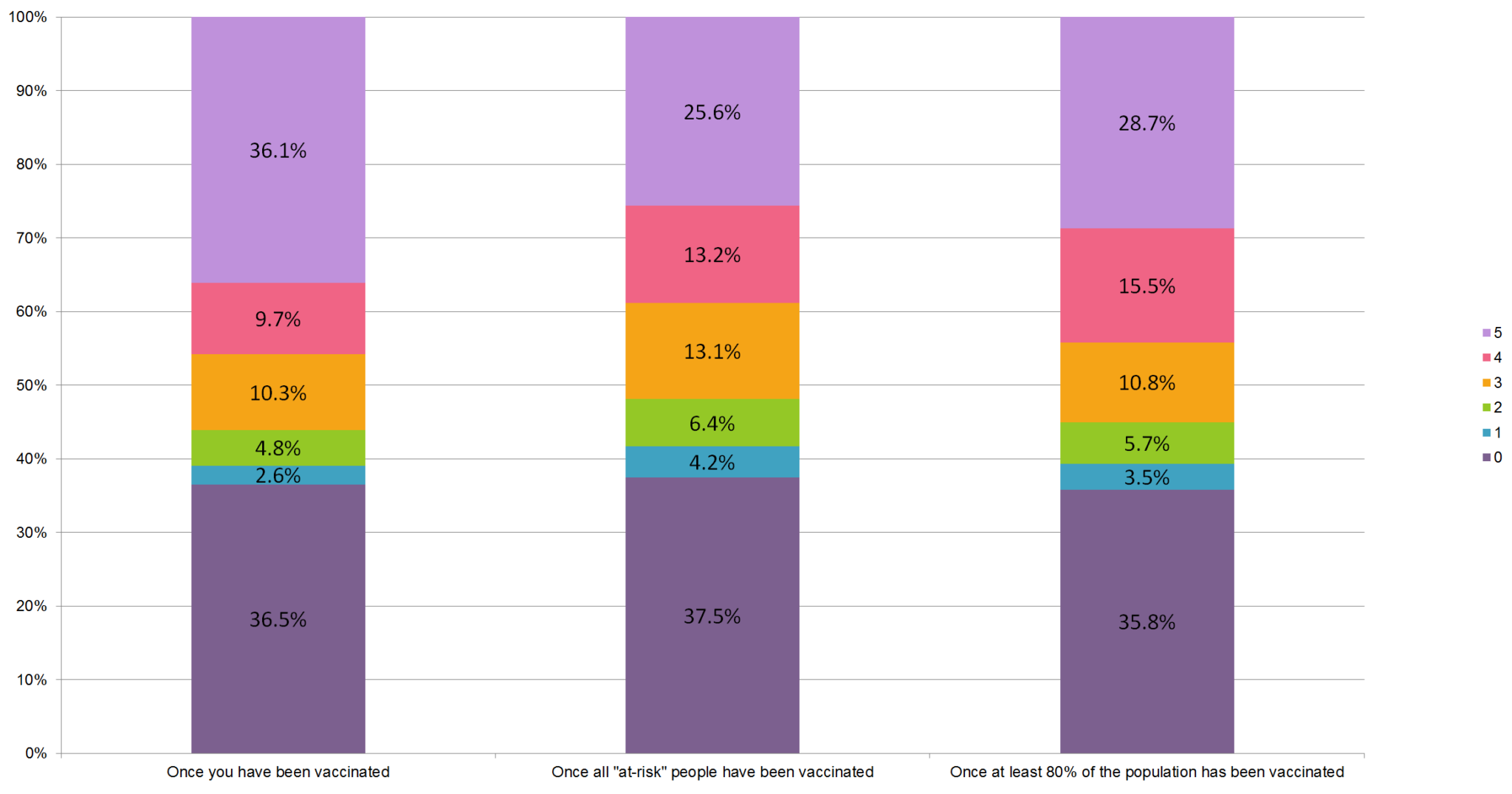

11. On a scale of 0 - 5, how will the following vaccination scenarios

increase your likelihood of booking a vacation within six months? (0 =

No Impact, 5 = Dramatically Increase)

- Observation: More than 60% of respondents in all 3 categories said that a vaccine would increase their likelihood of booking a vacation. Those who said being vaccinated, themselves, would have no impact was equal to those who voted that it would dramatically increase their likelihood to book.

- Data Comparison: We saw little change in the percentages of people voting for no impact, while the rest of the votes moved more into the 5 category. Once you have been vaccinated increased from 24% to 36%; all at risk people increased from 19% to 26%; at least 80% of the population increased from 24% to 29%.

- Vaccine Status Comparison: Those not getting the vaccine voted between 73%-78% for no impact across all three scenarios.

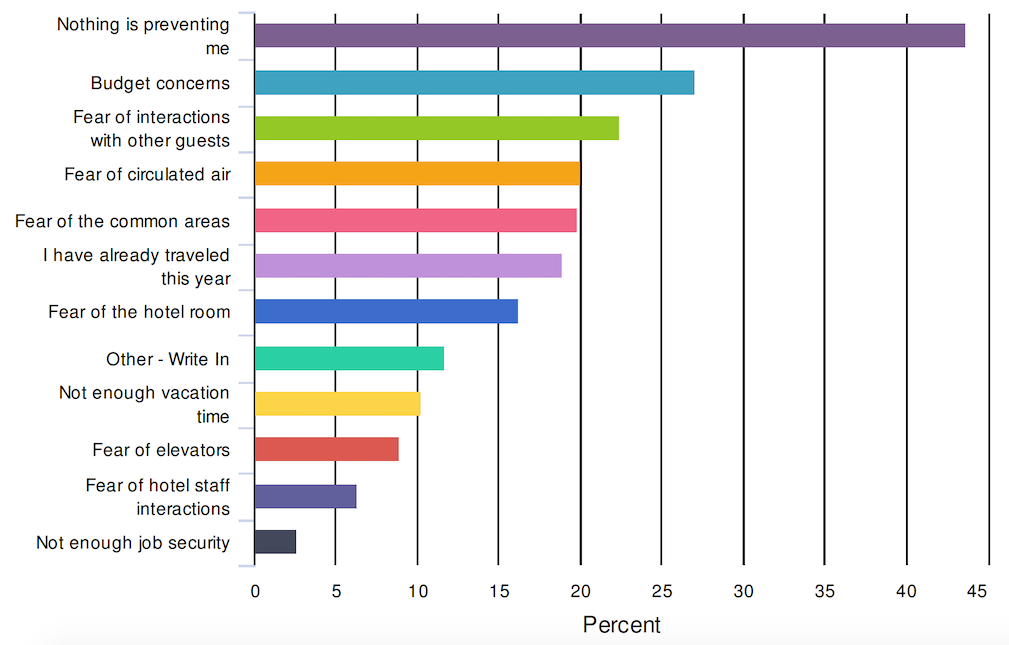

12. Pick the top 3 reasons that would prevent you from staying at a hotel right now.

- Observation: “Nothing is preventing me” is now in the top position, with 44% of votes!

- Data Comparison: “Nothing is preventing me” last had 27% of respondent votes, and is now at 44%. Budget concerns has moved up to the #2 position, having been at #6 in our last survey. Fear of other guests, which has held the #1 position for most of this survey, has dropped to #3 with 22% of votes, down from 35%.

- Vaccine Status Comparison: 37% of fully vaccinated respondents said nothing is preventing me, vs. 69% of those not getting the vaccine.

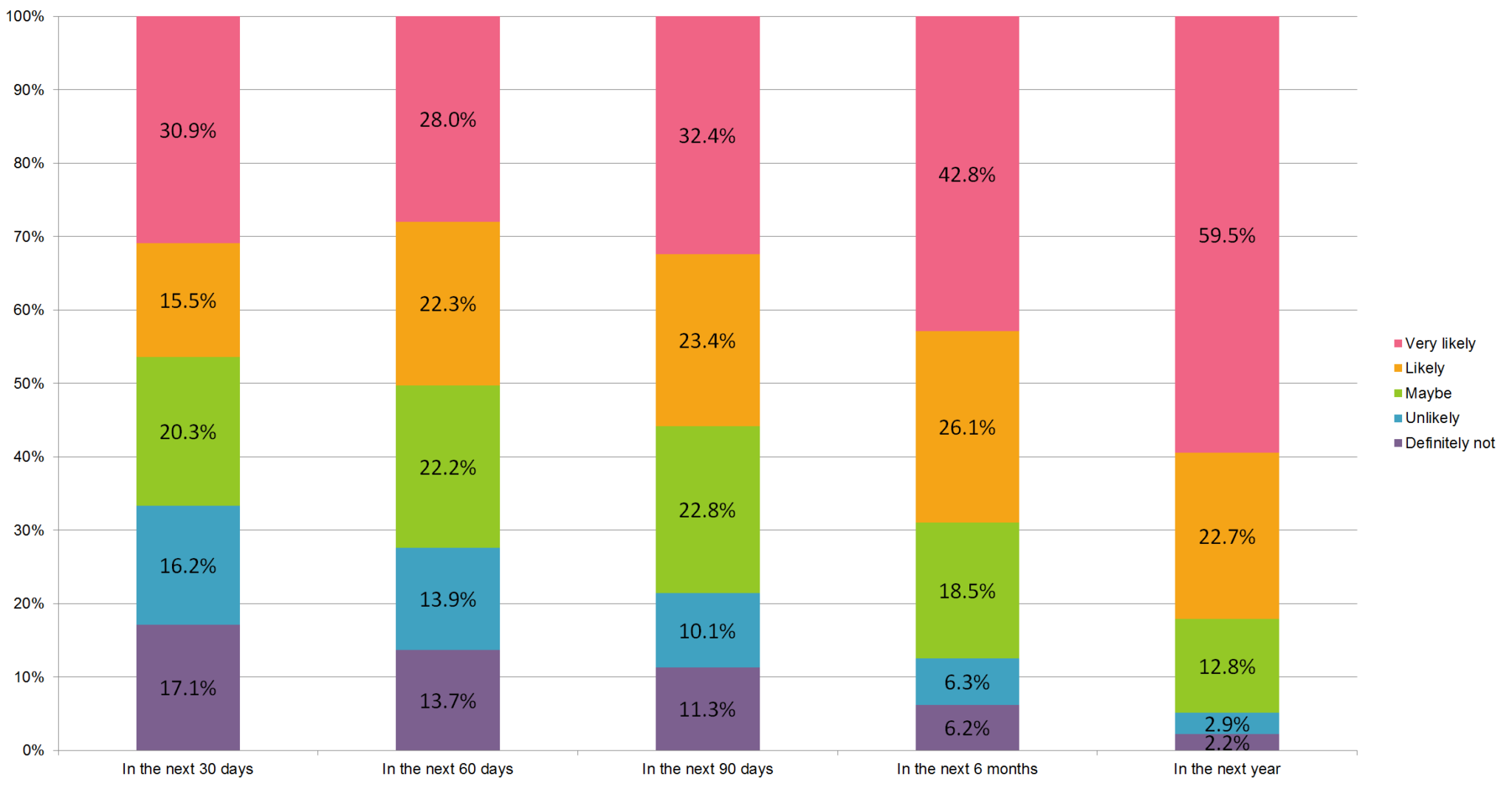

13. How likely are you to book a trip:

- Observation: 67% of respondents answered “maybe” or higher within the next 30 days. 72% responded for the next 60 days, and 78% for 90 days.

- Data Comparison: When we first asked this question on April 16, 2020, 37% responded at least maybe in the next 30 days.

- Vaccine Status Comparison: Those fully vaccinated had a 30% response rate to be very likely to book a trip in the next 30 days, vs. 41% of those not getting the vaccine.

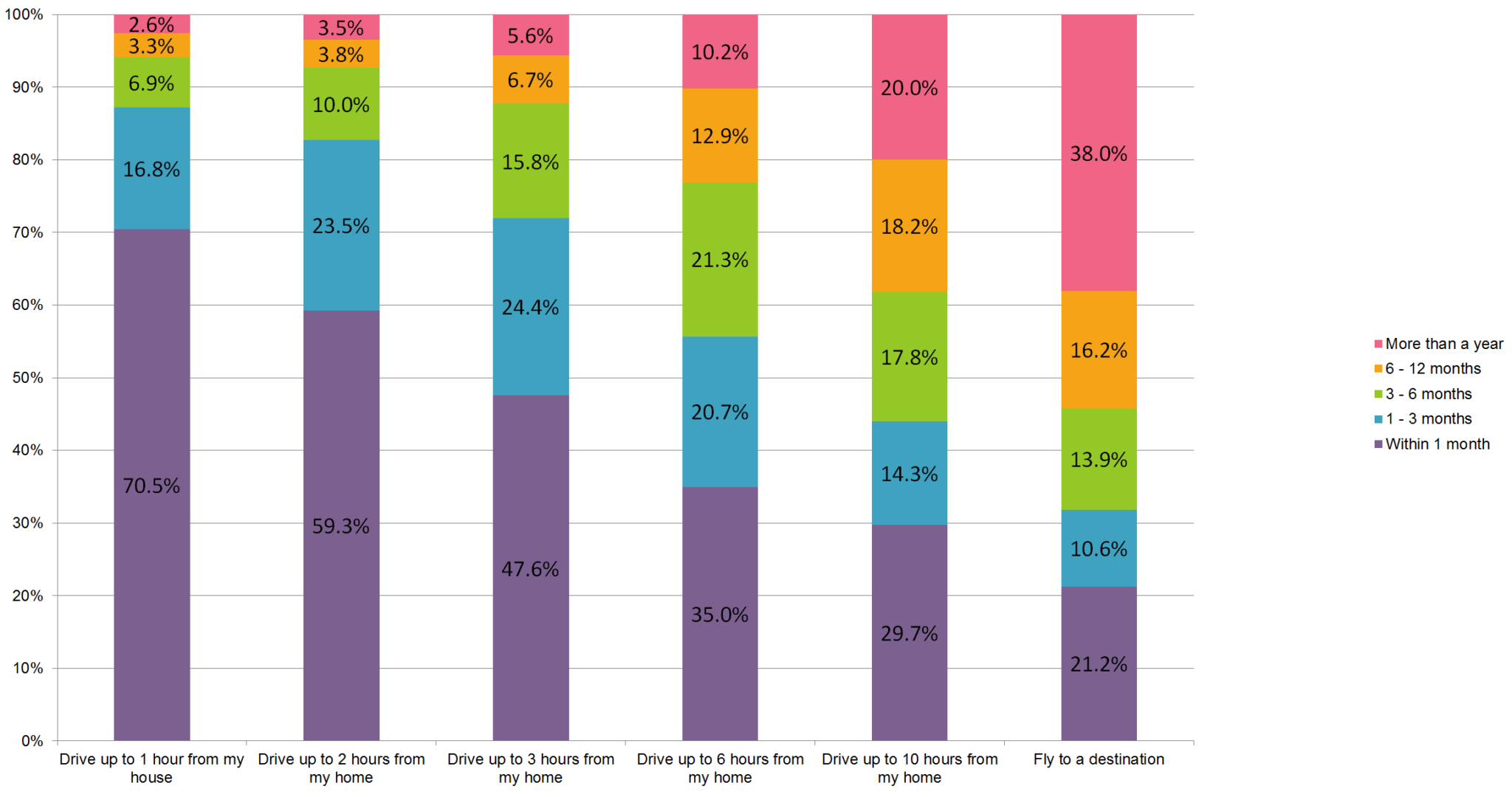

14. How soon will you be willing to make the following trips?

- Observation: Those willing to drive up to an hour from home within 1 month are now at 71%, 2 hours is 59%, and 3 hours is at 48%.

- Data Comparison: Flying to a destination is up to 21% within the next month. We reported this at 9% in our last survey, and 10% a year ago.

- Opportunity: The 1-3 hour drive market remains the most confident for traveling sooner rather than later. For the near future, targeting these consumers via email and paid search will yield the best returns.

- Resource: Fuel has developed A How-To Guide For Targeting Drive Markets

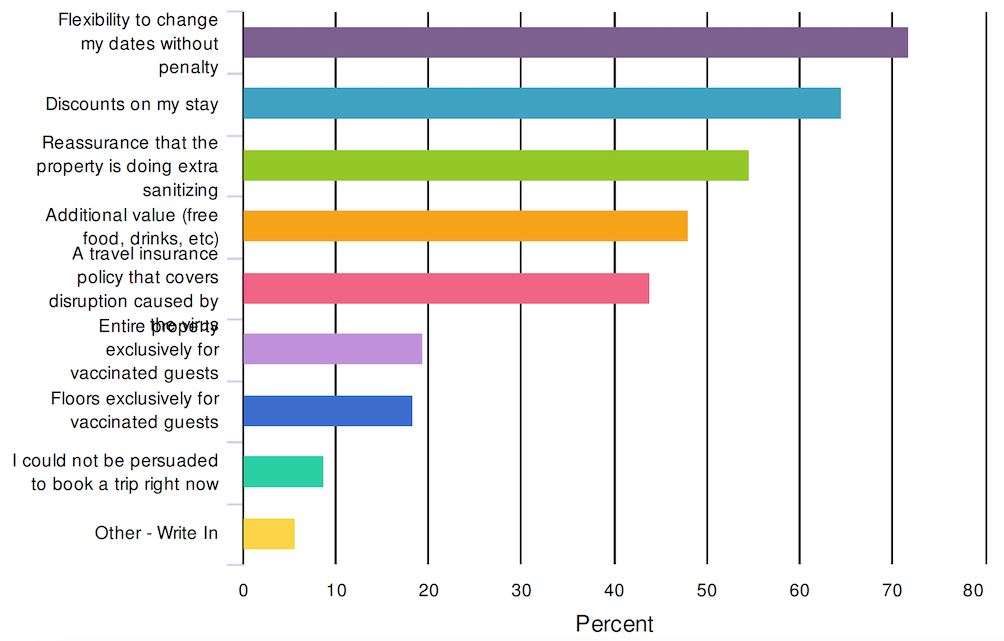

15. Which of the following would most likely persuade you to book a future vacation during the coronavirus outbreak? (Check all that apply)

- Observation: 72% of people chose flexibility to change without penalty.

- Data Comparison: People saying that they could not be persuaded decreased from 26% (which had previously been at 16%) to 9%. This is the first time we have reached a single-digit response rate for this option.

Discounts on stays and reassurance of extra sanitizing remained in the #2-3 spots, however we are up to 65% responding to discounts from 53% last time; reassurance of sanitization increased from 48% to 55%. - New choices were made for entire property exclusively for vaccinated guests (20% of responses), and floor exclusively for vaccinated guests (18%).

- Vaccine Status Comparison: Those not getting a vaccine was the only group to vote for discounts on stays above flexibility to change dates without penalty. All groups voted for Additional Value in the #3-4 spots, with ~50% of respondents.

- Resource: Fuel put this article together on what types of policy changes and messaging you should be implementing right now: The Definitive Guide To COVID19 Policy Updates & Communication.

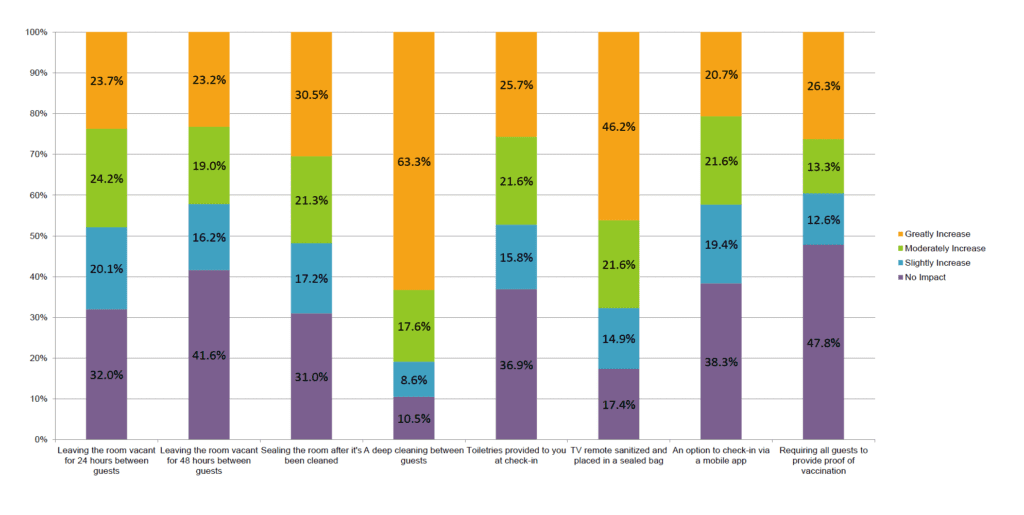

16. How would the following hotel protocols increase your confidence in staying at a

property?

- Observation: Deep cleaning between guests, and placing the sanitized remote in a sealed bag had the biggest impact, with 63% saying deep cleaning would greatly impact confidence, and 46% for the remote.

- Data Comparison: There weren’t any major shifts in data since we’ve begun asking this question.

- Vaccine Status Comparison: Even those who are fully vaccinated voted that deep cleaning between guests and the TV remote in a sealed bag would greatly increase their confidence of staying at a property. For those not getting the vaccine, 41% voted that a deep cleaning would greatly increase their confidence, but just 22% for the TV remote in a sealed bag.

- Opportunity: Be crystal clear in your communication to guests and potential guests about cleaning protocols. Additionally, with the remote having such a strong response, if you are able to incorporate this small item into your operations, it would be of great value to guests.

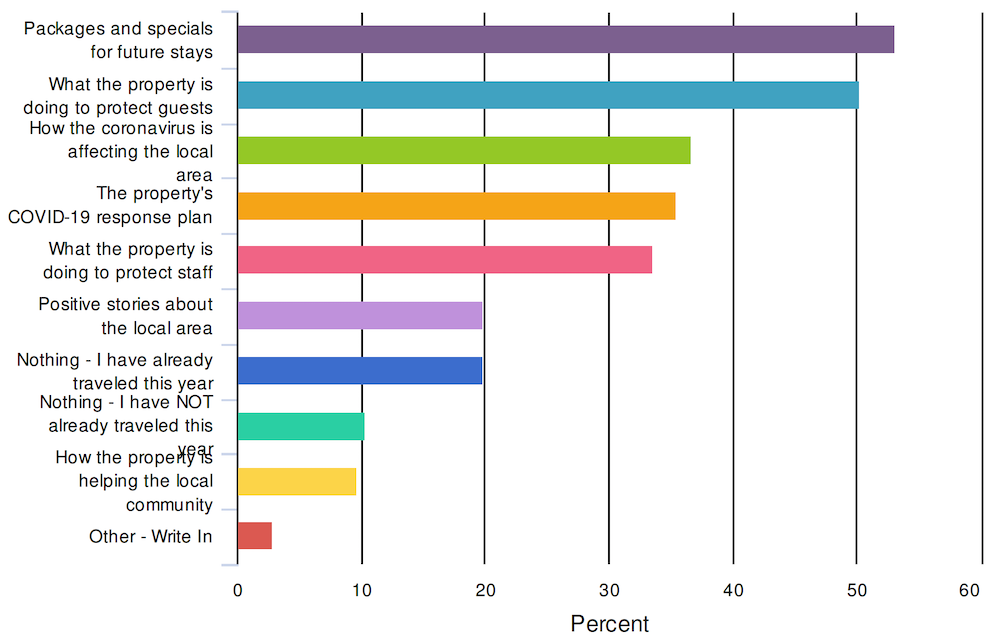

17. I would like to hear from hotels on the following topics: (check all that apply)

- Observation: Packages and specials has taken over the top result, with more than 50% of votes. This is the first time we’ve seen this since volume 3 of the survey, sent on 4/30/20.

- Data Comparison: Those saying that they don’t want to hear from hotels even though they haven’t traveled decreased slightly, from 12% to 10%.

- Opportunity: Even though packages and specials are the top interest right now, consumers still want to hear about all of the safety issues too.

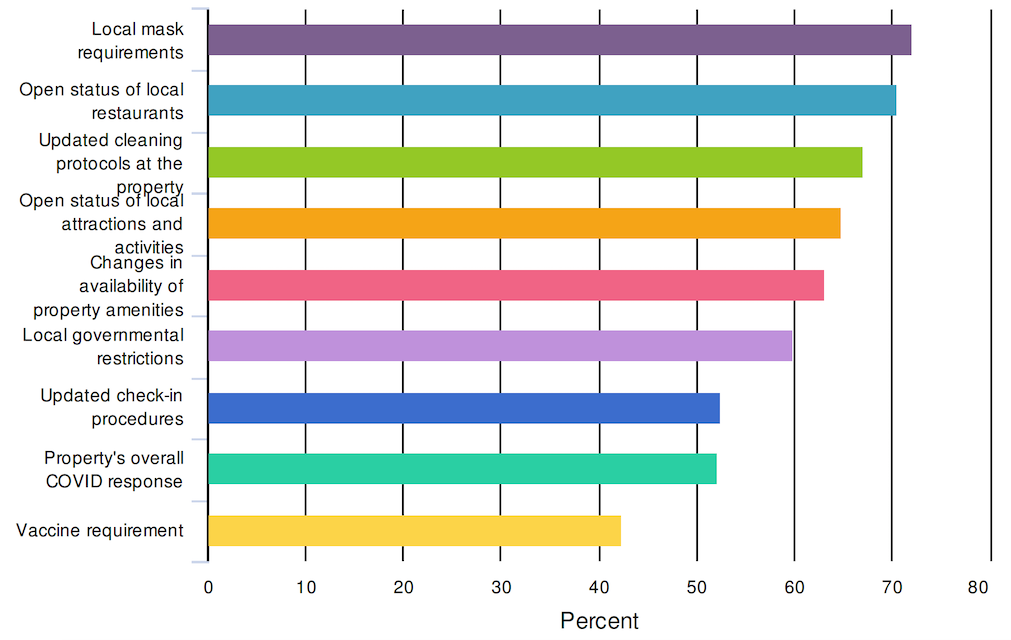

18. The next time you travel, which of the following would you want

the property to communicate to you prior to your stay?

- Observation: More than 70% of respondents want to know local mask requirements, very closely followed by open status of local restaurants.

- Data Comparison: The open status of restaurants increased from the #3 spot to #2, taking over updated cleaning protocols. Local attractions also moved from #5 to #4, with 65% of votes.

- Vaccine Status Comparison: Those not getting the vaccine voted for the status of restaurants and local attractions as their top choices, at 73% and 64% respectively. Those who are unsure about the vaccine voted similarly to those not getting the vaccine. Fully vaccinated respondents chose local mask requirements at 78%, cleaning protocols at 74%, and then status of restaurants at 71%. Those waiting for their second shot or waiting to be eligible voted similarly to those who are fully vaccinated.

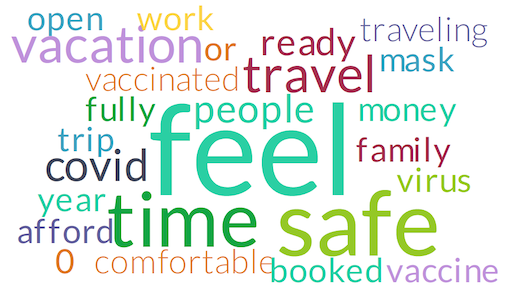

19. Complete the following sentence: I will travel when:

- Observation: “Feel safe” is most prevalent since we first asked this question. Phrases relating to a vaccine, number of virus cases declining have also been popular.

- Data Comparison: The mention of “masks” has come back in this round, which we did not see in the last survey, but had seen in the previous two sets of results.

- Opportunity: As mentioned before, whatever you can do to assure visitors that you have their well-being as a priority will increase your chance in convincing them to stay with you. Being cognizant of the financial stress many people are feeling, and providing value-add items to packages where possible will help consumers feel more comfortable booking.

Wrapping it Up

People ARE traveling, and nearly 70% of those who have traveled, have done so at least twice during the pandemic.

Consumers are likely to have more confidence in booking a trip next year once a vaccination has been administered (either to the traveler, the majority of the population, or those most at risk). Hoteliers need to be doing all they can to focus on potential guests located up to 3 hours away from the property. Communicating local safety ordinances, and status of local restaurants and attractions will continue to be very important.

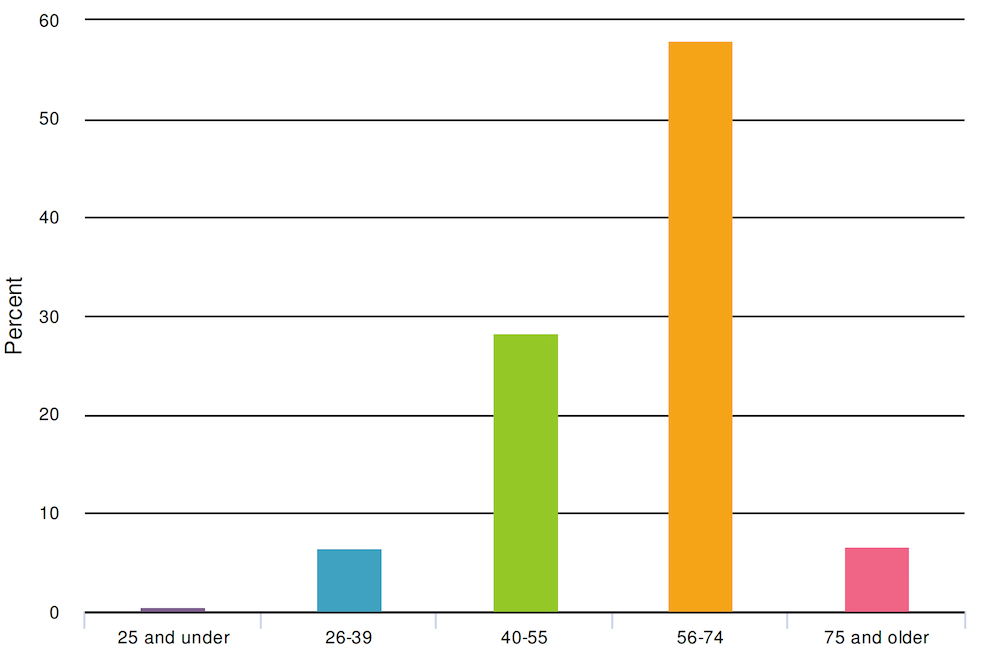

Survey Methodology

This was a self-reporting survey sent to a database of leisure travelers located in North America. Questions containing multiple checkbox responses had the options randomized to avoid positional bias. More than 2,600 respondents completed all questions.

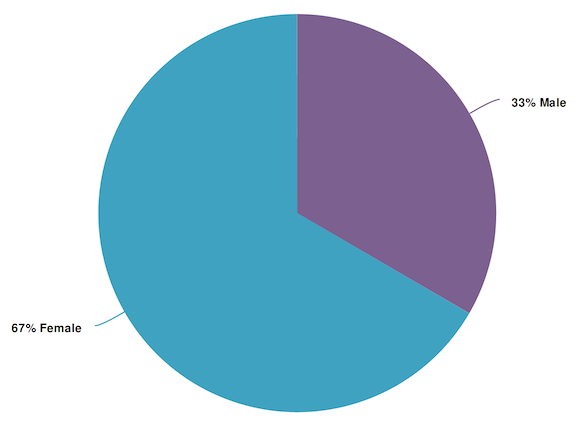

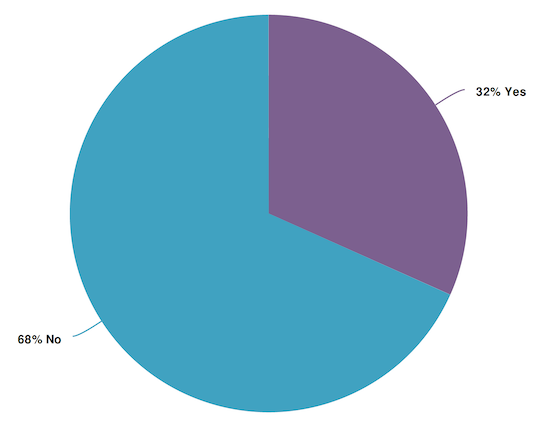

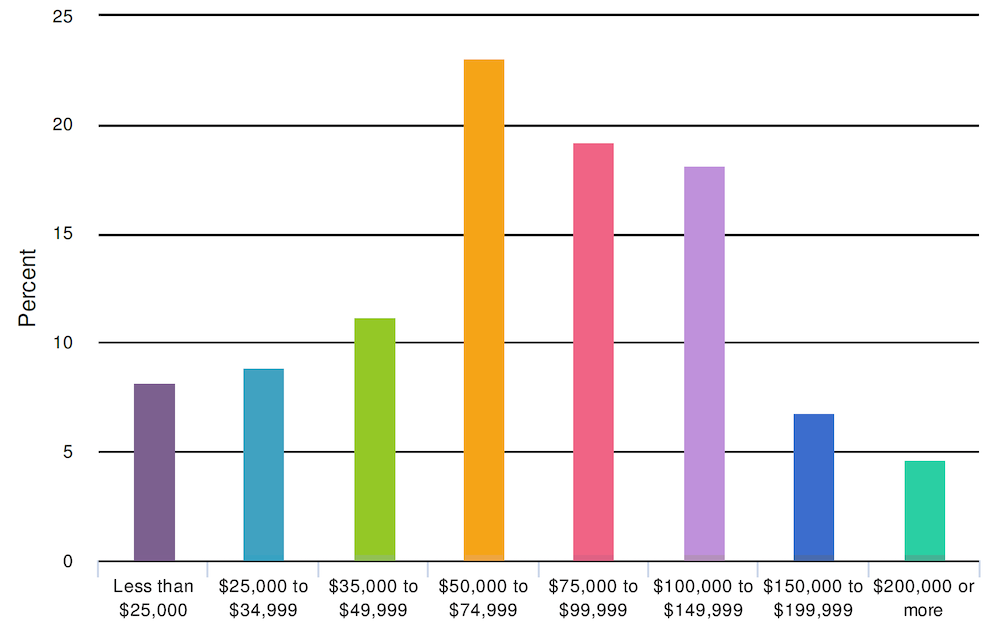

Below is the demographic breakdown of respondents.

Age & Gender:

Do you have children living at home with you?

Do you have children living at home with you?  What was your total estimated household income before taxes during the past

What was your total estimated household income before taxes during the past

12 months?

About Fuel

As a leading provider of advanced software solutions and digital marketing services for the hotel industry, Fuel helps independent hotels, resorts, condotels, and management groups maximize market share and profitability. This is achieved by providing a comprehensive suite of software and marketing solutions including: the Fuel Booking Engine, Fuel AI-Powered CRM & Marketing Automation, Fuel Mobile App & Digital Key, Fuel Gauge Analytics Dashboard, website development, SEO, SEM, email marketing, social media, and analytics services. Through these solutions, Fuel helps properties drive more direct bookings and reduce reliance on third-party channels. To learn more about Fuel and to take your travel marketing to the next level, call (843) 839-1456, visit the website, listen to the #1-ranked Fuel Hotel Marketing Podcast, and follow Fuel on Facebook and Twitter.